April 12, 2024

Tokyo startups eye US market for expansion

Recent News

- May 1, 2024

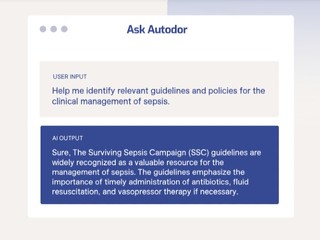

Every Cure and BioPhy launch partnership on drug repurposing

EveryCure will leverage BioLogicAI, BioPhy’s predictive AI engine, to assess drug-disease matches

- May 1, 2024

Credentialing automation platform Baton Health launches Universal Primary Source database

That gives its customers access to hundreds of PSV databases through a single query

- April 30, 2024

Autonomous blood drawing device developer Vitestro raises $22M

The company plans to bring its device to market in Europe before expanding to the United States

- April 29, 2024

Washington state selects Fusion Health as its official EHR vendor

The contract will make it easier for state agencies to evaluate and implement Fusion's technology

- April 29, 2024

OpenAI goes to Tokyo to resolve LLM struggles with Japanese language

The new office marks OpenAI's first location in Asia

- April 29, 2024

Meet John Beadle, co-founder and managing partner at Aegis Ventures

Aegis Ventures works with health systems to build and invest in digital health companies

- April 26, 2024

Thirty Madison and Talkspace join forces to expand mental health access for women

Talkspace will be the therapy partner for femtech brand Nurx and migraine treatment platform Cove

- April 26, 2024

Midi Health, a virtual care clinic for women's health, raises $60M

Midi is currently on track to serve about 100,000 patients this year, up from about 30,000 in 2023

- April 25, 2024

Smart infant monitoring company Owlet partners with Wheel

Wheel clinicians will be able to prescribe Owlet's BabySat, which monitors oxygen and heart rate

- April 25, 2024

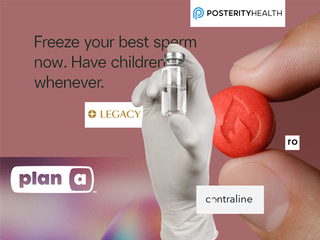

Rising infertility concerns fuel growth of male-focused innovative startups

Fertility treatments are more relevant than ever; here are a few startups pioneering new solutions

- April 25, 2024

X to charge new users for interaction in battle against the bots

After a trial in select locations, Elon Musk is expanding its fee to more X users

- April 24, 2024

Using generative AI for health plan claims, Alaffia Health raises $10M

Amish Jani, Founder and Partner at FirstMark, joined the company's Board of Directors

- April 24, 2024

MyFitnessPal launches support tools for patients on GLP-1 meds

The tools include content such as educational videos, recipes, and daily nutrition tips

- April 23, 2024

New disease models unlocking secrets to neurological research

Advances in technology, like in vitro and microfluidics, have helped advance research

- April 23, 2024

Forum Ventures report: where health systems say innovation is most needed

The report outlined four areas as a guide to help startups to sell into these systems

Sign up now to subscribe to our newsletter and stay up to date with the latest news!

Featured News

X to charge new users for interaction in battle against the bots

- By Anna Vod

- |

- April 25, 2024

New disease models unlocking secrets to neurological research

- By Steven Loeb

- |

- April 23, 2024

Tokyo startups eye US market for expansion

- By Kym McNicholas

- |

- April 12, 2024

Which large corporations are leading the charge in warehouse automation?

- By Steven Loeb

- |

- April 12, 2024

Healthtech investing still lags behind even as funding grew 42% in Q1

- By Steven Loeb

- |

- April 8, 2024

Fertility benefits help your company stand out among competitors

- By Anna Vod

- |

- April 3, 2024