Peter Thiel: 'Almost everybody (tech CEO) I know' shifted right

At Culture, Religion & Tech, take II in Miami on October 29, 2024

Read more...

Well, Amazon had another poopy quarter, but what’s new? The company just isn’t interested in surprising and delighting shareholders or Wall Street. They’re all “whatevs, bitches! Haters gonna hate!” And that’s why we love them…

Amazon came in well below estimates in its fourth quarter with a net income of 51 cents a share on $25.59 billion in revenue. While both are fairly sizable increases over Q4 2012, when the company raked in 21 cents a share on $21.27 billion in revenue, both numbers come in well below Wall Street’s expectations. Analysts had been expecting 66 cents a share on $26.06 billion in revenue.

Amazon is also lowballing its Q1 2014 guidance, projecting its revenue to come in at $18.2 billion to $19.9 billion. J.P. Morgan’s Doug Anmuth had forecasted a guidance of $18.4 billion to $20.5 billion. Wall Street is expecting $19.67 billion next quarter.

Shares tumbled 8.75% to $368 from $403 in after-hours trading. Investors are ticked off—EVEN THOUGH WE GO THROUGH THIS EVERY QUARTER, YOU GUYS. I think in the last two years, Amazon has maybe had one or two decent quarters that pleased investors. Nevertheless, the stock keeps rising. Amazon shares have increased 585% in the last five years.

Amazon shares were up nearly 5% at the close, possibly due to reports that Amazon plans to start offering brick-and-mortar retailers a POS system for Kindle Fire tablets—as many people expected after Amazon acquired technology and engineers from mobile checkout startup GoPago last year.

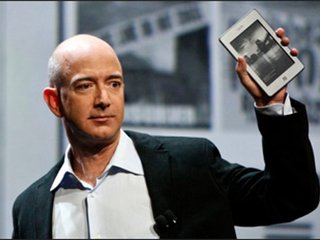

“It’s a good time to be an Amazon customer. You can now read your Kindle gate-to-gate, get instant on-device tech support via our revolutionary Mayday button, and have packages delivered to your door even on Sundays,” said Amazon CEO Jeff Bezos, in a statement. “In just the last weeks, Forrester, YouGov, and ForeSee have all ranked Amazon #1 – and we believe we’re just scratching the surface of what world-class customer service can be.”

Good time to be an Amazon customer, bad time to be an Amazon investor. But it’s always been a bad time to be an Amazon investor. That doesn’t seem to stop people from buying Amazon shares.

For the full year of 2013, Amazon saw a net income of $274 million (59 cents a share) on revenue of $74.45 billion. That’s up from a net loss of $39 million on $61.09 billion in revenue in 2012.

At Culture, Religion & Tech, take II in Miami on October 29, 2024

Read more...The company will use the funding to broaden the scope of its AI, including new administrative tasks

Read more...The company will be deploying Qventus’ Perioperative Solution to optimize its robotics program

Read more...