Meet Jonah Midanik, COO and General Partner at Forum Ventures

Forum Ventures operates its own venture studio, accelerator, and pre-seed fund

Read more...

Venture capital used to be a cottage industry, with very few investing in tomorrow's products and services. Oh, how times have changed!

While there are more startups than ever, there's also more money chasing them. In this series, we look at the new (or relatively new) VCs in the early stages: seed and Series A.

But just who are these funds and venture capitalists that run them? What kinds of investments do they like making, and how do they see themselves in the VC landscape?

We're highlighting key members of the community to find out.

Richard Lim is co-founder and Managing Director of GSR Ventures.

Lim focuses on investments in early-stage companies that apply artificial intelligence to healthcare and enterprise sectors. Prior to GSR Ventures, Richard was a serial entrepreneur. He was also an executive at Lotus Development Corp. and the National University Hospital of Singapore.

He earned an MBBS degree (MD equivalent) from the National University of Singapore and an MBA from Stanford University where he was an Arjay Miller Scholar.

VatorNews: What is your investment philosophy or methodology?

Richard Lim: We've been around for a while; I started the fund in 2004. We manage over $3 billion and we invest between $50 to $200 million a year. The fund is focused on early stage investments and is global. Although we have a separate entity investing in the United States, the majority of our LPs are from the US, and our office is Palo Alto. As far as stage is concerned, we are primarily early stage technology investors.

Early stage means we will do seed, we’re almost always the first institutional investors in the companies we invest in, and we have the capacity to pro rata up to what used to be the Series C rounds, what you might now call the Series B rounds. We're now investing out of seven funds.

VN: What are your categories of interest?

RL: Although we do have a global focus, in the U.S. our primary focus is on digital health. As a general theme, starting in around 2014, we started making investments in AI and by 2016 or 2017, the vast majority of our investments had some AI component to them. In the last year or two, we started investing in digital healthcare.

To give you a little bit of background, I actually went to medical school, then I worked in public health for a while before I went to business school, where I did computer science as well as business at Stanford. I then joined a company called Lotus Development and I left a few years later to start a company as a startup, this was in Boston. I started a couple companies before starting GSR Ventures in 2004.

VN: What’s the opportunity you see in healthtech right now?

RL: A little bit more context: although I went to medical school and I had the intention of working in health tech technology, I graduated from Stanford in 1988 and it very quickly became apparent to me that the healthcare industry was not ready to deal with DOS-based PCs with 18x24 character displays. Although I looked at health care a couple of times over the years, each time I decided that the time was not quite right.

When we decided to focus on AI in 2016, it became apparent to us that AI perhaps could make a dramatic, transformative difference to healthcare. After spending about a year looking into the sector, we decided as a partnership that that was something we would like to focus quite a lot of attention on. I brought on Sunny Kumar, who joined us in 2017 and then recently Justin Norden. All three of us are MDs, we all have a background in AI. That’s important because the transformative companies are merging the application of AI and healthcare, so it will require people that understand not only healthcare, but the technology and how it could be applied in healthcare, and understanding what are the cases that would actually make a difference.

(Editor's note: Sunny Kumar will be participating in Vator's Future of Virtual Care event on July 1. Get tickets here!)

I was actually quite gratified to see that there was an article in Forbes this weekend, where the reporter basically said that the first trillionaire will be some entrepreneur who applied AI to healthcare. A trillionaire founder implies that the company is going to be worth $4 or $5 trillion. That’s a big number.

VN: What's the big macro trend you're betting on?

RL: AI is going to be transformative across many industries and sectors, particularly in the spaces that have not, up to now, been impacted by the development of computer systems. Healthcare is one of them. In many different ways, you could say that the way we practice healthcare now is not very different from how it was 20, 30, 40 years ago. I mean, of course now have implants, over the years we developed laser treatment for retinopathy, we have corneal transplants, so it’s true things have changed, but the IT systems themselves have not really made a dramatic change in healthcare, and in education, for that matter, as it has in many, many other industries.

Another way you can think about it is that healthcare, which is now close to 20 percent of the US economy, if you measure productivity in terms of the output of the number of patients being treated over a period of time, that has not really changed, and that's because the way we practice healthcare is not that different. One doctor sees one patient and then examines the patient, maybe makes some tests, comes to a conclusion in diagnosis and prescribes the treatment. We believe that the AI, correctly applied, could be transformative in a whole relationship between physician and patient, and transform what is a shortage of qualified medical practitioners to something where, because productivity increases so much, we can afford to provide high quality healthcare to everybody who needs it, at an affordable cost.

VN: What is the size of your current fund and how many investments do you typically make in a year?

RL: The current fund is actually several funds, because we have a segregated fund for the GPs, we have a growth vehicle and we have a usage vehicle for opportunities, but combined it’s approximately $650 million. We expect to make in the range of 15 to 20 investments a year for roughly a three year fund so between 45 and 60 investments.

