Video: Mario Schlosser at Vator Splash Health 2017

Reinventing health insurance

Read more...

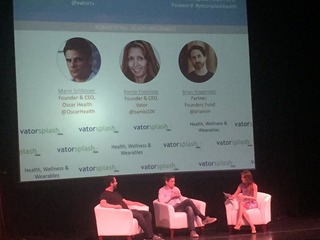

Mario Schlosser, Founder and CEO of Oscar Health, who was speaking on stage at Vator Splash Health, Wellness & Wearables 2017 with Brian Singerman, Partner at Founders Fund, an investor in Oscar, as well as Bambi Francisco, Founder and CEO of Vator, revealed something interesting: that his company is actually owed quite a bit of money by the U.S government.

The revelation came when Schlosser was mentioning some of the ways he thought that the American Care Act exchanges needs "heavy fixes."

"The government owes Oscar about $200 million because one of the stabilization programs that you have to have in these newly emerging health insurance markets. Medicare Part D, Medicare Advantage, all the emerging insurance markets from many years ago all had various stabilization programs when they launched, which were dismantled as we went along, he said.

"That made it very difficult to have any financial stability in this market. Those are things that need to get fixed up."

Francisco pointed out to Singerman that the government had called the money owed a "bailout," which he balked at.

"To call it a bailout is just insane. This is part of the law that the government said could entice insurance companies," he said.

Francisco also asked Singerman what is government's role in providing subsidies to help innovators in the healthcare industry and how can Silicon Valley be a bigger influence.

"I'm just in favor of the government enacting laws and then standing behind those laws. If you know the playing field, if you know what you're supposed to be doing, the government says, 'Ok, here's the law, here's the Affordable Care Act, you can read the law.' As long as then you're playing by the rules within that, that's what I expect."

Ultimately, he believes that "Oscar is going to thrive regardless of the legal landscape. Forgetting anything about tax relief, or anything else, just stability of the law, and stability of the membership" is the most important thing.

Schlosser chimed in again to say that, "the classic Silicon Valley approach to regulation, I think, doesn't work with healthcare," since those companies are going to be extremely regulated.

For example, in New York, ads for Oscar call it "a new type of health insurance," whereas in California, say "health plan." While that's how specific the regulations can be, Schlosser also said he has always found regulators to be very level headed, no matter what level they were, be it state or federal.

"They want good public policy, they want functioning markets, they want better coverage for members. You can work ith regulators in a very fruitful kind of way. We were never blocked from doing anything we wanted to do.”

Later on, during the audienc Q&A part of the talk, Matthew Holtz of Health 2.0 asked Singerman about his firm's investment in Oscar, given that Founders Fund put in a big chunk of the $700 million that the company has raised and it's no secret that Oscar is bleeding money. According to Bloomberg, the company lost $204 million in 2016, up from $121 million in 2015.

"How patient, Brian, do you think investors are going to be with Oscar, and other new plans, given the vast resources of their competitors?" asked Holtz.

"Very," is how Singerman replied.

"I have no fear on Oscar. To me, Oscar is in a phenominal position right now. We've got our narrow networks in order, in many places. We're going to be unit economic very positive. I can't control what money the government actually owes us. Somebody can do the math on the numbers that have been reported on Oscar's losses, and then compare that to the number that the government actually owes the company," he said.

"But, from an actual business perspective, no, I have no fear on Oscar right now. It's doing the exact right thing that needs to happen to get everybody insurance coverage, which I do feel like everybody deserves to have. To be treated under a healthcare policy. The way that Oscar is moving is the way that the country has to go for that. They're doing an extremely good job executing, so I think the company is extremely well positioned and is in a fine cash position to take this to the next level."

Thanks to Splash Health 2017 sponsors: Advsr, AARP, Avison Young, Bread and Butter Wine, Surf Air, Stratpoint and Scrubbed.

Reinventing health insurance

Read more...Staying human while becoming immortal

Read more...What would it be like if our doctors were perfectly matched to who we are and to our needs?

Read more...