I keep turning back to this statement made by President Barack Obama yesterday only because, despite how large or little effect it might have on the world, it strives to be such an inspiring glimmer of hope:

“Markets will rise and fall,” said President Barack Obama on Monday, in an attempt to inject some seriously-needed optimism into the economy. “But this is the United States of America. No matter what some agency may say, we have always been and always will be a Triple-A country.”

Obama made the statement amid a troubled global market on Monday, as shareholders sold their stock en masse, affecting everything from the major exchanges down to newly public tech companies.

On Tuesday, however, those same companies and organizations appeared to be recouping some of their losses.

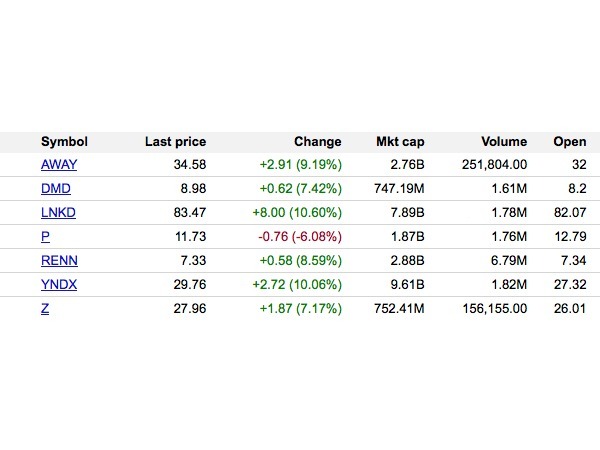

LinkedIn, for example, had suffered the most drastically yesterday, dropping $15.89 to $75.47 per share (-17.39 percent). In today’s reversal of fortune, though, LinkedIn saw its shares rise $8.00 (10.60 percent) to $83.47. That’s still a lot lower than the $110.28 peak seen in late July, but it’s a potential start.

Most other new tech IPOs saw their stock recovering after a rough Monday. In after hours trading, Demand Media more than made up for its $0.90 loss yesterday, rising $1.53 to $10.51. Similarly, HomeAway erased its $0.57 loss yesterday by rising $2.91 to $34.58. Zillow nearly recouped yesterday’s $2.07 decline, today rising $1.87 to $27.96.

International tech stars Renren and Yandex each had a harder time making up for their stock drops. Renren stock rose $0.58 (after decreasing yesterday $0.87) and Yandex stock rose $2.72 (after decreasing $3.79).

The only company that we reported on yesterday still seeing red is Pandora, which on Tuesday saw its shares continue to drop by $0.76 (-6.08 percent). With Pandora, the complications run deep, as a swarm of competitors from Spotify to Apple vie for a chunk of the rapidly transforming music and technology crossroads.

While, indeed, the markets will rise and fall, it must be comforting for these companies to see that the frantic sell-off from yesterday does not have as strong legs today.