(Corrected: To reflect Walia’s role at FINRA)

One of the more interesting ways to package investment funds comes from a startup called Motif Investing. Almost a year after launching out of stealth mode, Motif has now raised $25 million from Goldman Sachs as the lead. Existing invstors, including Ignition Partners, Foundation Capital and Norwest Venture Partners, participated in the round as well. The new funds brings the total round of financing to $51 million.

Darren Cohen, Managing Director of Principal Strategic Investemtns at Goldman, the group that made the investment, is joining Motif’s board.

Hardeep Walia, founder and CEO of Motif, wouldn’t share much of the details of how the prestigious investment bank would help distribute Motif’s theme-based funds or what kind of integration there would be. But he did emphasize that the investment came from Goldman’s “strategic” arm, meaning such an investment isn’t just a financial one, like many corporate venture arms are.

For Goldman Sachs, an investment bank not well-known for catering to retail investors, making this kind of investment in a startup whose product initially targeted retail buyers, suggests that it’s probably looking for exposure to a new online banking brokerage operation that’s cutting edge and social.

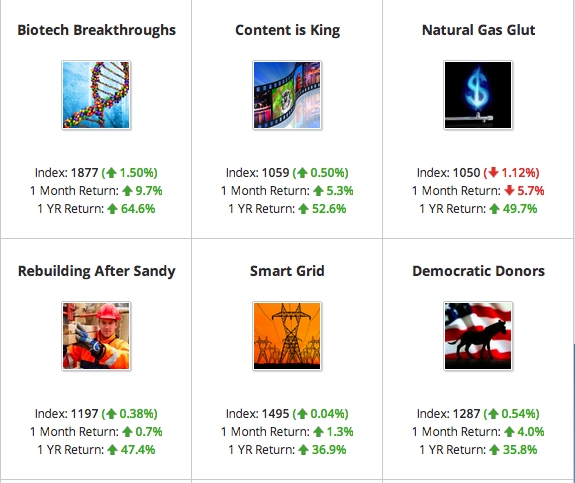

Motif launched in June 2012 with a product called motifs, essentially themed-based ETFs (exchange traded funds). And, as we wrote in that launch piece, ETFs are a basket of stocks and other assets, that trade just like stocks. Mutual funds are a basket of stocks, but only trade once a day. The difference between a Motif and an ETF is that a motif is made up of stocks only (30 to be exact) and individuals own each stock in the basket and can change the weightings on the stocks or trade in and out of those stocks.

Additionally, motifs are packaged to reflect ideas, such as clean tech or social media. If you invested in the Biotech Breakthrough Motif, a month ago, you’d be looking at a near 10% return.

The Cleantech Everywhere Motif is up 26% for the year. The Chinese Solar Motif, however, is down 43%. Anyone can buy a Motif for $9.95. If you have $10,000 or $100,000 to invest, it’s $9.95. If you’re looking to sell the Motif, it’ll also cost $9.95. If you’re looking to sell an individual stock, it will cost you $4.95, but if you sell multiple stocks it’s $9.95. The $9.95 is per every $100,000 invested. So if you have invested $200,000, the cost to sell the motif is $20 and the cost to sell multiple stocks within the motif is also $20.

“Most competitors charge $9.95” on the trading of a stock, said Walia. Additionally, if a person buys a fund, there are a lot of transaction fees. “Every year, whether something happens or not, you get charged fees,” he said. “In 2008, $8 trillion of net worth was evaporated. [Yet] people had to pay $376 billion in fees.”

Sounds like a great deal! So how’re these motifs being received?

Walia wouldn’t discuss how many motifs and stocks have been traded or how many investors are trading these assets.

He did say, however, that the reception from people to build their own motifs has been positive. Earlier this year, the company began allowing anyone – individuals, brands, investment advisors – to create their own motifs. Motif lauched with 110 motifs created by their own research team. In the first few weeks of opening up its platform to allow anyone to create motifs, a total of 7500 were built. The idea is here to get others to promote and market these motifs.

Motif hopes investment advisors, whose job is to help manage people’s money, will be a strong distribution channel to create and market the motifs. Motif will soon be launching a new dashboard for investment advisors, a new target market that was announced in January. The new dashboard is designed to help them not only manage their motifs, but manage the assets (other investments) of their accounts.

Interestingly enough, even I can create a motif and sell it and get paid without needing a securities licence and being registered as a broker. Motif pays anyone who wants to create these funds a royalty fee on the IP created. Since I’m creating the content – in this case the basket of stocks – I’m paid a royalty each time a motif is sold. It’s a clever way of getting around government regulations, which can be very tricky around people selling stocks to the public. But Walia is now a member of the Small Firm Advisory Board of FINRA, the largest independent regulator of securities firms. Suffice it to say, I’m sure he’s thought this through.

Now someone like Jim Cramer, the hedge-fund-trader-turned-business-show personality, can put together a list of stocks, pump them (as he does and can) and get something for it, without having to be regulated. He’d get paid a royalty each time his motif was sold. Walia wouldn’t disclose that fee amount.

Walia hasn’t disclosed any of the individuals or entities creating the motifs, but he did say that you could imagine Sierra Club creating a motif, or a business publication. “Think of the Apple App store, but with motifs,” he said. “We want to recruit Motif builders.”

Now this sounds all great, as long as the motifs actually perform well. To this end, it might be a little unnerving for organizations to get into the business of stock picking. It’s one thing to “talk” about stocks and be openly critical or positive, it’s another to put your money where your mouth is.