Venture capital used to be a cottage industry, with very few investing in tomorrow’s products and services. Oh, how times have changed!

While there are more startups than ever, there’s also more money chasing them. In this series, we look at the new (or relatively new) VCs in the early stages: seed and Series A.

But just who are these funds and venture capitalists that run them? What kinds of investments do they like making, and how do they see themselves in the VC landscape?

We’re highlighting key members of the community to find out.

Mark Selcow is a General Partner at Costanoa Ventures

Before joining Costanoa, Selcow was an operator, co-founding and serving as President of two companies, BabyCenter and Merced Systems. BabyCenter was a pioneer in the consumer Internet, grew to become a leader in the online parenting market, and was sold to Johnson and Johnson in 2001. Merced became the dominant provider of Performance Management software for large Customer Service functions and was sold to NICE Systems in 2012.

Selcow is a longtime volunteer with the March of Dimes, having served as a National Trustee and was Chair of the California Chapter. He currently serves on the Board of the San Francisco Friends School.He is a drummer in three bands and is learning jazz guitar.

He has B.A. in English from Brown University and an MBA from Stanford Graduate School of Business.

VatorNews: What is your investment philosophy or methodology?

Mark Selcow: At Costanoa, we’re early stage, B2B investors. So, we invest from company formation through Series A; our wheelhouse is really Series A but, lately, we’ve been investing at an earlier stage for a range of reasons. We’re really looking for are companies that that change how business gets done. The revolution of data strategies, like AI and ML and other techniques, can change industries and business functions. We are quite broad within that mantle of what we’ll do, and that include everything from business marketplaces to vertical industry platforms to functional software to even frontier technologies where there’s a business buyer that fits.

VN: What are some of the opportunities you see in B2B and why is that interesting to you?

MS: The strategies of leveraging data, and the insights that flow from it, have the potential to transform everything from whole investitures to every business function. The way people manage supply chains, the way people manage their finance function, the way people hire and staff and manage teams and how they collaborate and communicate. The way industries’ value chains can be unlocked to release efficiency and profitability and velocity and things that accrue to a great customer experience. We just believe that we’re at a point where data can transform, and our job is to find those sectors and those choke points where we think someone can build a great company that unlocks that value.

Of course, it’s really hard to find those, but that’s our job, to go out and find entrepreneurs who we think have the creativity and the leadership potential and the product development skill to do that.

VN: What are some of the verticals you invest in as a firm, and where do you personally like to invest?

MS: As a firm, we have a big practice area in infrastructure, security and the process of managing data consistent with our thesis, so data stack. Think of all of that as anything owned by CIO, a chief security officer, product development organizations and data experts inside organizations. That’s one area where we are focused. I personally spend a lot of time in fintech and I see great opportunities for value to be created inside financial processes. In the last year, in particular, I’ve spent time inside banking and lending and insurance, with a bit more of a focus on insurance tech, which I think is really exciting.

As a firm, we focused on vertical industries; we made an investment in a company called Aquabyte, within the category of agriculture tech. Natural resources and mining and earth moving is another area where we’re made an investment. I’ve done investing in the world of the future of work, training the workforce for the economy of tomorrow, and thinking about major trends around upscaling people for digital careers all the way to managing increasingly mobile, deskless workforces and what categories of technology are going to be required to support that model of working. So, those are just a few examples of where we, as a firm, and where I have been focusing our time.

VN: What’s the big macro trend you’re betting on? It is AI and machine learning like you mentioned earlier?

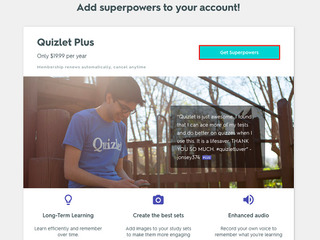

MS: AI and ML are the macro trend that we’re focusing on, but it isn’t the only thing that we do. We’re investors in a company called Roadster, which has built a point of sale solution for auto dealerships. They’ve just built a superior way for people to buy cars, working directly with dealers. It is not an AI company but it was a great business opportuntiy for a surprisingly big part of the economy. We have one consumer investment, that I am on the board of, called Quizlet, which is a learning technology company. It does get used by businesses, but it also gets used by consumers, and they’ve grown to over 100 million monthly users. AI has, to date, not been a big part of their strategy; they’ve been using user generated content, network effects to supply learning content for anyone who needs to learn and master anything, whether it’s medical boards or a realty exam to middle school Spanish. It just go happens that Quizlet is unveiling an AI strategy for their next phase of growth. So, the macro trend is definitely using what was, when we founded the firm, called Big Data, and now it’s increasingly called AI or ML or other techniques. It is the majority of what we do but not the totality of what we do.