In the successful companies, we’ll invest as much as up to $20 or $25 million.

VN: What kind of traction does a startup need for you to invest? Do you have any specific numbers?

RL: We will invest pre-product, and we will also invest in companies with early commercial traction. Just as an example, this was many, many years ago, we invested in a travel search business, and they eventually went public on NASDAQ and did a merger became the largest travel technology company in Asia with a roughly $11 billion exit. The combined company was worth about $20 billion. We invested in them at a $6 million post-money valuation when they had no revenues and a bunch of users. So, they had a product, but were pre-revenue. We've also invested in companies before they even ship the product.

VN: What other signals do you look for? Team, product, macro market?

RL: We like to invest in entrepreneurs who have the capacity, ambition, and the ability to build truly transformative business. We've been fortunate in the 15 years we’ve run the fund to have had four investments which have exited in the range of $10 billion dollars each, where we were actually the first investors in the companies, so we have convinced ourselves that we know when the company will actually generate a return. So, we look for people with that perspective, where we believe that this team and this CEO can build a transformative company that can truly make a difference.

To do that, they need to understand the space that they're investing in, they need to understand the technology they’re doing it with, they need to understand what direction the technology is moving in, they need to understand why what they're doing will truly make a difference, and why it will adopted, especially in healthcare, by the community. If you don't understand why people want to adopt it and the system, then it’s really difficult to figure out why this will actually work.

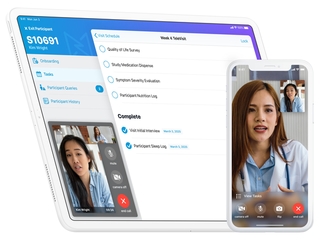

I’ll give you an example: we recently made a relatively limited investment for us in a company called Medable. They raised over $25 million dollars, we led the round with $15, and the company is involved with virtual clinical trials. So, in a historical context, in order to run a clinical trial, your patient actually has to go back to the treatment center to be seen by the doctors and nurses, and interaction was almost always at the clinic. In the go-forward model you look for in the future, there are many ways technology can change that interaction. For instance, the patients could be at home, they could register information, you could collect information on patients without them necessarily coming to the clinic.

The interesting thing is, when COVID-19 hit, we were not sure how it would affect them. We were truly fortunate in that it totally turbocharged their business because suddenly the large pharmaceutical organizations that had been looking at this technology, whether it was AstraZeneca or early adopters, the coronavirus basically made it a necessity for them. I can tell you that going into March and April we were really concerned because these are big contracts, and everything was frozen, but suddenly the amount of interest they have had was unprecedented and the decision making has gone much faster than anybody anticipated. So, sometimes you're lucky, but the team, to their credit, was able to grab that opportunity and make a transformative difference in how to do clinical trials.

VN: How do you see valuations being affected by the current conditions, like the coronavirus and the economy? How have they changed in the last few months?

RL: There are two or three factors that come into play here. Number one is the exit markets are highly uncertain. I mean, the stock market had a 35 percent swing downwards and then 35 percent swing back up in about three months, and today it went down six percent. So, there's a high degree of uncertainty about what exit valuations are going to look like and that has an impact. And there's also a very real impact on business. If you're selling into health systems, I don't care if you’re selling diagnostics, selling therapeutics, or selling quality care systems, you have a huge problem because the health system in the US suffered tremendous losses during the COVID-19 pandemic, which is still ongoing. So, everything is broken. Yet you also have the telemedicine space, the virtual clinical trial space, digital therapeutics, where we're seeing a tremendous success happen.

Valuations are affected by a couple of things. The first question need to ask yourself is, does what you're doing suffer from a headwind or a tailwind because of the coronavirus? Because we don't know whether coronavirus is going to be around us for the next 12 months, or the next 18 months, maybe forever and so if you're going to be suffering headwinds, then your valuations are going to be significantly lower than it would have been pre-coronavirus. If you have strong tailwinds, then it's likely that your valuations will be the same, or perhaps even higher than it was before coronavirus. So, this is a hugely uncertain view for an early stage company. It was probably April, maybe the beginning of May, before it dawned on us that the health systems were in trouble, because you'd think that with all these patients coming in they'll be okay. Then you realize that, no, it's not the case because the systems make most of their money from elective case, and the number of elective cases collapsed. They don't make that much money from the coronavirus cases. So, I think it very much depends on what you're doing and very much depends on how your particular business is affected by coronavirus.

Sorry to avoid the question but, you know, that's the reality.

VN: There are many venture funds out there today, how do you differentiate yourself to limited partners and to entrepreneurs?

RL: We’ve been very fortunate. We had two closings on fund one, we oversubscribed the second close. All our other funds have been single close, and we oversubscribed. We got ourselves in that position because our funds, on a macro basis, have returned about 6x, of which more than half of it has been realized. We seem to be able to fairly consistently find companies that are able to have a large transformative impact, and, out of that, have large returns.

