We are hosting our second annual Post Seed (#postseedconf) event on Dec. 1 at Ruby Skye in San Francisco. The event – which we expect to draw more than 500 attendees – kicks off at 8 am and ends around 5 pm. We’re excited to have Cory Johnson, anchor at Bloomberg West, broadcasting live from 7 am to 11 am PST. It should be a riveting day! Register here: Post Seed 2015.

A few years ago, Vator did a series of articles about accelerators around the country. We focused on the big cities that you probably already associate with tech, like San Francisco, New York, Los Angeles and Boston. But we also looked at the small cities around the country, and what I found was that there is a tech scene in places I had never even considered, like Kansas City, Atlanta, Baltimore and Indianapolis.

The point is that tech does not just exist in the few cities we think it does. This is a big country, and there’s a lot of entrepreneurship. And the levels of funding to the rest the country are beginning to rise, according to a report out from CB Insights,

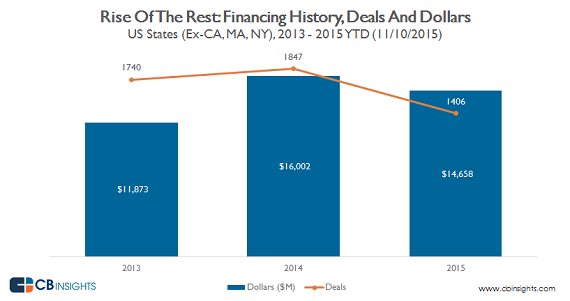

California, Massachusetts and New York still take up 75 percent of all venture capital funding in this county. But when looking at the 47 states, as well as Washington D.C., CB Insight found that annual funding levels went up 36 percent between 2013 and 2014. That is a jump from $11.8 billion to $16 billion.

So far this year, more than $14.6 billion has been invested across 1,406 deals to those markets, putting the year roughly on track to equal last year’s funding total. However, deal activity has fallen to a three-year low, which is an indication that that deals are getting larger even as deal count decreases.

When it comes to what kinds of startups are being invested in companies in the internet sector were the largest by far, jumping to 44 percent of the total, up from 35 percent in 2014. Healthcare investment fell from a 28 percent share of dollars in 2013 to 20%, while mobile investment shrank from a 13 percent dollar share in 2013 to 8 percent. Software investment fell to 6 percent dollar share from 11 percent in 2014.

Top flyover startups

Despite being smaller markets, they are still home to some of the top companies in the United States, including some unicorns startups. That incudes Domo and Qualtrics in Utah, and Uptake Technologies and Avant in Illinois.

The top state is Texas, followed by Washington and Colorado, Georgia, which is home to a unicorn, Kabbage, also made it onto the list.

These are the top five fundraising deals in the other 47 this year were:

1. Hoboken, New Jersey-based Jet.com, an e-commerce startup taking on Amazon, has raised a $500 million round of venture capital led by Fidelity.

2. Chicago-based Avant, a startup der for borrowers with less-than-stellar credit, raised $325 million of equity in a funding round led by private-equity firm General Atlantic, along with JPMorgan Chase & Co. Balyasny Asset Management and Tiger Global Management LLC.

3. Jacksonville, Florida-based Fanatics, an e-commerce company focused on sports merchandise, sold a minority ownership stake to private equity firm Silver Lake for $300 million.

4. Houston-based Sunnova Energy Corporation secured approximately $300 million in committed debt and equity funding. The transactions included a conduit facility arranged by Credit Suisse, and an equity financing round led by Triangle Peak Partners, LP. Additional equity investors include business development companies sponsored by Franklin Square Capital Partners.

5. Fort Mill, South Carolina-based Red Ventures, a marketing technology and services company, raised $250 million from Silver Lake Partners.

(Image source: flyovermovie.com)