We invest in any product that we think has the potential to transform its segment. So I’ll pick another example that doesn’t leverage AI today and that is Skedulo, a company that I’m an investor in and on the board of. It’s an Australian company that is building a system of work for the mobile workforce. So, these are workers that are growing in numbers massively; we see it as a mega trend. People are hiring more gig workers or 1099 workers, and, at a growing rate, these are people who don’t go to an office every day. They are inspectors or installers of solar systems, they are home health care aids and nurses, they are nurses who go and draw blood for life insurance applications, they are highway safety workers, they are pool cleaners. It’s a massive segment of the workforce, horizontally distributed, and there’s no major system for assigning the right skill with the right task, finding the optimal schedule for those workers, dispatching and rounding them, and then having a studio where, for every company-specific use case, you can document they’re doing the work on site they need to do with a photo, a signature or a workflow. That’s an example of a company that isn’t primarily an AI company, it’s a business application that we believe has the potential to make a really big difference for companies that have a mobile workforce. We just saw a really great trend and that’s why we did it.

VN: What is the size of your current fund and how many investments do you typically make in a year?

MS: Costanoa is investing out of its third early stage venture fund, and it’s $175 million. We also have an opportunity fund, which is a follow-on vehicle for putting additional capital at later stages behind the companies in our portfolio that we’re most excited about. That’s $75 million for additional follow-on.

In the early stage, $175 million fund, we’ll do 17 or 18 investments and our objective is to be Series A holders of those companies. Some we’ll invest in at seed and top up in our position at Series A, and some we will enter in at Series A. That’s 17 or 18 total out of the fund, so five or six a year, though we don’t have a goal in any given year for how many we’ll do; there are some years where we might do many more than that and some years where we’ll do many fewer, it all depends on the quality of the opportunity.

VN: You said you’re starting to do investing at earlier stages? How early are you investing?

MS: We have four companies that we’re incubating now, so that means we invested at company formation, that’s pre-seed. We have two offices, one in Palo Alto and one in San Francisco, so we have the ability to incubate three or four companies at any give time. So, we’ll do some at pre-seed, we’ll do quite a few at seed, and then our core is Series A. That’s range of what we do.

The reason we’re doing more early is two-fold; one, if we know the founder, and we just have deep conviction this is an extraordinary person with a great idea, we don’t care how early it is, we want to be in business with that person. We find those opportunities at seed from time to time and we jump on them. The second reason we do it is because we built a platform for Series A with an operating team, so we have a full time chief sales officer, a chief marketing office, a chief talent officer, and we have execs in residence, generally, with product and engineering backgrounds that enable us to provide a level of operating support to the portfolio that many seed firms simply can’t offer. We find, because of our Series A core and the breadth of resources we offer, we really have a lot to bring to the table at seed that we think helps us deliver more, build a deeper relationship and understanding of that business, so that when the Series A comes around we’re in an excellent position lead it. As a result, we’ve found good results applying these resources earlier, and it’s differentiator for us, because many seed firms do not have the kind of operating support model that we do.

For a typical seed we invest $1 to $2 million, for a typical A it might be $5 to $10 million, and at company formation it could be even less, $500,000 or $1 million. We’re not rigid; the numbers can range based on the capital needs of the business. We take a bottoms up approach on how much we think the company needs to accomplish what they need to during the life of that financing cycle. We typically reserve additional funds from the early stage venture fund.

VN: What kind of traction does a startup need for you to invest? Do you have any specific numbers?