I think that is partly a matter of strategy. We are primarily focused on sectors where we think we are differentiated and we can make a particular difference to the entrepreneurs. Entrepreneurs look at us, they talk to other people and tell us that, "Oh, you're the best possible investor for me. You know more about what we're doing than anybody else I've met." Which is why we put together a team in the digital health space, not just the three of us but the supporting ecosystem of people who truly understand how digital technologies, especially AI, can be applied to healthcare. For the healthcare entrepreneurs that is a huge differentiator. Very often we meet an entrepreneur and they tell us "Wow, you're the first investor I’ve met who actually understands, truly understands what we do."

VN: What are some of the investments you’ve made that you're super excited about? Why did you want to invest in those companies?

RL: It’s very much driven by people. Like Qunar, the travel search business I talked about. The co-founder, who was then the CTO was probably the most knowledgeable and thoughtful person we've met. He ended up taking over as CEO of the company and he built a truly transformative business, which became one of the largest travel tech businesses in the world and then merged and became the largest travel tech business in Asia. I think it’s the second most valuable travel technology company in the world. So, fantastic entrepreneurs, who understand the space and understand how technology can be applied, with vision to the future, are key to keep the things that we've invested in.

We talked a bit about Medible, and Michelle is this impressive individual who has had a vision of being able to transform clinical trials for a while, and managed to convince investors to fund projects where she spent millions of dollars, building a system before it could see the light of day. From an exit standpoint, very early on we were the first investors in a company called DiDi, which you might know was the largest ride hailing company in Asia. It actually bought Uber’s business in China. Again, it was the team and the CEO that impressed us.

On the healthcare side, many years ago we invested in a company called Kinsa. You might have seen them in the news, they've had a lot of publicity. Inder, when we met him four or five years ago, had the vision of being able to build a network of digital connected thermometers that would provide early warning information on the flu, and other epidemics that cause a fever, which is most epidemics. When COVID-19 hit, they were in the right place at the right time to be truly transformative.

VN: What are some lessons you learned?

RL: The first lesson is that we're in the business of finding the five or 10 percent of successes. So, 80 or 90 percent of companies are not going to make a big difference, but the five or 10 percent that do make a huge difference in everything that we do. So, then the question is, with that type of betting average and odds, what makes the difference? It's the person and the team around him. The space they choose to be in also makes a huge difference because if you pick the wrong space, you can be really good but if there's no hope in that space then you're not gonna get anywhere. And is technology ready? One of the reasons why we invest in AI and digital health companies is that we think technologies have emerged. We think we may be at a point where technology can make a difference, whereas even five or 10 years ago it was not possible. So, the right team and people in the right sector, right when the technology is ready.

Technology changes all the time, so I can give you another example: four years ago we said, "Speech recognition is not ready." But we do know speech recognition is changing very rapidly, so we watched the space. There were many attempts at having interactive voice-based diagnostics, and we said that was not ready, the technology was not ready yet. I'm not hundred percent sure it's ready now but it’s getting better by the day and I think it's closer than it used to be. On the other hand, four or five years ago everybody thought that by 2020 we would all be sitting in autonomous taxis, and those cars would be on the streets. We all know that that didn't happen, and we all know at this point that we're looking at the thing and saying, "Well, it will be another four or five years before it’s ready." So, sometimes that happens too.

VN: What excites you the most about your position as VC?

RL: For somebody who's passionate about technology, passionate about how technology can change the world, this is the best job in the world. We have the time and the opportunity to work with some of the brightest people in the world, looking at how emerging technologies could be transformative to our society and world that we live in. That is truly inspiring and interesting, and there's an infinite amount to be done because the technology's changing all the time. We have the luxury and the opportunity to work with some of the brightest, most motivated people in the world.

VN: Is there anything else that you think I should know about you or the firm or your thoughts about the venture industry in general?

RL: We are convinced more than ever that AI tied to healthcare will be transformative for the delivery and practice of healthcare. We're truly excited to see how rapidly the businesses have evolved, and the technologies have evolved along with them. We don't know whether there'll be a trillionaire entrepreneur, but we will certainly see a huge difference in our lives in the next decade or two, both to our state of health and the conditions and treatments that we're able to treat on a global basis because of AI and healthcare.

We’re delighted to be part of this, and if entrepreneurs are interested we're delighted to talk to them and share with them how we think. They don't need any revenues, they don't need any products, they just need to know what they're doing, and the space they want to be in.

Forum Ventures operates its own venture studio, accelerator, and pre-seed fund

Read more...Beta Boom is a Salt Lake City-based firm that focuses on founders with lived experiences

Read more...Branded is an early stage investor in the food service space

Read more...Startup/Business

Joined Vator on

Medable is a privately held, venture-backed company headquartered in Palo Alto, California. We are focused on building a unified platform for clinical trial execution, enabling patient generated data to drive clinical research, and precision and predictive medicine.