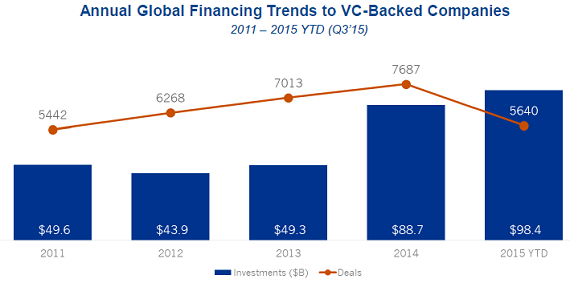

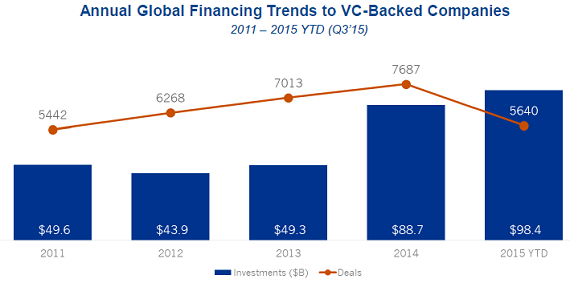

2015 is turning into a pretty impressive year for venture capital investments. In fact, in just the first nine months of this year, the VC funding tallies have already eclipsed all of 2014 which was a big year for fundraising as well.

So far in 2015 there has been $98.4 billion invested in the first three quarters globally, compared to $88.7 billion in all of 2014, according to the Q3 2015 Venture Pulse Report, issued by CB Insights and KPMG on Wednesday, which tracks financing to VC-backed companies globally.

However, that has not translated into more deals, which have reached 5,640, compared to 7,687 for all of 2014. Deals are actually on pace to fall below 2014’s total at the current run rate.

What sparked this were 10 deals worth at least $500 deals including five of them that were at, or over, the $1 billion mark. Median late-stage deal sizes soared as well, In the most recent quarter they hit a median of $35million globally. Seed/SeriesA early-stage deal size also has kept pace at a median of $2.5 million globally.

Again, deal activity suffered, falling for three of the last four quarters, and hitting the lowest total since the second quarter of 2013. The rounds are getting bigger, but they are becoming harder to get.

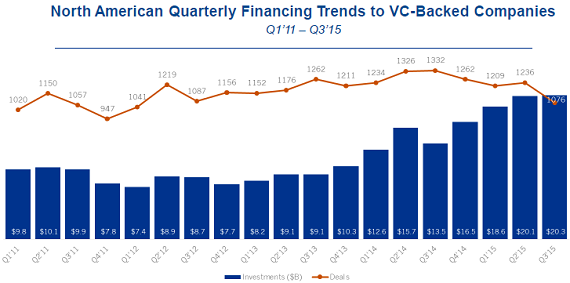

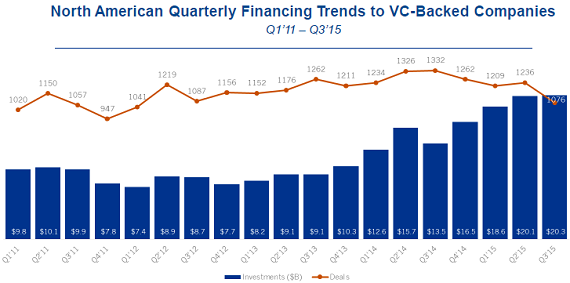

In North America, venture capital investment has also already surpassed all of 2014, with $59.1 billion raised in 3,521 deals. There was $58.3 billion invested in 5,154 deals last year.

Investment rose slightly in Q3 2015 compared to Q2 2015, driven by a number of high profile mega-rounds, including over $2 billion raised by Uber alone.

Deal activity to VC-backed North American companies in Q3’15 fell to the lowest level since Q1’12. But funding continued to roar to new highs as Q3’15 clocked in at $20.3B, rising for the fourth consecutive quarter.

While seed deal share fell to 23% in North America, for a five-quarter low, Series A activity surpassed seed to take one of every four deals.

In Europe, VC-backed companies have raised a total of $10.1 billion through the first three quarters of 2015 across 990 deals, up from $8.3 billion invested in 1,228 deals in all of 2014.

Venture capital investment activity rose to $3.5 billion in Q3 2015, for a really impressive 19 quarter high. Overall, funding topped $3 Billion for the third straight quarter, bouyed by $500 million plus rounds to Delivery Hero, Spotify, and OneWeb.

Deal activity is on pace to reach multi-year highs as well.

Mid-stage, meaning Series B and Series C, deals reached a five-quarter high in deal share in Q3’15 at 19%. Early-stage activity remained relatively range-bound, as 64% of all deals in Q3’15 were to those at the Angel to Series A stage.

Unicorns

We’ve written about unicorn companies quite a bit, and they are not slowing down, as the number of new private startups that are joining the billion dollar valuation club continues to be strong.

In Q3, there were 23 new unicorns globally, including 17 in the US, including Kik and ZocDoc.

There were three new unicornsin Asia, down from nine in Q2. This decline may be a fallout from the economic slowdown occurring in China, although not necessarily given 2015 total deal value is still on pace to reach record highs. Among Asia’s new unicorns were food delivery service Ele.me, and Guahao, which is a health-tech company.

There were also three new unicorns in Asia, making it the fourth quarter in a row that Europe has spawned either two or three new unicorns. Among the new European unicorns were ride sharing service Blablacar, and Hellofresh, which is a Germany-based recipe and food preparation company.

(Image source: solarviews.com)