MS: At the early stages, often there’s little or, in some cases, no data so we’re making our investment decision based on the founders and there are many attributes we look for: creativity, leadership, and will great people want to want work for this person? Do they have a deep understanding and a theory of the product and the business? Do they understand the customer deeply? So, we’ll do our best to really understand the founder and we’ll do our best to understand the market. We’re on our third fund, and we have lots of portfolio companies with lots of customers, plus I come from an operating background, I co-founded two companies, so I have a decent network, as do my colleagues, so we can do our own independent marketplace research to understand the characteristics of the market. So, if it’s a great team focused on a great market, we’ll invest without a ton of data.

At Series A, generally there’s business performance data, and that’s really helpful and it’s great to know how the product is performing, how customers feel about it, how their sales team is doing, how many sales people are on plan, the unit economics of the customer. We’re very bottoms up in understanding the facts around how the business is performing. I would say we don’t have specific rules or thresholds. For example, the dollar level of sale for it to be ready for the Series A, that could be really variable. We look more at the overall picture of the business and have they derisked the opportunity and demonstrated that there is product market fit? Is there evidence that customers really care and are prioritizing this problem? Is there evidence that they’ve built the team that’s performing and evidence that the product is doing what they told customers it would do? If those things exist, then the dollar sale threshold can have a wide parameters around it.

VN: What other signals do you look for? Team, product, macro market?

MS: We have a rubric we often use, which is team, market and product. We want to have conviction that it’s a great team that either has built a best-in-class product, or they have a theory or a capability to do that, and that it’s in a really attractive market.

There are many dimensions in each of those categories. For the team it’s if the founder is smart, driven, has domain knowledge, or if they have people around them who have it. I often look for evidence of judgment when I’m evaluating a founder. What tough calls have they made? What the system and process they used to make decisions? What’s the pace of decision making? Of course, I look for leadership attributes, since hiring great people and the ability for them to recruit is key, but also I want to know that they’ve gotten through bad and good times alike, and that people who’ve been there with them say, ‘This is the kind of person I really want to take the hill with.’ This is all work that you can do by getting to know people on a deeper level and referencing them.

On product, we study products, we do architectural reviews, we do demos, we talk to customers when there are live customers. We leverage our portfolio and our network of other product experts; as I mentioned, the executives in residence who work at Costanoa, many have product and engineering backgrounds and they help us understand how products are working and how they’re performing in customer environments. I’d say we weigh product and product market fit pretty high relative to some others who are investing at our stage.

And then on market, we look for the same thing everyone does: is the market big enough that you do a good job you can build a really transformative, meaningful company? But we also look at really important dynamics like propensity to buy, propensity to switch from an old way to a new way, t he kind of unit economics and margin that might exist if you do a good job. We look for who the internal champions and the detractors might be in a business who are interested in not only prioritizing a project in this category but then choosing this company versus alternative approaches and homegrown solutions, which are endemic in a lot of organizations. So, we look at all of those dynamics and many other inside market, not just market size. And we find that it’s really helpful for us to have theory around the investment and ultimately make a decision.

VN: What do you think about valuations these days? What’s a typical Seed pre-money valuation and Series A?

MS: There’s definitely great inflation on valuations. We observe it and we’re responding in a few different ways. We continue to believe that there are incredible investment opportunities, not withstanding the increases in price; yet, for us to deliver the kind of returns that we need to for our fund, we need to have price discipline. So, what do we do? We are investing more at seed, which doesn’t mean that the Series A will be any less expensive but we will understand the business more deeply and be able to have more conviction at Series A if we’ve been involved from the seed stage. So, that’s another reason I didn’t mention before about why we’re doing seed.

Second, there’s a little more pressure on market and market size if you’re going to enter at a higher price so that weighs a little more heavily in our analysis. And then, third, we are actively looking to invest in geographies where we think there’s talent and great companies being built and where the entry price might be a little more attractive; we’ve done three investments in Australia, we’ve been active in Canada, and we’ve done an investment in Europe, which is new for us. We’ve spent a lot more time outside of Northern California and, frankly, it’s going well for us. So, those are all ways that we’re responding to, on weighted average basis, have good entry prices yet still have access to the best companies.

