Venture capital used to be a cottage industry, with very few investing in tomorrow’s products and services. Oh, how times have changed!

While there are more startups than ever, there’s also more money chasing them. In this series, we look at the new (or relatively new) VCs in the early stages: seed and Series A.

But just who are these funds and venture capitalists that run them? What kinds of investments do they like making, and how do they see themselves in the VC landscape?

We’re highlighting key members of the community to find out.

Chun Xia is a founding partner at TSVC.

Concurrent to his role at TSVC, Chun is the founder and CEO of Mash5 Technologies, a company that focuses on IoT for smart devices. Mash5 is dedicated to help enterprises improve their user experience, reduce costs, and transform businesses by consolidating technologies, products, and operations. Mash5 is headquartered in Silicon Valley, with operations in Beijing and Suzhou.

From 2000 to 2001, Chun was President and CTO of Thinkmart, which offers web marketing solutions for small to medium intellectual service providers, including legal, accounting, design, and many other sectors. Prior to that, Xia was the co-founder and CTO of brightinfo.com, a leading company in e-merchandising management for B2C online retailers.

He holds a Ph.D. in Computer Science from University of Illinois at Urbana-Champaign, and a Bachelor of Engineering from Tsinghua University, Beijing.

VatorNews: What is your investment philosophy or methodology?

Chun Xia: TSVC is an angel fund. We invest mostly in the seed stage and we have 10 years of history. Our philosophy is to constantly look for unicorns. We need to get a unicorn. We write the very first check, like in Zoom we were the first fund to invest, and then to make returns we need to have a unicorn. We’ve already had five, and two more are coming.

Also part of a philosophy is that we believe in big trends. Even when those trends are not so obvious, if we do believe they have big potential then we want to invest. Also, if we believe that the team has very strong execution and ability, and they can be a winner.

VN: Talk to me about some of those trends that you have invested in over the years.

CX: One of the old ones, for example, when we invested in 2011, the trend was mobile internet for enterprise. Apple announced its iPhone in 2007 and after a few years we believed it was pretty much ready to get into the enterprise. So, that was a big trend.

The current trend, of course, is what we see with COVID. COVID is really a huge cultural shift, and will change our behavior, like how everyone is now working from home. There is a lot of change, and some changes will stay. That’ll create new opportunities, so we’ll see that happen in a lot of ways and new ecosystems.

VN: What are some of the trends that you’ve seen now because of COVID that you want to invest in going forward?

CX: One good example is one of our recent portfolio companies, MyYogaTeacher. People started practicing yoga at home instead of going to a classroom, so this startup has a yoga teacher on the other end of the globe, in India; you get a one-to-one Indian teacher and everything happens on Zoom. This is something new and we believe it will stay after COVID.

VN: What are your categories of interest?

CX: In general, we can invest in whatever is IT related technology, from semiconductors and software and hardware to artificial intelligence. We don’t do things like material science, we don’t do agriculture technology.

VN: What’s the big macro trend you’re betting on?

CX: As a fund, we just recently discussed a lot internally that the big trend is big VCs dominating the market. We call them the ‘blue chip VCs.’ So, then, how does a micro VC survive? This is a big challenge for us. So, we need to find our survival strategy, find our angle.

VN: What is the size of your current fund and how many investments do you typically make in a year?

CX: We are on Fund IV; we started at $5 million and now it’s a $25 million fund, so it’s a small fund. Every year we invest in 10 to 20 deals, and so far we have 180 portfolio companies.

VN: How much is that in dollar amount for you?

CX: The typical check size is $250,000 to $1 million.

VN: What kind of traction does a startup need for you to invest? Do you have any specific numbers?

CX: That’s the difficult part because, in our view, we and the startup, we are in the jungle and there’s no clear path, no traction. It’s very different from the people who invest in the A round and can see numbers; we cannot look at any financial numbers, in that sense. So, the traction, you can consider it in two parts: one is whatever they’re currently doing, and whatever they’ve done in the past. The big part is their history. We can backtrack what they have done as a founder and that’ll give us some kind of a prediction or assessment to see if the actual traction, in this sense, is proof of execution. Is too early for numbers so we need to see if the team or the founder is strong enough.

VN: What do you want to see in terms of the team when you invest?

CX: For us it’s extremely important. We want to see if there’s a DNA fit.

Zoom is a very good example. When Eric talked to us and said, ‘I want to do video conferencing on mobile, so people can use a cell phone, even when working at an airport,’ we said ‘Well, this is great, we believe that will happen.’ But Eric said, ‘I want to do this for Facebook users, for consumers,’ and I said, ‘Yeah, you don’t have that DNA, but I do believe in you. You guys come from WebX and you have enterprise experience, you can do a terrific job for enterprise.’ After one year they switched from consumer to enterprise and they made it. So, this is their DNA. The enterprise guy may have a very difficult time doing consumer and for each startup, they need to consider they have one life, one shot; don’t think you have three lives. This is your life and we don’t want to waste your precious time and resources and talent. Use the best energy you have. So, DNA matters. It’s what we want to look at. It’s why we want to see the last 10 years of your history, it’s because we want to do this kind of DNA test.

VN: What about the product or the market? Do you also look at those?

CX: Most startups have a vision they put on their deck and I always say that most of them will be wrong. Even then, we are not sure because this is so dynamic. As I said, we’re in the jungle, we can not know the ending clearly. The thing we believe in is the big potential or the rough direction. Just like in the jungle, ‘Yeah, you’re heading north but you really don’t know what the next step is.’ So, the big potential, like the mobile internet, or AI, how it can improve and create more automation. That’s the big wave.

For example, COVID created a big opportunity because people quickly switched to digital. In the past, companies spent so much money trying to create this demand; then, all of the sudden, there’s this demand that’s just a given.

VN: How have you seen COVID affect valuations?

CX: It really depends on the sector. Like there’s one company called Zum. They do a terrific job. It’s kind of an Uber for the kids going to school, but all the kids are doing homeschool, your classroom is on Zoom, so that’s a big hurt for this type of company. However, anything you can do online, we see the big potential. Those valuations are high.

VN: What sectors have been well affected positively in terms of valuations, what sectors have you seen that are affected negatively?

CX: It’s easy to tell. Anything where you rely on physical contact, there was a big downturn. Anything that could be done virtually did well. We evaluate it this way: if you can really leverage Zoom’s ecosystem, that’ll be good.

We made an investment last year, it’s called Avoma, it’s for Zoom recording and you can use AI to create an automatic transcript. This kind of business really benefited from COVID.

VN: Yeah, it’s a bad time to be in the co-working space, for example. Funny enough, I think Airbnb is doing well because people want to go on like a staycation. So, in some cases, you actually can benefit even though you’re in a physical and not virtual space.

CX: This is something we also talk a lot about. We really appreciate an Airbnb type of team, which has very strong execution. They can sense the new opportunity, they can grab the new opportunity. That’s the kind of team we’re looking for.

VN: There are many venture funds out there today, how do you differentiate yourself to limited partners?

CX: Everyone has to do this kind of job. ‘We’re special, we’re unique.’ For our uniqueness, we will say we have a lot of unique points. One is our team; we are all domain experts and all of us were previously engineers. We have very strong technical backgrounds, and everyone has a particular field. We have a lot of cumulative knowledge and also have our own networks. So, this technical expertise helps us a lot in our investments since we don’t have to rely on outsiders and we can judge for ourselves. For example, when we looked at Zoom, when they talked about inventing their own codec, we knew what they were talking about. We could ask, ‘how do you make your own codec? That’s a data transformation format.’ Actually, we had a huge advantage, because we could see the quality was much better.

The other part is the startup experience. Most of our team, we had our own startups and some of us are serial entrepreneurs, like myself. We understand how to grow from zero to one; we focus on zero to one, not one to 100. So, then using this experience, we can help us to evaluate the team, whether they are likely to make it. Also, down the road, when they go from the seed stage to the A round, we can help the team a lot with our experience.

One more thing is the team size, since we have a very special compensation structure. Our team is not small, even though we’re a very small fund: we have 12 partners, so we can cover a lot of different areas and different experiences. The way we work is that each deal we have a 10 points credit and then we assign the credit to the different partners. So, for example, say you feed us a deal; even if you’re not part of our team I can give you one to three points as a sourcing partner. You could be a one time sourcing partner for us, since we have a big network, we have a lot of friends, university and the company alumni. So, that’s a big network that helps give us a lot of deals.

VN: I want to actually go back a little bit of what you said about going from zero to one, instead of zero to 100. Is zero to one the hardest part?

CX: Yeah. If you look at the failure rate, most startups fail. The hardest part is maybe zero to 0.3, or even before. That is the really, really tough part.

VN: Venture is a two-way street, where investors also have to pitch themselves. How do you differentiate your fund to entrepreneurs?

