DUOS expands AI capabilities to help seniors apply for assistance programs

It will complete and submit forms, and integrate with state benefit systems

Read more... Every growing startup needs advice.

Every growing startup needs advice.

There are plenty of seasoned technology specialists out there with the chops to advise startups, but how do you connect the right company with the right advisor without resorting to word-of-mouth or waiting for the opportunity to arise organically?

In a nutshell, that’s the problem Bad Ass Advisors is trying to solve.

“I had many friends who were really smart and had seen good success in the industry, but felt like there weren’t great ways to connect them with today’s entrepreneurs,” said Mark Goldstein over the phone, describing the practical situation that led to his creating Bad Ass Advisors.

FounderDating is probably the most well-known network explicitly designed to connect entrepreneurs, cofounders, and advisors, but it’s not private and it costs members $50 per year. There’s also CofoundersLab, which is specifically intended to connect cofounders, minus the advisor element. AngelList, LinkedIn, and Vator.tv also function as matchmakers between not just startups and advisors, but also investors.

Goldstein, an angel investor who previously founded back office automation solution BackOps, admitted that there were some existing options out there, but none were purpose-built to serve the needs of startups.

“A lot of the time, companies don’t want to disclose what kind of advisor they need because then it becomes obvious what their weakness is,” he explained.

On Bad Ass Advisors, which soft launched this past July, everything is private from the beginning.

For a startup to be listed on the site, Bad Ass Advisors requires it be a tech company, have enough starting capital, and essentially have a strong business outlook and team. The capital aspect—which could take the form of either business profit or venture capital—is crucial not just to weed out questionable startups, but also because advisors matched on the service accept equity, not cash.

The requirements for advisors are a bit more intangible, though it helps if applicants have "been responsible for a company outcome over $50M." Otherwise, having excellent contacts, an impressive resume, or top-tier speaking experience all help improve an applicant’s chances.

“Most applications we receive, we don’t accept,” said Goldstein, highlighting the service’s high standard of quality.

Once accepted, startups and advisors build out their profiles on the network, the former describing who they might be looking for (e.g. a sales specialist with expertise in monetization in cleantech) and the latter offering their particular abilities (e.g. a marketing specialist with expertise in brand marketing in retail).

