As you may know, the Vator team is in Santa Monica this week for the 6th Annual Vator Splash LA conference. We’ve assembled an all-star cast of speakers including Mark Cuban (one of the hosts of Shark Tank and owner of the Dallas Mavericks), Tri Tran (CEO & co-founder, Munchery), and Andre Haddad (CEO, Turo).

As you may know, the Vator team is in Santa Monica this week for the 6th Annual Vator Splash LA conference. We’ve assembled an all-star cast of speakers including Mark Cuban (one of the hosts of Shark Tank and owner of the Dallas Mavericks), Tri Tran (CEO & co-founder, Munchery), and Andre Haddad (CEO, Turo).

And, while we’re in the area, we’ve also brought along a few of the top startup executives from LA to speak, including Brian Lee (Founder & CEO, Honest Company), Leura Fine (Founder & CEO, Laurel & Wolf ), and Nick Green (co-founder and co-CEO, Thrive Market).

So with LA on our minds, how does the city stack up in terms of startup deals and venture capital flow? Coincidentally, Dow Jones VentureSource just released its U.S. venture capital report for the third quarter of 2016, breaking down overall investments and deals by regions across the U.S.

Here are the top five:

- San Francisco Bay Area: $4.6 billion invested across 313 deals

- Boston Metro: $1.8 billion invested across 80 deals

- New York Metro: $1.5 billion invested across 135 deals

- Seattle Metro: $0.5 billion invested across 36 deals

- Los Angeles Metro: $0.3 billion invested across 37 deals

LA comes in fifth place on that list, but when you add Orange County, San Diego, and other cities to the mix, the broader Southern California region looks even stronger:

- Northern California: $4.6 billion invested across 317 deals

- Mid-Atlantic: $1.9 billion invested across 211 deals

- New England: $1.8 billion invested across 87 deals

- Southern California: $1.0 billion invested across 74 deals

- Pacific Northwest: $0.5 billion invested across 44 deals

In Q3 2016, the Los Angeles metropolitan area saw 37 deals done and $294.6 million invested. For the year, the area has seen 127 deals done and nearly $3.0 billion invested. Here were the three biggest deals for the quarter:

- Mobile entertainment network Scopely secured a $55 million late-stage round led by Greycroft Partners with participation from Elephant Partners, Evolution Media Partners, Highland Capital Partners, Participant Media, Sands Capital Management, Take-Two Interactive, TPG Growth.

- Healthcare company Aligned TeleHealth raised a $12 million Series A round of funding from SV Life Sciences.

- Pet food technology company Petnet raised a $10 million Series A financing round led by Petco.

But it’s not all about Los Angeles.

Dow Jones VentureSource separates data for nearby Orange County, which saw 13 deals for the quarter and 44 deals for the year. In terms of dollar amount, the county saw $344.1 million invested for the quarter and $850.6 million for the year. Here were the county’s three biggest deals for the quarter:

- Virtual reality company NextVR raised $80 million in a Series B round led by CITIC Guoan Information Industry with participation from China Assets, CMC Holdings, Comcast Ventures, Dick Clark Productions, Formation8 Partners, Founder Hesheng Investment, Individual Investors, Netease Capital, RSE Ventures, Softbank, Spectrum 28 Capital, The Madison Square Garden Company, Time Warner Investments, and VMS Investment Group.

- Medical device company AcuFocus raised a $66 million financing round led by KKR.

- Healthcare company Rox Medical raised a $40 million late-stage round led by Novartis Venture Funds and Apple Tree Partners with participation from Domain Associates and Versant Venture Management.

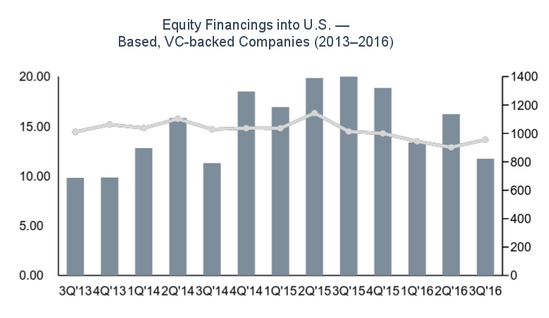

Overall, Dow Jones VentureSource reports the U.S. companies raised $11.7 billion across 956 deals in the third quarter, a 28 percent drop in capital and an increase of six percent in deals.

If you read my previous piece on Q3 VC data, you may have noticed a significant discrepancy in the data: Pitchbook says $15.0 billion was invested in the quarter, much higher than the $11.7 billion figure. The difference is in the methodology: Pitchbook and CB Insights include earlier “pre-venture” deals and later-stage growth deals.