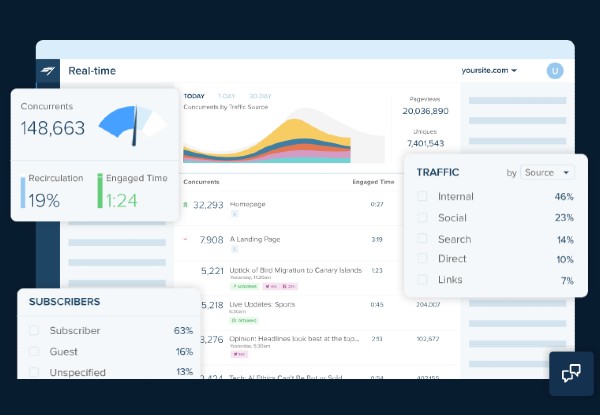

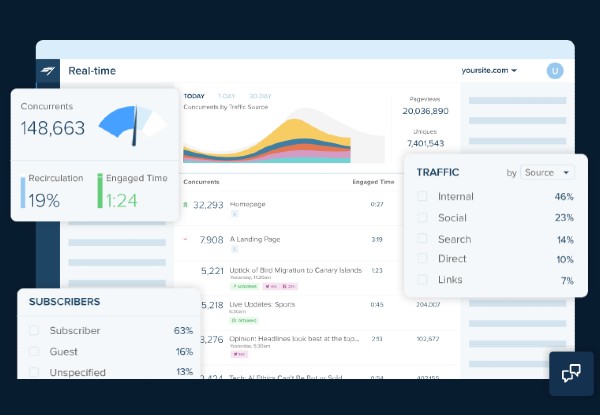

The company’s solution includes real-time analytics, helping publishers understand how their audiences receive their content. Because content is changing so often, having a real-time feed of analytics that is accessible to everyone who needs to make decisions is extraordinarily powerful and important for them to grow their audience.

Its customers include The New York Times, CNN, The Washington Post, BBC, ESPN and UOL.

Last month, it was announced that the company had been acquired by enterprise software investment firm Cuadrilla Capital. While no financial terms were disclosed, it was revealed that Chartbeat CEO John Saroff will continue to led the company going foward.

Saroff spoke to VatorNews about the acquisition, what it means for Chartbeat, and his vision for how the company can continue to help content providers get their content to the widest possible audience.

VatorNews: Give me a brief overview again of the company and what you do.

John Saroff: We are a content and editorial analytics company for the media world. So, we provide media companies with real time content analytics and optimization. If you’re a media company who wants to see where your audience is coming from, is it coming from social, search, your homepage or your app? Or, if you want to test and optimize your text or your images, Chartbeat provides a very, very user-friendly way for customers to do that. That’s what we do.

VN: It’s been like a year since we last spoke, when we had you on our podcast, so what’s been new since then? Obviously, there’s the acquisition, but have you released any new features? How have you been growing in that time?

JS: For the last year, we’ve actually seen tremendous growth. The secret to that growth has been, now that companies are coming out of the pandemic, audiences are growing, audiences are gravitating to reliable sources of information, and we’ve been happy to partner with our clients, and help our clients grow their audiences.

In terms of features, we’ve launched two features: I’m not sure if we talked about them last time, but we launched a feature called Image Testing, which enables customers to test images, so you can A/B test an image and see which one will drive a deeper engagement with your audience. And then we’ve also seen that, increasingly, more professional data teams want to be able to play with the data on their own, and they want to be able to pull it out of a tool like Chartbeat and put it in a data warehouse or put it into any of a variety of third party visualization layers. So, we launched a product called Data Stream that enables folks to do that.

Between growth and launching new stuff, it’s been a busy year.

VN: That’s interesting that you said that more people are reading the news now; I would have it would have been more people reading the news during the pandemic, because you’re stuck inside and can’t do anything else.

JS: What happened was, there was a huge audience boost during the pandemic. And, yeah, compared to actually the peak of the pandemic, like March and April 2020, that was unprecedented traffic; you saw traffic in March and April of 2020 that was bigger than on some election nights. Now what you’re seeing is an increase over 2019, especially for the big leading players. Most of our clients are large enterprise media companies and those folks have done very, very well.

VN: Let’s talk about the acquisition and I guess a good place to start would be to talk about Cuadrilla Capital and what they do.

JS: They’re enterprise software investors. They partner with us largely because they believe in the story. They’re headquartered in Santa Barbara, California, they’ve been at this for a little bit; we’re their third investment, I believe.

We partnered with them for a couple reasons: one, they really, really liked our vertical focus; we are focused squarely on one set of customers and one set of users, and that’s media companies and folks who worked there to grow their audience, and that was appealing. And then, secondly, we had a shared vision. Chartbeat is a great brand, we have great relationships, and we have a great product, and there was a sense that we could just do a lot more. Whether that’s building more stuff for our core user base, or bolting on other acquisitions for our user base, there was just a sense that the team that Chartbeat has, the relationships that we have, and the presence that we have in the newsroom of so many major media companies, was a great base for the Chartbeat team and the Cuadrilla team to team up on to really grow something interesting.

