Global AI in healthcare market expected to rise to $164B by 2030

The market size for 2023 was $10.31 billion

Read more...

The wholesale automotive space has, for the most part, not taken advantage of the efficiencies that technology can offer. The process of live auctions, which are conducted from franchise dealer lots, has not been brought into this century. It's an outdated and expensive way to do business.

ACV Auctions, a platform for deals to buy and sell wholesale cars, is fixing the problem, and has now raised $15 million in a Series B round of venture funding led by Bessemer Venture Partners, it was announced on Wednesday. The new round builds on the $5 million that ACV Auctions raised just six months ago, in September of last year.

This latest round brings the company's total capital to $22 million, including the $1 million that ACV Auctions secured in 2015 by winning the 43North startup competition. Previous investors include Tribeca Venture Partners, SoftBank Capital NY, Armory Square Ventures and Rand Capital.

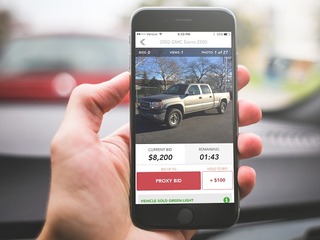

ACV Auctions is a mobile platform that enables used-car dealers to view, bid and purchase car inventory via online auctions, changing the way that wholesale cars are sold. Typically, a truck goes around the country, picking up wholesale cars, which are then brought to a huge parking lot, and they're then auctioned off by the dealerships in person.

In all, there are nine million of these auctions going on every year, accounting for nearly half of all the wholesale automotive transactions that occur. All of this takes more time, and costs more money, than ACV's platform, which saves dealers time and money, as they no longer have to wait for days to sell their cars, and they can sell them through the platform for a lower fee.

There's a big benefit on the buyer's side as well, since ACV Auctions is able to increase transparency in terms of what they're actually buying. As part of the app, the dealers are required to do a condition report, complete with 25 to 40 pictures taken, including the inside of the car. ACV will even do some of these inspections themselves. This reduces the risk for the buyer, and potentially saves them hundreds in having to recondition the car after purchase.

Through ACV, cars can be sold in as little as 20 minutes.

This new funding will be used to expand ACV Auctions into new territory. When the company last raised funding it was in five different markets, all in upstate New York. Since then it has entered Western Massachusetts, Pittsburgh and Northern New Jersey.

The plan is to continue expanding down the east coast, all the way to Florida, while also going into the Midwest as well.

"We have matured from the early stage of proving our product and model. Now, we're going through a phase where we know the model and product works, and it's about replicating our success in multiple markets, faster," George Chamoun, CEO of ACV Auctions, told me. "We had the capital and size to go one new market a month. With this new funding, we will have the opportunity to grow as many as two or three a month. That means our growth rate can at least double, if not more."

The strategy behind its rollout is to expand to adjacent markets, since that allows the company to build up its buyers and sellers before it officially launches into each one.

"Every marketplace needs sellers and buyers. When we entered New Jersey we already had 300 buyers in there from Albany and Binghampton. As we are growing, we already have buyers from markets north and west of the market's we're already in," said Chamoun.

Part of that expansion will require the company to expand the company's number of employees; currently has more than 60 employees and expects to hire over one hundred more annually for the foreseeable future.

That includes territory managers, who will run each new territory. They wil be someone who is typically already known in that territory, has an automotive background, and who knows the dealers and their principals.

"They're going out and letting dealers know about us. Ford, Chevy, BMW, whichever it is, instead of waiting until Friday or Tuesday for their cars to get picked up for auction, we let them know that we can help them sell cars all week. That's our value proposition, and the territory manager's job is to explain that," Chamoun said.

The company will also be hiring employees to inspect the vehicles, and a handful of engineers who will be focused on data and analytics, helping customers to buy and sell cars. ACV will also expand its operations team, who help with managing payments and transferring titles.

To aid with expansions, ACV also provides incentives to the first major dealership group that signs up in each new market. Typically that is a financial incentive, such as lower fees, or credits when they buy cars.

"When we raised our $5 million were in a position to deploy into market, but we weren't capitalized to go more than one new market a month," Chamoun said. "With this $15 million we have the capital to grow faster. Most time entrepreneurs wait to know if they’ve proved the model. We proved it quicker than most have, and now this round will help us keep expanding. Bessimer also adds a ton of value beyond just the capital provided."

The market size for 2023 was $10.31 billion

Read more...At Culture, Religion & Tech, take II in Miami on October 29, 2024

Read more...The company will use the funding to broaden the scope of its AI, including new administrative tasks

Read more...Angel group/VC

Joined Vator on

In 1911, Henry Phipps founded Bessemer Securities to reinvest the proceeds of his sale of Carnegie Steel for the benefit of his descendents. The start-up investment operations were spun out into Bessemer Venture Partners, which now operates out of seven offices around the globe.