VN: There are many venture funds out there today, how do you differentiate yourself to limited partners?

MS: We start with how we think attractive B2B is. There are tons of great places to invest if you’re building an allocation as an LP that’s looking at a range of different asset classes, but the performance of B2B has been really strong over time, so we start by explaining that we’re fishing where the fish are, where tons of great, billion dollar companies are getting built.

The second thing we talk about is that we’re a boutique, and we use that term deliberately and proudly. We’re not looking to grow the size of our fund massively with every new fundraising cycle; we like our size and we think it gives us the ability to build the infrastructure as firm to support companies in a way that’s really special, that’s really meaningful, that really helps those companies perform. So, we have to be big enough to do that, but not so big that we’re to deploy massive amounts of capital and have to only look for companies where we can write big checks. We believe LPs care about capping the size of funds, because it is correlated with returns, so we think we’ve found a nice mama bear place where we can keep our fund on the smallish size and still be a boutique, yet still be able to support companies in a meaningful way.

That’s generally how we present ourselves, and then as I described earlier in our conversation, what we do with our operating team, with the way our investment team supports companies, we really do feel that for firms our size, investing the way we do, and at the stage we do, we have a very special set of skills and that’s attractive to many founders. That helps us get access to fantastic company opportunities that other funds our size might now get access to, and LPs very much care about that.

VN: Venture is a two-way street, where investors also have to pitch themselves. How do you differentiate your fund to entrepreneurs?

MS: I’ll give you an example from an investment that we made last year that I led and I’m on the board of called Lively, which is a health savings account bank. It’s a savings and health spending product for people on high deductible health plans. That’s an established category and what Lively has done is created just a better version of something that exists for people to use their health resources more effectively and bend the health cost curve. It’s a category I’ve been thinking about, had a thesis in, so I was really excited when I came across the guys from Lively. We wanted to invest right away, but they were entering the Y Combinator Series A bootcamp, and we knew when they did that they’d come out and they would meet all the top investors in Silicon Valley. These were extraordinary founders, and the traction in their business at the early stages was really special, so we knew it would be a really competitive round.

This is a perfect case study to answer your question; number one, we tried to preempt and we tried to show them that they’re going to get support and resources from our firm. In this particular example, given that it was a category I’d thought about and that I’d worked in the area of heath insurance selling through benefits departments to employers, I’d built two companies and enterprise selling organizations, I felt like I had a lot to offer. I think we impressed them, so after they went into the YC program, they came out and, sure enough, they had tons of interest, loads of offers, and they went with us. So, we felt like our playbook worked; we showed them who we were, we showed them that, as a firm, we would be supportive. We showed them that we actually were company builders, and had actually done it on our own before we became venture capitalists, and we showed them that we’re the kind of people who would be not only useful but positive forces on their board. With all of the options they had, and if I remember correctly some were even at higher prices than ours, they went with us.

VN: What are some lessons you learned?

MS: I am an entrepreneur turned VC. I was supposed to be a doctor, my dad’s a doctor, I was pre-med, and I decided I didn’t want to go that route with my career so I worked in the biotech industry for eight or nine years. That’s when I really fell in love with business and how passionately you can build an organization in pursuit of something that’s meaningful. I worked at Genentech while I was at Stanford Business School, and I worked at Amgen, the biggest biotech company, coming out of business school. I really cared about what we were doing but always in a business capacity, mainly product management and marketing roles.

Then my best friend from business school and I started out first company about four or five years out of school, and that was a consumer internet company when the internet was new; we started in 1996, and it felt to us like a generational opportunity to do something and it was the matter of finding the right idea, and that was the arrival of the internet. I do think that AI, and the application of data and data techniques, feels like a very, very large trend, like the internet felt. So, we grew BabyCenter and it continues to be the biggest resource for pregnant women, and new moms and dads, in the world today. It’s owned by Johnson & Johnson. Then Matt and I started another company called Merced Systems, which was quite different: that was measuring the performance, and helping improve the performance, of high turnover workforces. We started with call center workers, because it was such a quantifiable job, and it expanded to field service and retail and financial back office, people processing things like insurance claims or mortgages. Merced grew to be a pretty sizable business, nicely in the tens of millions, and we grew it profitably. We raised money from Greg Sands, my colleague and partner and founder of Costanoa, when he was at Sutter Hill. So, I had a decade of opportunity working with Greg as our board member and just developed a deep admiration for him. So, when we sold Merced Systems, I worked for the company that acquired us for a number of years, and had three businesses to run, including a turnaround, which was really exciting, I hadn’t done that before.