VN: What does each company get from the other? What didn’t you have that Cuadrilla provides for you? What didn’t they have that Chatbeat provides for them?

JS: They’re enterprise software investors, so they own a majority stake in the company now, a significant stake in the company, and I think they see us as a great asset to own. For us, we get to refresh our investor group; most of our investors had been in the company for 10 or more years, and we love our former investors, but it was time to reinvigorate the company.

One thing that I was very, very pleased about in meeting them was that they shared the vision that I had had for the company for a long time, which is to become a software company that builds really, really great solutions for folks who are trying to build and grow audiences. When I walked into Cuadrilla’s office for the first time, and shared that vision with them, they immediately got it. For me to have thoughtful supporters investing in the company, helping us grow, is essential.

VN: How did you first get to know Quadrilla? Did you first work together before the acquisition? Were they a partner of yours? How did that relationship develop?

JS: We met them through a mutual friend. We’re pretty well known throughout the software space and a mutual friend of mine and of Cuadrilla’s, basically said, “Hey, you should meet these guys, it seems like you guys speak the same language.” We got introduced, and then we spent a few months getting to know each other, and then it made sense to partner and to move forward.

VN: Are they going to be using any of your technology going forward?

JS: No, they are just investors. They are solely investors.

VN: It seems like Chartbeat is going to be running a standalone company, so that makes sense. You’re not being incorporated into Quadrilla.

JS: No, they have several investments. They have three investments but they run them all independently.

VN: In terms of your role, I know that you’re staying on as CEO, but is that going to change at all? Are your responsibilities going to be any different or is it just going to be the same for Chartbeat going forward, just with Cuadrilla being a majority owner?

JS: I do my job as CEO, setting the mission and vision of the company, and then growing the business, funding the business, and making the business a great place to work. When I think about our partnership with Cuadrilla, they are backing me and my team to do all three of those things. So, by acquiring us, they’ve financed the business, and then they are very, very supportive of the plans that we have to grow the business and to keep Chartbeat the employer of choice that it is.

VN: What is the ultimate vision? What do you hope to get out of this acquisition? Let’s say five years from now, where do you want to see Chartbeat? And how does this help you get there?

JS: We want to be a one stop shop for creative folks inside media organizations. And when I think about some of the things that we can do to help, there are three key areas that I’m immediately looking at: one is subscription and other user-based revenue models. In the 12 years of Chartbeat’s existence, we’ve seen a massive transformation, going from almost every single one of our customers being advertising supported to now a significant portion being almost exclusively subscription funded. That is job one, how can Chartbeat, through building or acquiring software, grow to serve the needs of subscription media companies, whether they be in video, audio, text, etc.

The second thing that we’re thinking about is long form video. I would take ESPN as an example: we serve ESPN.com and the ESPN app, but there’s a whole world of ESPN video apps that we can help them a lot with, whether that’s ESPN+ or their streaming apps that deliver the cable programming, but just over the top. There’s a whole host of things that we could do to help our television and other video providing customers.

The third area that we’re thinking about is search; when we started, social media, specifically Facebook and Twitter, was just a really, really meaningful source of audience for our customers. Although it is still present, it’s just not as important as it once was. Facebook has, in some ways, pivoted away from media, at least from professional media, and Twitter is always changing its point of view on how it interacts with media companies. Google, and search in general, remains a very, very meaningful source of traffic for our customers. There are great companies that do SEO for non-media places, but there are less that do it just for media and we would try to figure out ways to to help the media use case, specifically.

VN: There are those legacy social media companies, like Facebook and Twitter, but there are new ones, like Snap and TikTok. How do those get incorporated?

JS: The thing about those folks is that they don’t really refer traffic back. So, they are different. For example, if you’re a media organization, you’re trying to build a Facebook or a Twitter strategy, you’re trying to maximize the referral traffic, you’re trying to get those folks to send traffic back to you. There is a Washington Post TikTok, but its goal is not to send traffic to the Washington Post; its goal is to brand The Washington Post as a cool, hip newsroom. So, it’s a little bit of a different game and that is less interesting to me than ways for our customers to build their owned and operated audience. When you think about their owned and operated audience, their website, their own mobile apps, their own video apps, social is less of a part of that than search is right now.

VN: Is there anything else that I should know anything else that we didn’t touch on that you think is important?

JS: We’re very excited, we’re raring to go. We have a very, very clear vision of what we want to be, we have great support, and the team is fired up so we’re excited and looking forward to the next few years of growth. Hopefully we’ll talk again in a couple years and we’ll have another story to tell.