April 12, 2024

Tokyo startups eye US market for expansion

Recent News

- April 26, 2024

Midi Health, a virtual care clinic for women's health, raises $60M

Midi is currently on track to serve about 100,000 patients this year, up from about 30,000 in 2023

- April 25, 2024

Smart infant monitoring company Owlet partners with Wheel

Wheel clinicians will be able to prescribe Owlet's BabySat, which monitors oxygen and heart rate

- April 25, 2024

Rising infertility concerns fuel growth of male-focused innovative startups

Fertility treatments are more relevant than ever; here are a few startups pioneering new solutions

- April 25, 2024

X to charge new users for interaction in battle against the bots

After a trial in select locations, Elon Musk is expanding its fee to more X users

- April 24, 2024

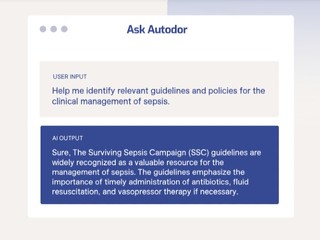

Using generative AI for health plan claims, Alaffia Health raises $10M

Amish Jani, Founder and Partner at FirstMark, joined the company's Board of Directors

- April 24, 2024

MyFitnessPal launches support tools for patients on GLP-1 meds

The tools include content such as educational videos, recipes, and daily nutrition tips

- April 23, 2024

New disease models unlocking secrets to neurological research

Advances in technology, like in vitro and microfluidics, have helped advance research

- April 23, 2024

Forum Ventures report: where health systems say innovation is most needed

The report outlined four areas as a guide to help startups to sell into these systems

- April 22, 2024

Pelvital raises $2.32M to commercialize its urinary incontinence device

Flyte delivers mechanotherapy transvaginally to the pelvic floor

- April 22, 2024

Healthcare staffing company ShiftMed acquires managed service provider CareerStaff

The country will need an additional 203,200 RNs each year until 2031 to fill staffing shortages

- April 19, 2024

Meet Jonah Midanik, COO and General Partner at Forum Ventures

Forum Ventures operates its own venture studio, accelerator, and pre-seed fund

- April 19, 2024

M&A activity in the warehouse robotic space

Robots are taking over the heavy lifting work inside warehouses

- April 19, 2024

DrFirst buys prior authorization automation platform Myndshft

This will allow DrFirst to accelerate its growth in the specialty medication space

- April 17, 2024

Value-based obesity care solution Ilant Health adds $2.5M to its seed round

The company initially raised $3 million in seed funding when it launched in October

- April 17, 2024

Maven Clinic launches program for members who want to get pregnant without IVF

The company also expanded access to 12 different provider types for male fertility care

Sign up now to subscribe to our newsletter and stay up to date with the latest news!

Featured News

X to charge new users for interaction in battle against the bots

- By Anna Vod

- |

- April 25, 2024

New disease models unlocking secrets to neurological research

- By Steven Loeb

- |

- April 23, 2024

Tokyo startups eye US market for expansion

- By Kym McNicholas

- |

- April 12, 2024

Which large corporations are leading the charge in warehouse automation?

- By Steven Loeb

- |

- April 12, 2024

Healthtech investing still lags behind even as funding grew 42% in Q1

- By Steven Loeb

- |

- April 8, 2024

Fertility benefits help your company stand out among competitors

- By Anna Vod

- |

- April 3, 2024