Mergers and acquisitions happen all the time. But how many actually make much a difference? Even the big ones might be forgotten. Facebook made a big splash by purchasing Instagram for a billion dollars. But will this go down as one of the smartest moves in 10 years?

It’s a once-in-a-lifetime purchase that makes such a ripple that people will even care all those years later.

On July 8, 2002, eBay purchased PayPal for $1.5 billion. Now 10 years later, it’s considered, by some, one of the most successful acquisitions in tech history.

Not only does Ranker list the acquisition as the third smartest tech startup acquisition ever, behind Google’s purchases of YouTube and Android, but PayPal’s revenue has grown every single year since it was purchased, as has its percentage of eBay’s total revenue.

(Image souce: Venturebeat.com)

PayPal now makes up 38% of eBay’s entire revenue, and has generated around $20 billion for eBay in the last 10 years. When it was first purchased, PayPal had 23 million users; now it has 110 million, up 12% from the first quarter of 2011, according to eBay’s most recent financial release.

PayPal revenue was up 32% from the previous year and its total payment volume grew 24% in one year to reach $34 billion. It is expected to process $7 billion in mobile transactions alone in 2012.

With numbers like that, eBay has a lot to celebrate on this anniversary.

The future of PayPal

San Jose-based PayPal was founded in 1998 by Peter Thiel and Max Levchin as a way to send money between Palm Pilots.

Despite its tremendous success over the last decade, PayPal is not sitting on its laurels

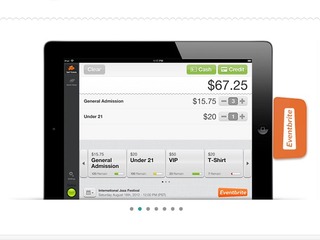

While the company drifted away from the mobile game throughout the years, focusing on becoming the leader in secure online payment, it is now refocusing on mobile to compete with other payment companies, such as Square, Eventbrite, and WePay.

In March, PayPal announced the release of its triangle dongle, called PayPal Here, which processes mobile payments for small businesses internationally.

The PayPal here allows small business owners to show the customer the total, as well as allow customers easy tip-of-the-finger signing, as well as allowing for the ability to scan cards if the dongle is lost or damaged. A merchant can scan the card (or checks) to secure payment. A great way to assure no revenue is lost.

Earlier this year, it was proclaimed that Square processing one million payments a day. Mobile payments are the future of payment, and PayPal seems to have realized that.

PayPal will have even bigger competitors to contend with soon, including Facebook, which, in June, wrote on its blog that it would be dropping Facebook Credits in favor of local currency in order to “implify the purchase experience, give you more flexibility, and make it easier to reach a global audience of Facebook users who want a way to pay for your apps and games in their local currency.”

With competition becoming so fierce, PayPal is looking beyond even mobile payments, and is planning on expanding its reach into other areas as well.

In June, PayPal also announced a deal with Comcast and TiVo that will allow users to donate money and purchase goods with a single click of their remote.

(Image source: lousamazingcakes.talktalk.net)