Forum Ventures report: where health systems say innovation is most needed

The report outlined four areas as a guide to help startups to sell into these systems

Read more...

Snap has been on the public market for just under two weeks now, and, so far, it's been a bit of a rough ride for the company. Its stock has lost 16 percent of its value from the end of its first day of trading over investor concerns regarding user growth, as well as concerns about it being overvalued.

Share of Snap dropped 2.42 percent on Tuesday, to $20.58 a share - still 21 percent above its IPO price of $17.

New revenue estimates, out from eMarketer on Tuesday, are certainly not going to help with concerns about the company being overvalued, as the firm now projects that Snap will make $770 million in 2017, $30 million less in than the $800 million revenue that it had previously projected. That translates to a 3.75 percent drop.

The downgrade comes from what eMarketer says is, "higher-than-estimated revenue sharing."

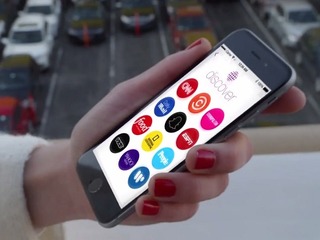

Snap makes all of its money from ad revenue, specifically from its Discover section, in which it partners with media companies for them to show exclusive content. Snap and its media partners, be it Vox, Comedy Central, Cosmopolitan, split the ad revenue that was generated by those channels.

Revenue-share costs were $9.6 million for 2015, and $57.8 million for 2016. From 2015 to 2016, Snap saw its revenue growing by nearly 7x, from $58.7 million to $404.4 million. That means that the percentage of revenue being paid to publishers actually went down, from 16.4 percent of revenue to 14.3 percent.

There are reports that Snap is looking to end its revenue-share agreement with its publishing partners. Instead, it would pay those partners an up front lincensing fee, and any ad revenue would go straight into Snap's pocket, meaning it would boost its revenue.

In the current situation Snap and the publishers are both selling ads for the content posted on Discover, splitting the revenue based on who sold it. With the change, Snap would be the only entity selling those ads, giving it more control over which ads its shows.

In all, eMarketer expects Snapchat to account for 1.3 percent of the US mobile ad market this year, which will more than double to 2.7 percent by 2019.

Is Snapchat overvalued?

Concerns over Snap's valuation have dogged from before it went public.

When it priced its IPO, Snap was valued at $23.8 billion, and with revenue of $404.5 million in 2016, the company has a price-to-revenue ratio of 58.8.

According to data compiled by Business Insider, that makes it, by far, the company with the highest ratio among many of its peers when they had their IPO; the only other recent offering that comes close to that is Twitter, which had a ratio of 44.8. Meanwhile, Facebook's was 28, Amazon's was 19.1, Google/Alphabet was 16 and Microsoft's was only 3.7.

Now that Snap is a publicly traded company, its current market cap is $23.23 billion, giving it a P/R ratio of 57, significantly higher than those other companies: Alphabet's ratio is 6.5; Twitter's is 4.48; Facebook's is 15; Amazon's is 3; and Microsoft's is 5.3.

Analysts have also questioned Snap's valuation and whether it is too high considering the company's current revenue.

“Academic literature suggests that the sexier and more glamorous a company’s IPO, the more likely it is to be overpriced at its IPO date and to suffer meaningful downwards earnings and valuation revisions in the first eight quarters after it goes public,” Needham & Co. analyst Laura Martin wrote in a note in which she gave Snap's stock an "Underperform" rating.

"We think they are going to be able to monetize and they’ve shown it but we don’t think it’s going to be as effective as the valuation is implying," said Ali Mogharabi, an analyst at Morningstar Inc.

Out of seven analysts, four have Snap as a sell, and three as a hold. None of them have it as a buy.

VatorNews reached out to Snap for comment on this report. We will update this story if we learn more.

(Image source: investors.com)

The report outlined four areas as a guide to help startups to sell into these systems

Read more...Flyte delivers mechanotherapy transvaginally to the pelvic floor

Read more...The country will need an additional 203,200 RNs each year until 2031 to fill staffing shortages

Read more...