Maven Clinic launches program for members who want to get pregnant without IVF

The company also expanded access to 12 different provider types for male fertility care

Read more...

As credit cards, smartphones, and online transactions become increasingly prevalent, physical cash is looking more and more like a bizarre anachronism. A 2012 survey found that fully 43% of respondents have gone a full week without using cash at all. These days, finding quarters under the couch cushions or dollar bills in the washing machine is like spotting a rare, exotic bird. Take a picture with your Polaroid and tape it to your dumb-fridge because you might not see it again soon.

It’s not surprising, given the rise in e-commerce and mobile commerce, that electronic payments and digital wallets are expected to eclipse cash in the near future. But businesses and organizations are leaving out a huge portion of the population in the process. Fully one in four households in the U.S. is either unbanked or underbanked—meaning they have no or limited access to traditional banking services like checking accounts or debit cards.

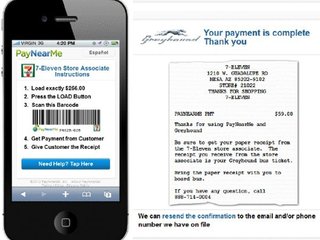

Since its founding in 2010, PayNearMe has been blazing new inroads to help businesses and organizations address this population by answering the question of how to digitize cash payments. Now, PayNearMe is announcing that it has teamed up with water districts in five California cities to allow customers to pay their water bills in cash.

Now, California residents in Fairfield, Glendale, Tracy, Padre Dam, and Santa Rosa will be able to pay their utility bills at their nearest 7-Eleven. The PayNearMe barcode is printed directly on their bill, so all they need to do is bring the bill and the cash and they can complete the transaction at any participating 7-Eleven or ACE Cash Express. The municipality is notified of their payment in real-time, so each transaction is instantaneous and the transaction fee is a fraction of the price charged by walk-up locations.

Why is this a big deal? Because right now, the alternative for residents who prefer to pay in cash is a walk-up location. But walk-up models are prone to error. The agent might write the wrong amount, or a customer could accidentally underpay, and there’s no real paper-trail to identify the error or how to correct it.

In one municipality, there is only one walk-up location. There are often upwards of 30 people waiting in line, parking is hard to find, and if you need to go there to pay in cash, you can end up waiting for hours. One woman drove several hours once a month to that particular walk-up in order to pay her utility bills in cash. When she was told that she could now do it online and pay at her nearest 7-Eleven, she cried.

The first pilot launched in Fairfield some 18 months ago, and over the course of 2012, over 5% of the city’s residents paid their water bill in cash using PayNearMe. The service was made possible through a partnership with InfoSend, the billing service provider for over 200 municipalities and utility billers.

“It’s a huge win for the city,” said CEO Danny Shader in an interview. “The last thing they want to do is handle cash, or disconnect someone’s service.”

It also means fewer people going to a walk-up location or the municipality’s main office, which means reduced operating costs.

PayNearMe and InfoSend anticipate millions of new customers using the service in the near future. There are currently 88 million unbanked or underbanked consumers in the U.S. One in 12 households in the U.S. is completely unbanked, representing approximately 17 million adults.

The road going forward is wide open for PayNearMe, which teamed up with AppFolio back in March to allow renters to pay in cash. Fully 20% of renters already pay in cash or money order, so when that service officially launches, it will be a huge source of business for PayNearMe.

Additionally, the company is making forays into auto and health insurance. Cash payments for non-standard auto insurance should be possible in the very near future via PayNearMe, and cash payments for health insurance will follow some time later. That’s a pretty big deal, since the Affordable Care Act kicks into gear in 2014, at which point it being uninsured will be a felony. But at present, the vast majority of health insurers don’t accept cash payments.

“One investor said we’ve caught .007% of the market,” said Shader. “There’s an incredible amount of growth in the category. It’s vertical by vertical. Right now, we’re signing up businesses in self-storage. There isn’t a week that goes by that we don’t uncover a new vertical.”

Is he worried about the shrinking usage of cash? Nope. Because it turns out, while cash accounts for a shrinking fraction of the type of spending seen in the U.S. economy on any given day, cash in absolute use is actually growing. Why? Because as an economy grows, so too does cash spending. In the U.S., cash spending saw an average annual growth rate of 4% from 2000 to 2011, according to a study by Market Platform Dynamics. There is currently $1.2 trillion in circulation as of June 2013, and fully $1.15 trillion of that is in federal reserve notes—also known as cash.

“You have a very large portion of the population who needs to pay in cash, and they’re not going away. But it’s typically the minority form of payment and it’s disproportionately expensive,” said Shader, adding: “If we keep succeeding at what we’re doing, we’re going to make it so that you’re not penalized for using cash.”

The company also expanded access to 12 different provider types for male fertility care

Read more...Ezra's AI cancer screening platform will be available in 150 RAYUS locations

Read more...Foggy uses the Taptic Engine in Apple Watch to provide vibrotactile stimulation for gait freezing

Read more...Startup/Business

Joined Vator on

PayNearMe combines a modified cash load network with an application technology platform so that consumers without credit or debit cards—or those who prefer to pay with cash—can conduct a wide range of remote transactions. By doing so, PayNearMe enables companies in a diverse set of industries to turn millions of American households into new paying customers. Consumers can use PayNearMe to pay for ecommerce purchases, telephone orders, loan repayments, money transfers, load funds into e-wallets and more at retail locations throughout the U.S., starting with 6,000 7-Eleven stores.