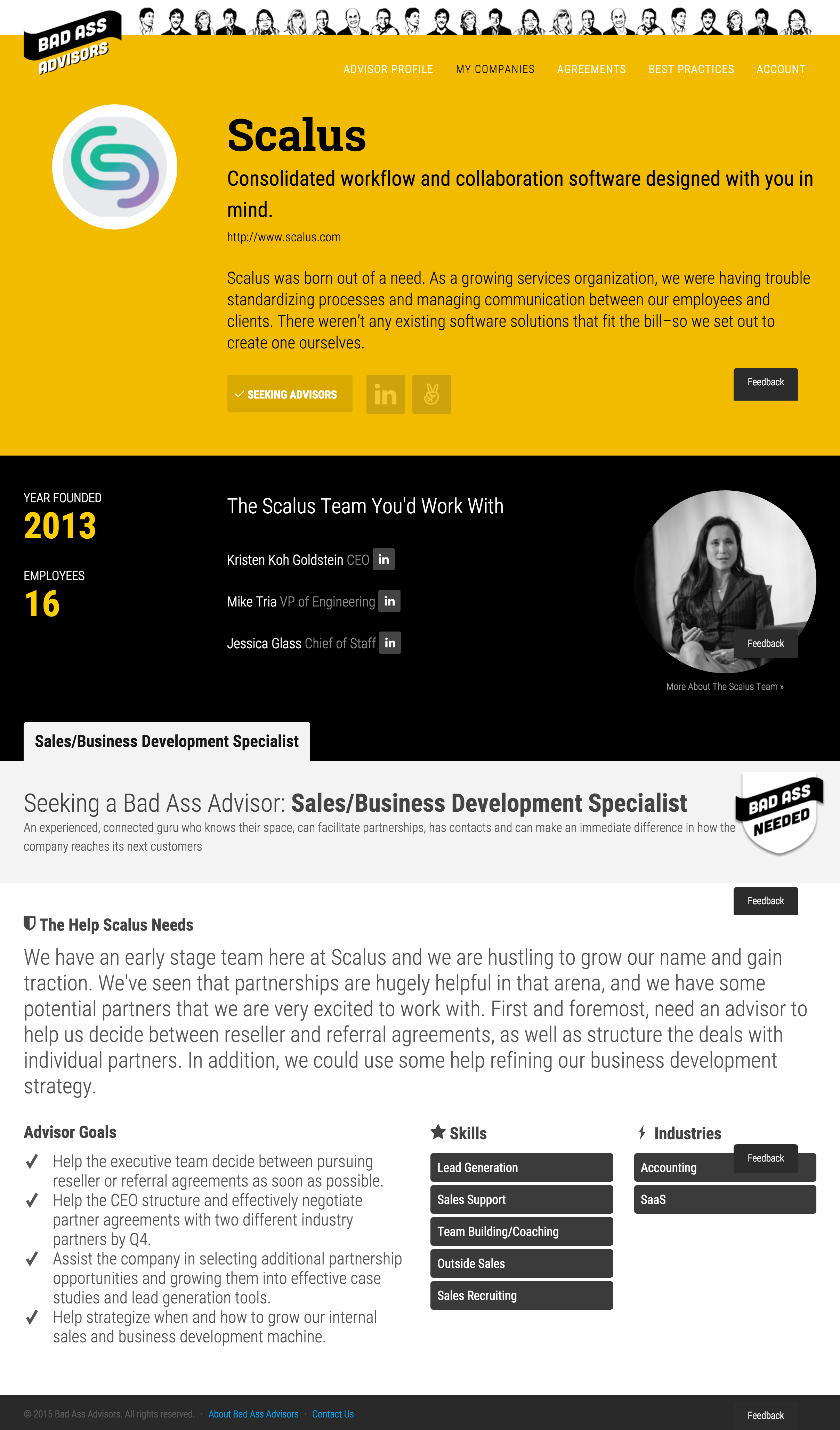

Here are two screenshots: the yellow one is a company profile and the blue one is an advisor profile.

Profiles are kept private until Bad Ass Advisors specifically believes it has made a match. Then it connects the two.

Today Bad Ass Advisors serves up just 2-3 matches per day from a pool of hundreds of companies and advisors. The service is free to use for now, and Goldstein doesn’t envision charging anytime soon.

It’s not just for charity, however. Goldstein and his wife Kristen Koh Goldstein (CEO of Scalus) operate Efficient Capacity, Marc Benioff's private investment vehicle, investing in two to three early-stage startups a month. He makes no secret about the fact that the fund benefits from networking opportunities fostered by Bad Ass Advisors.

Overall, the service solves a real need and gathers strength through its simplicity, something the other matchmakers out there have lost along the way.

It will complete and submit forms, and integrate with state benefit systems

Read more...The bill would require a report on how these industries use AI to valuate homes and underwrite loans

Read more...The artists wrote an open letter accusing OpenAI of misleading and using them

Read more...Startup/Business

Joined Vator on

Vator (short for innovator) is an awesome professional network for entrepreneurs and investors that sits at the intersection of media and finance. Our entrepreneurial ecosystem consists of startups, investors, strategics and service providers.

Vator’s platform offers an extensive set of services to the entrepreneurial community. Here is a quick summary of our suite of offerings:

VatorNews: Research, analysis and coverage, spanning news, thought leadership and lessons learned

VatorX: SaaS platform leveraged by startup communities and competitions to rank and filter participating startups

Vator Events: Well recognized large and small events across numerous geographies and sectors

Vator Investment Club: Our investor group for accredited investor members of the Vator community

Vator Teams: Our confidential acquihire platform for startup teams

Background

Vator was originally founded by Bambi Francisco and seed funded by its original lead investor Peter Thiel as a social network for startups and investors, combining media coverage with rich profiles and filtering. Over the more than decade since its founding Vator has expanded to offer a full range of services to the entrepreneurial community. Today Vator is a well-recognized and trusted member of the startup community.

Business Model

Vator has a range of business models due to its diversified set of offerings.

Joined Vator on

Managing Partner, Advisors.fund Founder, Bad Ass Advisors