(Correction: Consumer out-of-pocket expenses)

We’re excited to have Bind’s co-founder Shawn Wagoner join us on Nov. 14 for our final Invent Health salon of the year. This one focuses on the “Future of Healthcare Insurance“.

[NOTE: Just like our final salon in 2018, this one gathering will also be our pre-holiday cocktail party. So join us! Must be a Vator member to get the Vator access code. Log in here for your VIP pass code!]

The Minneapolis-based startup burst onto the scene last year with a $70 million round of financing. Backers include Lemhi Ventures, whose managing partner is Tony Miller, Bind’s co-founder and CEO, as well as St. Louis-based Ascension Ventures and Minnetonka-based UnitedHealthcare.

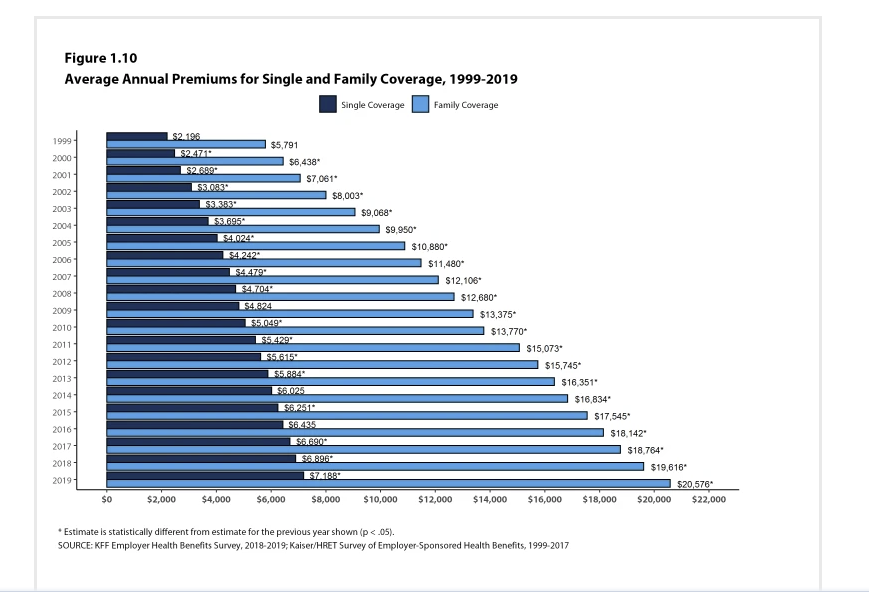

Bind works with self-insured employers to offer on-demand insurance, removing two significant barriers to efficient healthcare engagement—lack of informed choice and deductibles. In a 2019 Employer Health Benefits study by Kaiser Family Foundation, it showed that annual premiums for families under employer-sponsored programs reached just under $21,000 a year, up 5 percent from last year.

The idea is to upend the traditional model of high-deductible health care and give people something they’ve never experienced with health insurance: coverage flexibility and cost certainty. For example, search results for a sinus infection might show that going to the emergency room will cost a $350 copay, versus seeing a virtual doctor for a $10 copay (on some plans). Many insurance companies provide “estimates” of costs, but not the actual prices. With Bind, 80% of members pay less than $500 in out-of-pocket expenses a year— about half of what they typically would spend trying to reach their deductible, said Shawn.

Have any questions for Shawn? Join us at Invent Health on November 14 where our audience interacts with our select speakers who jumpstart the interactive conversations during the event.

In the meantime, here’s a couple interesting news I curated about the topic as we draw closer to the event!

Yikes! Rising premiums, KFF study shows

As referenced above, the KFF survey on employer-sponsored insurance plans shows that premiums continue to go up every year for the last two decades. Compare this to say, travel, where the price of airline tickets dropped by half since 1980.

So why are premiums going up? We’ll discuss at our Invent Health event on November 14!

Fierce competition for seniors from insurers!

Baby Boomers are entering retirement age! The youngest is 55 years old while the oldest is in their 70s’. In the middle, about 10,000 turn 65 years old every day! This has Medicare enrollment jumping. Medicare is now the fastest-growing segment of the health insurance market. Medicare Advantage plans have doubled over the past decade. This amounts to a 32 percent increate in the number of MA plan choices compared to last year. Moreover, MA plan premium costs will be down 14 percent from last year, according to the Center for Medicare and Medicaid Services.

The surge in new options may partly be due to the Trump administration’s policy to allow insurers greater flexibility to design MA plans and add services such as home care, chronic disease, transportation, etc.

Even with older, sicker enrollees, all-in-one Medicare Advantage plans can still be lucrative for insurers if they can keep them at home and avoid costly hospital stays

(Image source: Milwaukeeindependent,

Tags: