Meet Murat Abdrakhmanov, one of the largest business angels in Central Asia

Murat left the VC firm to invest independently; now he enjoys it more

Read more...Editor's note: Our Splash Health, Wellness and Wearables event is coming up on March 23 in San Francisco. We'll have Mario Schlosser (Founder & CEO of Oscar Health), Brian Singerman (Partner, Founders Fund), Steve Jurvetson (Draper Fisher Jurvetson), J. Craig Venter (Human Longevity), Lynne Chou (Partner, Kleiner Perkins), Michael Dixon (Sequoia Capital), Patrick Chung (Xfund), Check out the full lineup and register for tickets before they jump! If you’re a healthcare startup and you’re interested in being part of our competition, learn more and register here.

Also, vote for your favorite healthcare startup before February 16! Vote here!

—————

Venture capital used to be a cottage industry, with very few investing in tomorrow's products and services. Oh how times have changed. While there are more startups than ever, there's also more money chasing them. In this series, we look at the new (or relatively new) VCs in the early stages: seed and Series A.

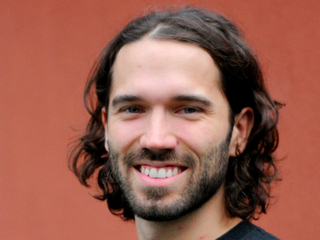

In this edition of "Meet the VC," we interview Amitt Mahajan, Managing Partner at Presence Capital.

In this edition of "Meet the VC," we interview Amitt Mahajan, Managing Partner at Presence Capital.

Amitt is a curious technologist and entrepreneur based in the San Francisco Bay area. He was the co-founder, CTO of MyMiniLife (exited to Zynga) and the co-founder, CEO of Toro (exited to Google). While at Zynga he co-created the game FarmVille and served as the CTO of Zynga Japan. Prior to his entrepreneurial work, Amitt was an engineer at Epic Games on the Unreal Engine and Gears of War. Amitt holds a bachelors degree in Computer Science from University of Illinois - Urbana / Champaign.

VatorNews: Tell us a bit about your background. What led you to the venture capital world?

Amitt Mahajan: My background is in games and game programming. I was working on 3D engines and 3D graphics from a young age. After college, I went to the games industry and spent some time working on AAA games like Gears of War and Real Tournament.

I started a company with some college friends building social applications and virtual worlds. Virtual world didn’t really pan out but the idea of using our technology to build social games was our way of getting around that. We started building a farm-themed social game that would become FarmVille. In the middle of our building process, we ended up getting acquired by Zynga. I was at Zynga for 2.5 years, continuing development on FarmVille, and helped start CityVille.

Then I left to start my second company focused on growth marketing for mobile apps—more of a SaaS business—which was acquired by Google in 2015. After leaving Google, I decided to travel a bit. Then my partners Paul and Phil started talking about VR, which was interesting because it was a culmination of my background in 3D graphics.

So we decided to start a fund focused on VR and AR.

VN: What do you like to invest in (e.g. categories of interest, important qualities for companies)?

AM: We’ve done a couple hardware deals, but the majority of what we do is software. I think the VR headsets themselves are going to be fairly commoditized. We invest mostly in software, but not a lot of content. We’re not financing films or games. We’ll invest in companies that are building recurring processes for creating that content.

Obviously, the number one thing we look for is team. In team, we look for folks that have a lot of persistence. I’m a cheerleader for VR but also I’m realistic: this market isn’t coming as fast as everyone thinks it is. We tell our entrepreneurs: keep your burn rate low, weather the storm. A lot of people think it’s usually the money that runs out first. But when you’re entrepreneur, your patience can run out first.

VN: What kind of traction do you look for in your startups?

AM: I absolutely love cutting the first check to a company, especially if it’s a bunch of really smart people.

Traction in VR is kind of B.S. right now—unless you’re B2B, and you’ve sold contracts to other companies. The numbers are so small right now it doesn’t make sense to invest in traction. This stuff is changing pretty quickly.

On the AR side, it’s almost all computer vision. We’re investing in folks who have Ph.Ds in computer vision and are developing perception algorithms because we believe they’re building the future of human-computer interaction. But, in order to develop, it’s going to take a really long time because much of it is theoretical.

VN: What would you say are the top investments you've done (and what stood out about them)?

AM: One of the first investments we did was baobab studios. Their CEO was one of the VPs at Zynga, and she brought in Eric Darnell, formerly a director at Dreamworks who created the Madagascar series. They started Baobab, and they’re basically building Pixar-quality animation for VR so you're more immersed in these stories. They were in Tribeca, they just raised their second round of funding, and they’re up to great things.

More recently, we’ve invested in STRIVR. They’re incredible. They started out using VR to train quarterbacks in Stanford’s football program, helping them gain more perceptual awareness when learning plays, patterns, etc. Now they’re starting to expand past sports, like helping companies onboard employees and helping with diversity training.

VR is an empathy machine. If you’re in the shoes of someone who is a victim (or doing the victimizing) of some sort of harassment, it creates a much stronger sense of empathy. It makes you realize why you can’t act a certain way, which will have a real impact in the world.

