A look at which companies might go public in 2018

Companies like Airbnb, Uber and Dropbox have been highly anticipated IPOs for years

Read more... Etsy, the peer-to-peer marketplace for handmade and vintage items, is set to report Q4 earnings next week amid continuing financial market turmoil.

Etsy, the peer-to-peer marketplace for handmade and vintage items, is set to report Q4 earnings next week amid continuing financial market turmoil.

The global markets have been showing little growth, with the Dow Jones Industrial Average up 1.0 percent this week (to 16,362) but still down 6.1 percent for the year and the Nasdaq up 3.3 percent this week (to 4,506) but down 10.0 percent for the year.

Even Twitter stock managed to shoot up 18.5 percent in the past week to $18.65, though it's still down 19.6 percent for the year. Facebook, one tech company that has managed to weather the turmoil fairly well, is up 0.6 percent this week to $104.75 and up 0.1 percent for the year.

Apple is up 2.8 percent to $96.29 this week, and for the year it’s down 8.5 percent. Alphabet (Google) is up 2.3 percent to $722.01, and for the year it’s down 7.1 percent.

So how will the broader financial climate affect Etsy’s stock?

In the past ten months since the company hit the Nasdaq under the ticker symbol ETSY, Etsy has has been on a long downward trajectory. Shares for the company closed at $30 on IPO day, a huge 88 percent pop from the company's initial pricing for its stock. The IPO raised $267 million for the company, ultimately valuing it at $3.3 billion.

Since then, the company's stock has tanked 73.4 percent to $7.98 today.

Etsy's share price from IPO to the end of 2015:

Etsy's share price since the start of the year:

As for how financial market turmoil has affected the company already, the consequences don’t seem especially dire. For the year, Etsy is down 3.9 percent, perhaps demonstrating that you can only go so low before shareholders feel that they’ve found the right price—even in a bear market.

Interestingly, Etsy actually went up 18.5 percent in the past week thanks to new, mostly positive comments from analysts. Brean Capital maintains a Buy rating for Etsy's stock with a 12-month target price of $20. Vetr upgraded the company’s stock from a “sell” rating to a “buy” rating with an $8.10 price objective. Monness Crespi Hardt upgraded the stock from a “sell” rating to a “neutral” rating.

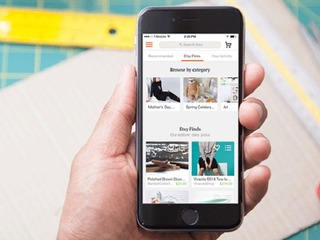

One important factor driving this positive feedback has been Etsy’s growth on mobile, which should be noted as the same important factor that helped spur Facebook’s growth in its second year as a public company.

"When considering conversion rates on Etsy's mobile app are twice those on its desktop/laptop website, we see the company's efforts to drive usage of its mobile app as a potential near-term catalyst for shares." said Brean Capital analyst Tom Forte.

We’ll be sure to follow and share Etsy’s earnings as they come in next week to see how the company has managed to weather the ongoing financial market turmoil.

Companies like Airbnb, Uber and Dropbox have been highly anticipated IPOs for years

Read more...Who were the winners and losers and which ones rose

Read more...Who were the winners and losers and which ones rose with the record-setting market?

Read more...