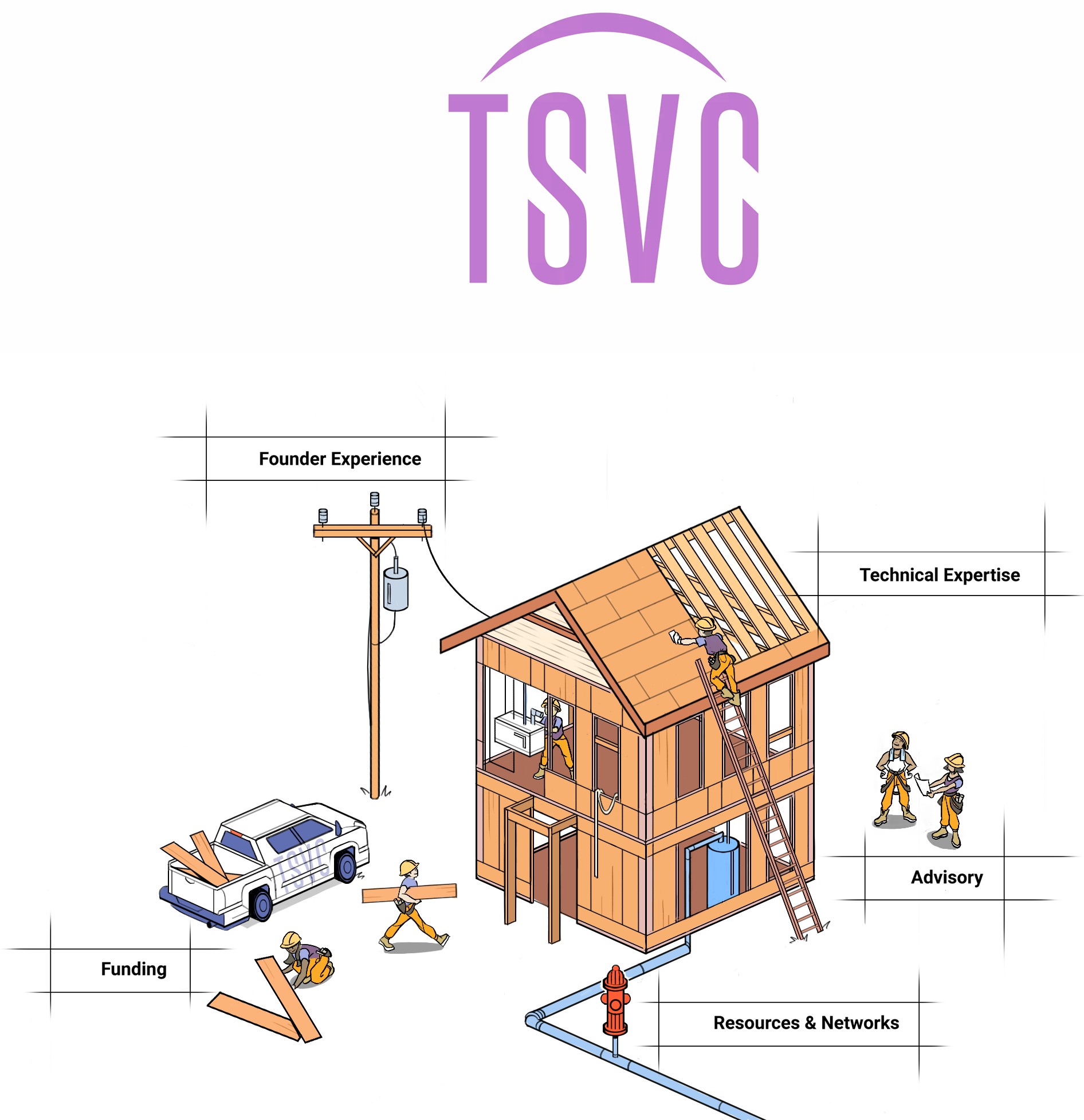

CX: Let me share an image with you. We are trying to rebrand ourselves a little bit and this picture will be on the homepage.

Say you’re the founder, and your startup is a house, then funding is actually just one part, it’s kind of a raw material, building material. Then what we offer is our founders’ experiences, which is just like electricity, and we constantly help you run this house. Our resources and network are like water, you need that, and with our technical expertise we can give you a lot of tips on how to build the house. Our advisory experience can help you with designing the house. So, this is what we’re working on.

Say you’re the founder, and your startup is a house, then funding is actually just one part, it’s kind of a raw material, building material. Then what we offer is our founders’ experiences, which is just like electricity, and we constantly help you run this house. Our resources and network are like water, you need that, and with our technical expertise we can give you a lot of tips on how to build the house. Our advisory experience can help you with designing the house. So, this is what we’re working on.

