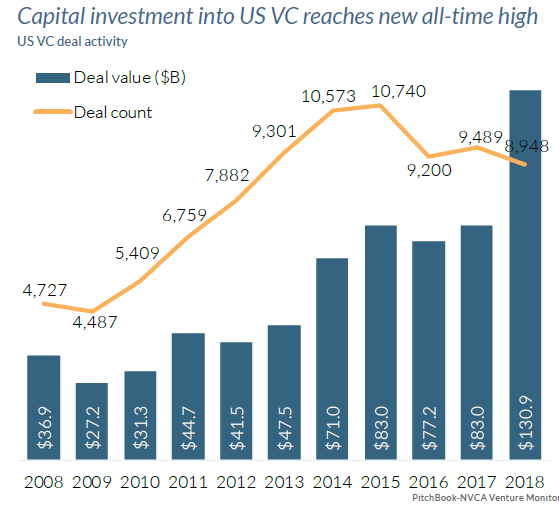

In Q3 of this year, the amount invested in U.S. companies was already higher than the total raised in all of 2017 and, with an entire quarter left to go, it was feasible that 2018 could see the most venture capital invested in the U.S. in a single year.

In the end, 2018 managed to pull it off, setting an all time record for venture capital with $130.9 billion invested, according to the PitchBook-NVCA Venture Monitor, a report that is jointly produced by PitchBook and the National Venture Capital Association.

That total represents a 25 percent increase from the $83 billion invested in 2017. The previous record for venture capital investing was set all the way back in 2000, with $105 billion.

While the amount of funding was reaching all time highs, the number of deals continued to decline, dropping 5.7 percent from the 2017 total to 8,948 in 2018. This is the second time in three years that deal numbers have fallen, and they are now at their lowest point since 2012, the last time they were below 9,000.

This trend of more money and fewer deals is even happening at the earliest stages of venture capital. The angel and seed rounds saw $7.5 billion invested, the highest amount in nearly 10 years, an increase of around 3 percent from what was invested in 2017, but the number of deals fell 17 percent, causing median deal sizes go up 15 percent year-over-year.

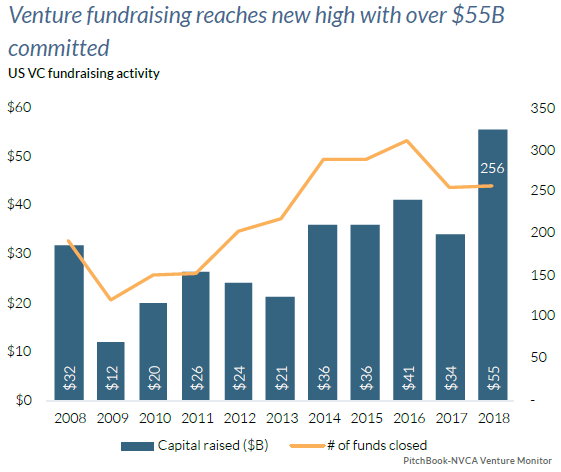

Of course, in order to invest more money, funds have to raise more, and so 2018 turned out to be a record setting year in another way, as venture funds closed $55.5 billion last year. the highest capital raised figure PitchBook has ever recorded. That is also the fifth consecutive year that at least $34 billion was raised. That number also represents a 62 percent increase year-over-year.

As a result, not only did the median fund size increase by 64 percent year-over-year to $82 million, but so called “mega-vehicles,” or those of at least $500 million, accounted for more than half of all capital raised last year. There were also a record 11 funds of at least $1 billion.

As a result, not only did the median fund size increase by 64 percent year-over-year to $82 million, but so called “mega-vehicles,” or those of at least $500 million, accounted for more than half of all capital raised last year. There were also a record 11 funds of at least $1 billion.

2018 was also a strong year for exits, with 864 companies either going public or being acquired for a total value of $120 billion, up 33 percent year-over-year and the highest total value since 2012. IPOs made up more than half of exit value for the year.

Some of the top exits of the year included the IPO of Moderna Therapeutics, which raised $604 million, as well as Allogene Therapeutics, which raised $324 million. On the M&A side, there was Microsoft’s $7.5 billion acquisition of GitHub, Cisco’s $2.4 billion acquisition of Duo Security and Alexion buying Syntimmune for $1.2 billion.

(Image source: growthx.com)