VN: These days a seed round is yesterday's Series A, meaning today a company raises a $3M seed and no one blinks. But 10 years ago, $3M was a Series A. So what are the attributes of a seed round vs a Series A round?

AM: My first company raised $300,000 in our first round. That was a Herculean task at the time. Things are very different now.

The valuations are kinda out of whack. If you’re optimizing for your seed round, the issue is that you may be able to get the valuation you want based on your background. Even when you go raise your Series A, it may be fine if you raise from less sophisticated investors or if they’re just trying to invest in the category. But when you get to the Series B and C rounds, investors come significantly more discerning. It’s less about your category and “making a VR bet.” At that point, it’s either you have traction and revenue that justifies your valuation or you don’t. It’s not whether you have a VR business, it’s do you have a better business compared against the entire state of startups. Are you better in a marketplace business? Are you better than a mobile e-commerce business?

The issue is that, as a VR business—especially a consumer one—it’s very unlikely that the market will develop as quickly as everyone believes. As a result, when you raise your B and C rounds at a high valuation, it’s unlikely that your actual revenue will justify that valuation when compared against the entire universe of startups.

VN: In 2015, there was a lot more money going into late-stage deals than during the heyday back in 2000. So do you think we're in a bubble? And is it deflating now?

AM: These businesses saying “scale as much as possible” and “the unit economics will work out at significant scale” put an entire damper on the entire market. Everyone has started to look at the underlying business models, and I think it’s perfectly healthy for the industry. Invest in real businesses not on hype.

These things are cyclical, right? Perhaps investors are more discerning now, looking for more revenue and traction, and looking deeper at the fundamentals of the business. Who knows? Maybe next year AR comes out in a big way and there will be a whole new app ecosystem, and everyone’s investing left and right.

VN: How long does it take between meeting the startup and making the investment? How do you conduct your due diligence?

AM: We pride ourselves on moving quickly. It’s just myself, Paul, and Phil—we’re the entire firm.

What’s interesting about seed stage investing if you just hustle harder and take more meetings, that’s a competitive advantage. We can turn around a deal in 24 hours—or less. I usually decide within five minutes, and then it’s just about the entrepreneur not messing up the rest of the pitch.

I go really deep on tech—having an engineering and 3D graphics background helps with that. My partner at Phil was the guy who started the VR team at HTC, so he’s got really deep hardware background. Paul has met with thousands of entrepreneurs, so he’s got a really good sense of people. Between the three of us, we get a sense of where the entrepreneur’s strengths and weaknesses are. And then we just make sure they’re incorporated properly and there’s nothing strange on the cap table.

VN: What is the size of your current fund? And where is the firm currently in the investing cycle?

VN: What is the size of your current fund? And where is the firm currently in the investing cycle?

AM: We started in August 2015 and announced in January 2016. We’ve fully closed $10 million.

VN: What is the investment range? How much do you put into each startup?

AM: Between $100K and $500K. Average check size is $200K.

VN: Is there a typical percent that you want of a round? For instance, do you need to get 20 percent or 30 percent of a round?

AM: Not really. Nice thing about VR is it tends to be very collaborative.

VN: What series do you typically invest in? Are they typically Seed or Post Seed or Series A?

AM: Either “friends of family” first check in pre-seed, or Seed.

VN: In a typical year how many startups do you invest in?

AM: Averaging about .8 per month. (About ten per year.)

VN: What do you like best about being a VC?

AM: One thing different about being a VC versus an entrepreneur is you get a much broader view of the world, which I find fascinating. When you’re an entrepreneur you tend to go very deep on your industry, where as a VC you get a 10,000 foot view—which is what I always wanted as an entrepreneur. It’s interesting because you make better long-term decisions based on the fact that you have more information.

I almost wonder if some of the best entrepreneurs are just really good at making this part of their process: you’re running the company but you’re also meeting a ton of people just to gain more insight and build a complete picture of what the world’s actually going to look like.

VN: Is there anything else you think I should know about you or the firm?

AM: If you’re starting a VR or AR company, definitely reach out to us. I blog on Medium and I’m on Twitter.

Murat left the VC firm to invest independently; now he enjoys it more

Read more...The firm invests in sectors like artificial intelligence, space, defense, and healthcare

Read more...MMC deploys a media for equity model, backed by Sinclair Broadcast Group and TelevisaUnivision

Read more...Startup/Business

Joined Vator on

Zynga is the largest social gaming company with 8.5 million daily users and 45 million monthly users. Zynga’s games are available on Facebook, MySpace, Bebo, Hi5, Friendster, Yahoo! and the iPhone, and include Texas Hold’Em Poker, Mafia Wars, YoVille, Vampires, Street Racing, Scramble and Word Twist. The company is funded by Kleiner Perkins Caufield & Byers, IVP, Union Square Ventures, Foundry Group, Avalon Ventures, Pilot Group, Reid Hoffman and Peter Thiel. Zynga is headquartered at the Chip Factory in San Francisco. For more information, please visit www.zynga.com.