We’re trying to position ourselves behind the scenes, and a lot of founders, especially deep tech companies, love talking to us. Quite often they’ll say, ‘oh, you’re the first VC I can really, really truly talk about our technology. You guys really understand. You even understand some particulars better than me, and you can give me advice.’

VN: What are some of the investments you’ve made that you’re super excited about? Why did you want to invest in those companies?

CX: The first thing we really need to see is if the company has a great vision. The vision can fit into the big potential or the big emerging market, or even the existing market that will change and is moving to a different direction, just like Zoom. Video conferencing was not a new thing, but going after mobile, that was different. Even today, I think Zoom needs to reinvent themselves after COVID. So, everyone has a good story but we’ll see if this is truly a good story or if it’s just a bluff.

The other part is, of course, is if we can be so excited when we see a great team, a great founder. So, we have our sense, we have our judgment.

We have, for example, Carta. That’s a really a true innovator in their space, and also Quanergy, which is probably the first to do LiDAR. For the self driving car, you need to have a laser radar sensor. Even today that is a not a household name, but we do see that they have a big potential. Just like last year, we invested in MyYogaTeacher, there’s one small example on how to leverage the COVID effect and create this kind of a business. And it has potential to be a unicorn because why not? We are not 100% sure, it really depends on the market and also their execution.

VN: What are some lessons you learned?

CX: I came from China and got a PhD at the University of Illinois. I came to Silicon Valley in 1996 and joined Sun Microsystems. That was a terrific experience because what I quickly realized was that Sun was a really a huge startup company. Each product is an internal startup, so my first startup, actually not my own startup, was at Sun. That project was the earliest cloud project; we did cloud computing, so we learned a lot.

After that, I had my own startup: we were the first to do e-merchandising because in 1997 and 1998 e-commerce had just gotten started. Even if you looked at the Kmart website, it was just a catalog, from A to Z, and there was no merchandising or way to place a product. There was no personalization. We were the first to do that. That was a very exciting experience and then the startup quickly got acquired by somebody else.

I feel this kind of innovation, doing new things right now, is so exciting. For me, VC is a lifetime career direction. Whatever startup or investment, we need to look at new things and that’s my ideal job. I find it’s very, very fascinating to do this. The fund started 10 years ago as a kind of a nonprofit project, because I graduated from Tsinghua University, which is like the MIT in China, and we have a lot of alumni, like 15,000 alumni, in Silicon Valley. A lot of people want to do startups and they seek us as an angel investor. I talked to Eugene Zhang and we started this fund because there was a big trend 10 years ago called a super angel, like Funders’ Fund; they paved the path, so we said why not just do a super angel? So, that was the starting point. So, this is a really exciting career for me. I really love to see new things, I love that.

VN: What excites you the most about your position as VC?

CX: I was born in 1962, so, at this age, I think I should heavily leverage my experience and my accumulated resources. I try to do whatever I feel I can do best, so it’s really like the book the Outliers, where you spend 10,000 hours working on one particular thing; I have spent a lot of time and work to create a new thing and innovate something that never existed. That was in my past career, and that was my accumulated experience. That actually really helped me to spot new trends and new potential. Even when it’s not so obvious, we can spot that early and also leverage it to look at the people and whether or not a team can really execute, can really make it. We made a lot of mistakes, and we learned a lot of lessons.

VN: Is there anything else that you think I should know about you or the firm or your thoughts about the venture industry in general?

CX: We are trying to raise a Fund V, and we want to tell people about our strengths. We are extremely focused on how to identify the next unicorn and leverage our expertise and our experience and our very uniqueness of operating our fund, especially with compensation. We can make a fund as a platform. So, even you could be part of a fund, in that sense. We can contribute and we can give a piece to you. That’s the whole idea.

VN: I like that idea, it’s inclusive. I think venture capital can sometimes feel exclusive. ‘I don’t have a lot of money, I can’t be an investor.’ So, I like that idea that anybody can be part of it. That’s like democratizing it.

CX: We want to make it open. The whole technology world and the culture is going in that direction. Just like in the media, where it used to be dominated by the big players, and now we have social media making it more open.

VN: Do you see other firms going in that similar direction? Is that a trend in the industry?

CX: It’s hard to tell. So far, to the best of our knowledge, we’re the first in Silicon Valley. But we do see some of that trend and some people have started to accumulate small money LPs and they claim to be a platform. We need to see what the best model is to operate and we already have a 10 years of history. I think we were able to prove that our model really works.