I was an LP investor first two Costanoa funds, so I always connected with the firm, and the opportunity to work with Greg, who I respected so much, was really attractive to me. I wasn’t sure I wanted to get into venture capital but the way he had built the firm, it was at a stage that was of interest to me; it was early stage, it was B2B, which was where I had spent the last chapter of my career. He was building the culture of the firm to be operationally supportive, which was really how I wanted to work as an investor. I didn’t want to be a picker, I wanted to be engaged in the companies we worked with. And he built a really collaborative, team-oriented culture, which lots of people do, but not everybody, and that was important to me. So, when it was time for Fund III, I was hooked and that’s how I decided to do it. A lot of it had to do with what was specifically attractive about Costanoa and I’ve been really, really happy and enjoying it. So, that’s the arc of my career. All along I’ve been serving on non-profit boards, and have been active outside of work in music, so I really enjoy all these dimensions of my life.

So, having a diverse background, consumer, B2B, life sciences, has actually been really helpful because of the broad purview of what we invest in at Costanoa. A company might come in and they’re building AI software for drug discovery or clinical trial management, and it just so happens from my biotech days that I’ve got four or five or six people I can call who know me because we worked together 20 years ago. I can say, ‘Does this sound like a good idea? Who are the smartest people you know who I can talk to who can help me understand if this is right?’ So, I do feel like the diversity of things I’ve done help me get to good decisions a little bit quicker.

In terms of my learning, one of the things I’ve worked on is my own decision making heuristics. I don’t have a long career in investing, I was an angel investor for quite a while before I became a professional investor, but I’m still developing my own models for how much information is adequate to make a decision, and am I really thinking it through in a way that’s rigorous enough? I would say I’m learning to move a bit faster, which I think is not only good so I can see more things, but it’s also a fair way to treat entrepreneurs. If the answer is that we’re not the best fit, it’s really better if I can tell them that sooner, so I’ve been working on that and I think I’m improving. But, so far, I feel that just in the last year all of the Series A investments that I led have successfully raised their Series Bs, so they’re financed and are growing, and I feel like I’m off to a pretty good start.

VN: What excites you the most about your position as VC?

MS: The things that I remember from my companies the most are the people we took a risk on because we just saw something special in them, then fast forward five years and they’ve been promoted three times and now they’re running a business, or they’re running a function, or they’ve grown in ways that they didn’t think was possible. Honestly, those are the things that I remember. The other would be customers who took a risk on us as a company, and we really helped them accomplish something that was meaningful for their company, and meaningful for them in their careers.

Those are the things that stay with me and I would say it’s no different as a venture capitalist. I think of the founders who are just dogged and passionate and they just believe and where we line up with them and we share that believe, and we’re the firm who took a risk on them, or we’re the firm who they felt most comfortable coming to in a vulnerable time and said, ‘I’m not quite how to make this decision, or what to do. Can we just hole up in a room and figure it out together?’ These are the things that I take with me. When my venture career is over one day, those are the things that I’ll feel most proud of, and, fortunately, in venture capital you get a ton of that. You really do. I work really hard to stay in touch with the founders that we don’t invest, where I feel like there’s good chemistry and a good connection because I care about them too and try to be helpful.

VN: Is there anything else that you think I should know about you or the firm or your thoughts about the venture industry in general?

MS: I’m a drummer and I’m playing in three bands, and, for me, that’s a huge creative outlet, and it bring a lot of camaraderie. I think part of the reason I became an entrepreneur, and I’m now a VC, is I always wanted to reproduce the camaraderie that comes from being in a band. You’re working together to build something and make something, like music, and I feel like it’s a pretty similar thing when you’re an entrepreneur with a small team. I feel like that’s what we’re doing at Costanoa,