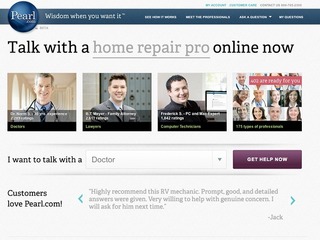

There’s tons of question-and-answer services out there. But very few are places where you can find solid advice worth paying for, with the exception of Pearl, formerly known as JustAnswer.

JustAnswer announced Tuesday that it’s re-branded itself as Pearl. It’s a name to reflect the wise instruction and advice (in other words – pearls of wisdom) a consumer can get from the service, said Andy Kurtzig, founder and CEO of Pearl, in an interview with me.

At the same time, the company said it’s raised $25 million in financing from angel investors, such as Charles Schwab, as well as Glynn Capital. The San Francisco-based company, which has been around for eight years, has been bootstrapped primarily by Kurtzig. Since the company has been making money since it was just Kurtzig coding in his extra bedroom, the question is: Why raise money now?

“Because there’s going to be a $100 billion revenue company in this professional services space online and I want to make sure it’s us!” said Kurtzig. On his way to world domination, Kurtzig plans to first use the funds to expand into France and China, and get a mobile product off the ground.

The funding news comes just a month after Quora, a Q&A competitor, raised $50 million, for a valuation of $400 million. Kurtzig wouldn’t disclose the valuation of Pearl, only to say that the company is on a gross revenue run-rate of $100 million this year. Given the going revenue multiples for fast-growing consumer Web companies, it would’t be a surprise to see Pearl valued at well over 4x or 5x revenue.

While Quora, which can boast the Silicon Valley digerati as an active community, typically gets a lot of press coverage, Pearl has been quietly building a big business as the go-to place to get answers on medical, legal, tech support, and accounting questions.

There are 700 categories, but 80% of the questions are anwered by doctors, lawyers, mechanics and tech support, said Kurtzig. All told, there are 10,000 experts, who on average make about $1500 a month from Pearl. A few have even generated $40,000 a month.

To date, there are about 10,000 questions answered daily. On average, customers are paying about $30 per question. The customers are actually setting their own price by choosing how quickly they want a response, and how detailed they want it to be. See image below. The customer gets to a page where they move the sliders to make the price go up and down. In the below example, low/low would be $14, middle/middle would be $35 and high/high would be $75.

Pearl takes a fee of 50% of the payment made by a customer.

How does it work? A customer chooses who he/she wants to ask a question from a doctor, mechanic, lawyer, etc. The customer then inputs a question and lets Pearl know how quickly the answer should come in and how much detail they want. Then Pearl takes the credit card information. Depending on how quickly a customer wants a question answered, the first available expert typically answers the question. A customer can then have a conversation with that expert to clarify the question if need be. There is also a 100% satisfaction guarantee policy if a customer isn’t satisfied with the answer.

Typically, legal questions cost the most because attorneys charge the most, but doctors do more volume, said Kurtzig.

Pearl also has a subscription plan for $35 a month for unlimited answers. Kurtzig would not disclose how many subscribers Pearl has for this service. But he did say that the subscription allows user to access the 19 million questions and answers Pearl has already aggregated. It’s quite an useful library of information if you consider that many questions don’t have to be personalized.

Even though there’s a plethora of information out on the Web. If you’ve trolled around forum sites long enough to find out how to get a printer attached to your computer, or to understand certain symptoms, you’ll know that paying for the “exact” information from a verified expert is a no brainer. And, $35 seems pretty reasonable for that kind of service and comfort.

The expert community

Pearl prides itself on having a rigorous process and patent-pending algorithm to verify experts. It’s not easy to become an expert on Pearl.

In fact, there’s an eight-step quality control process, which includes third-party background checks making sure people have licenses. There are even tests that experts have to take. For instance, a Honda mechanic needs to take a test on Hondas. It takes about a day or two to get verified across 50 different data points and approved by the 10-person quality-control team at Pearl, said Kurtzig. And, sometimes experts have to go before an expert quality board, which is often paid $500 an hour just to give their stamp of approval on the experts. There are 30 expert quality board members.

The expert community is just one of the many assets Pearl has created to ensure trust and credibility in its marketplace. It’s a long way from where Kurtzig began.

“It’s hard to build liquidity in marketplaces,” he said. “When I first started, it cost about $1 to ask a question and a person would get an answer in a day.” Even today, when response rates slow down to 30 minutes, Pearl immediately investigates and will often find someone to come onboard to answer the question. In fact, Pearl has 20 so-called market makers (similar to those who help match trades on stock exchanges) whose sole job is to make sure questions are being answered in a timely fashion.

Unlocking a supply of answers

Pearl is just one of the many companies that fit into the new trend of start-ups that are unlocking supply. Airbnb has unlocked real estate supply; Uber is unlocking supply of private limos; TaskRabbit is unlocking supplies of workers willing to do small tasks. In like vein, Pearl is unlocking answers.

And, the market is big. If you look at the services sector, it’s about $2 trillion. Of course, a lot of this money comes from medical bills at a hospital or legal bills at the courtroom. But only 1% of the services sector is online, said Kurtzig. And, most of that is money that goes toward tech support. “There’s many parts of the services sector that aren’t touchable by us,” he said.

“But if you want a quick second opinion about something, or ask a quick question – you can totally do that.”

(Image source: fineartamerica)

(Full disclosure: Andy Kurtzig is an investor in Vator)