No one looks forward to a call from the bank—especially when the person calling is a collector. As it turns out, though, it’s a fairly complicated process, from how the conversation is initiated, to how the conversation is controlled, to what kind of language the collector uses during the call. Ultimately, the delinquent customer is still a customer, and their satisfaction matters.

In the Federal Reserve’s most recent report, it noted that delinquencies on residential home loans have risen in the last year, reaching 10.61% in Q2 2012. To put that into perspective, in Q2 2006, the home loan delinquency rate was 1.62%. How banks respond to these delinquencies can have long lasting impacts on their customers’ lives.

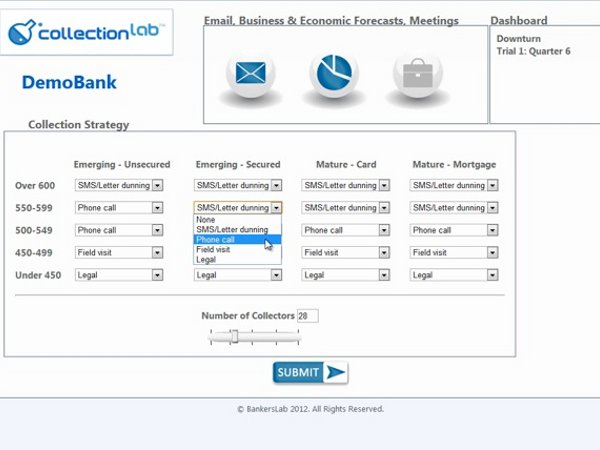

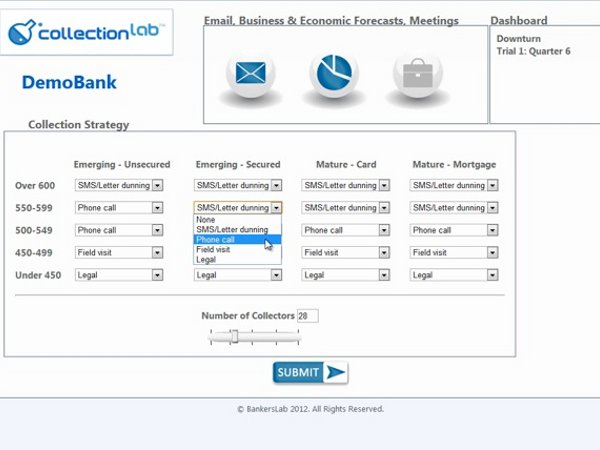

BankersLab, a company that has gamified banker training, has come out with a new product to help collectors get a better idea for how their customers will be affected by certain actions. Dubbed CollectionLab, the simulation game allows competing teams to test different collection strategies to see what kinds of real-world effects they have.

“What we are trying to address is the ability to anticipate and balance trade-offs,” said BankersLab CEO Michelle Katics. “In daily life, many bank staff don’t get an opportunity to see the impact of their decisions on the portfolio or their customers. Sometimes the impacts occur months or years later, or are difficult to isolate. Through simulation gaming, they gain insight into the underlying customer behaviors and inherent tradeoffs that their decisions impact.”

The object of the game is to operate the most profitable virtual bank with the most satisfied customers. To do that, each team has to master the key areas of collection management, including staffing, resource allocation, economic stress, and product growth.

Katics says that the point of the game isn’t to necessarily give them the answer when it comes to addressing each individual scenario, but rather to guide bank staff through the thought process of analyzing the different trade-offs they face.

“Users tell us that they gain enormous insight into the underlying customer behaviors and tradeoffs that affect their daily decisions,” said Katics. “They tell us that choosing the right customer treatment and planning for the right resources, based on an analysis of the data, becomes second nature after the simulation experience.”

Founded in January 2012, BankersLab has another simulated game training program: CreditLab, which is designed to train bank staff on the credit lifecycle, including product design, underwriting, account management, portfolio monitoring, and more.

BankersLab has offices in the U.S., Brazil, United Arab Emirates, South Africa, Thailand, India, and South Korea.

Image source: northborough.ma.us