Digital health news, funding roundup in the prior week; December 06, 2021

Harrison.ai raised $92.3 million USD, Droplette secured $15.4M,

Read more...

VC's Raising Funds

If you are interested in being included in our funding roundup, submit your press release or blog post about your financing round to mitos@vator.tv.

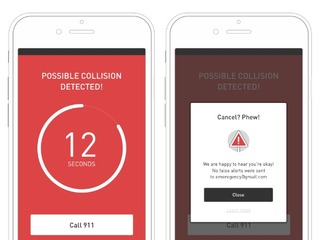

Image source: www.digital.je

I produce Vator Events and enjoy the challenge. I am learning and growing a lot, being involved with Vator and loving every moment of it!

All author postsHarrison.ai raised $92.3 million USD, Droplette secured $15.4M,

Read more...Amazon Health sells healthcare services to Hilton; Athenahealth acquired for $17 Billion

Read more...How Microsoft can transform healthcare delivery; Trusted has raised $94M; Aptihealth landed $50

Read more...Angel group/VC

Joined Vator on

Our experience makes us realistic about how businesses unfold, and we can advise our portfolio companies at all phases of growth. Our size, global presence and heritage enable us to offer our venture capital and growth equity portfolio companies high-level, long-term assistance.

Angel group/VC

Joined Vator on

In 1911, Henry Phipps founded Bessemer Securities to reinvest the proceeds of his sale of Carnegie Steel for the benefit of his descendents. The start-up investment operations were spun out into Bessemer Venture Partners, which now operates out of seven offices around the globe.

Angel group/VC

Joined Vator on

There’s a simple premise behind the founding of General Catalyst (GC) in 2000: entrepreneurs are best served by those who've been in their shoes. In fact, all of GC’s managing directors are accomplished entrepreneurs in their own right. We’re familiar with the challenges you face. And we thrive on our ability to use our entrepreneurial experience to assist, guide, and nurture entrepreneurs on their journey.

As a venture capital firm focusing on Early Stage and XIR/Growth investments, we're thrilled to encounter and delight in helping exceptional entrepreneurs and innovative companies bring a new product to market or transform an industry. But it’s more than just writing a big check. We're tireless in our business-building and partnership development assistance.