Forum Ventures report: where health systems say innovation is most needed

The report outlined four areas as a guide to help startups to sell into these systems

Read more...

Vator's will be holding its second annual Splash Health event at the Kaiser Center in Oakland on February 23rd. Speakers will include Ali Diab, CEO of Collective Health; Helmy Eltoukhy, Founder & CEO of Guardant Health; and Ted Tanner, Co-founder & CTO of PokitDok. Get your tickets here, before they jump up next week!

With healthcare, as with all things relating technology these days, the key to unlocking its potential is data. There are a ton of companies out there, all dedicated to getting people healthy, and putting them back in charge of their healthcare. The only way to do it is to be able to have access a person's health records.

One of the most powerful companies in the health analytics space is Truven Health Analytics, which has more than 8,500 clients, including U.S. federal and state government agencies, employers, health plans, hospitals, clinicians and life sciences companies.

Now all of that will be added to IBM Watson Health portfolio, as the company has been acquired in a deal worth $2.6 billion, it was announced on Thursday.

While the companies did not say what would happen to Truven going forward, it seems likely that the company will be shutting down, as IBM is integrating both its team and its technology.

Update: A spokesperson for IBM told VatorNews that Truven will not be shutting down.

IBM revealed its plan to integrate Truven’s cloud-based data set, which spans hundreds of different types of cost, claims, quality and outcomes information, with its existing data sets. Over time, IBM will integrate Truven's cloud-based technology, methodologies and health claims data.

Meanwhile Truven's team, including clinicians, epidemiologists, statisticians, healthcare administrators, policy experts and healthcare consultants, will be joining the IBM business unit. That brings Watson Health’s employees to more than 5,000 worldwide.

Founded over 40 years ago, Truven Health Analytics owns healthcare such as MarketScan, 100 Top Hospitals, Advantage Suite, Micromedex, Simpler, ActionOI and JWA.

For IBM, it gets Truven's wealth of data and analytics, which will help turn the company into "one of the world’s leading health data, analytics and insights companies," Deborah DiSanzo, general manager for IBM Watson Health, said in a statement.

For Truven Health, it gets to use the data it has been collecting on a more massive scale.

“The Truven Health Analytics team is eager to combine our capabilities and expertise with the Watson Health portfolio,” Mike Boswood, President and CEO, Truven Health Analytics, said. “This will help catapult the industry forward to transform healthcare and to save and improve lives.”

IBM has been on a bit of a healthcare spree for the past four years, ever since it launched Watson Health in April 2015. This is the company's fourth acquisition in the space.

It previously acquired population health management company Phytel; healthcare intelligence company Explorys; and medical imaging company Merge Healthcare for $1 billion. In all, IBM has spent $4 billion on all four of these acquisitions.

The acquisition of Truven is expected to close later this year.

The healthtech space

There was $4.5 billion invested in healthcare companies in 2015, above the $4.3 billion invested in 2014. Digital health now represents 7 percent of total venture funding.

Some of the biggest fundraisings last year included Theranos, which raised $537 million in March for a $9 billion valuation; Immunocore, which raised $320 million in July; and Intarcia Theraputics, which raised $300 million in June for a $5.5 billion valuation.

So far this year some companies in the space that have raised money so far this year have included cloud-based API platform PokitDok, which raised funding from McKesson Ventures; subscription-based supplement company Vitagene, which raised $5.5 million; Hometeam, a provider of home care for seniors, which raised $5 million; Synlogic, a biopharmaceutical company developing medicines based on its proprietary synthetic biology and microbiome platform, which raised $40 million; First Stop Health, a provider of 24/7 telemedicine services, which raised a $2.1 million seed round; and Lantern, a provider of mobile and Web programs for mental health wellness, which raised a $17 million round.

Since the start of 2010, the four biggest VC investors based on number of deals have been New Enterprise Associates, with 13; Khosla Ventures, with 12; Qualcomm Ventures, with 11; and Sandbox Industries, with 10.

VatorNews reached out to Truven Health Analytics for additional comment. We will update this story if we learn more.

(Image source: vencore.com)

The report outlined four areas as a guide to help startups to sell into these systems

Read more...Flyte delivers mechanotherapy transvaginally to the pelvic floor

Read more...The country will need an additional 203,200 RNs each year until 2031 to fill staffing shortages

Read more...Startup/Business

Joined Vator on

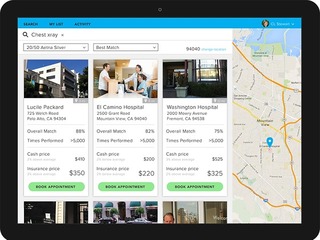

Provider of a cloud-based application programming interface (API) platform designed to make healthcare transactions more efficient and streamline the business of health. The company's platform enables third-party developers such as payers, health systems and digital health companies to process eligibility checks, claims, scheduling, payments, and other business transactions, enabling hospitals and health systems to build new patient-centered experiences. With DokChain, an evolution of PokitDok’s platform utilizing blockchain and other distributed technologies, PokitDok seeks to remove even more waste from healthcare administration while enabling new value creation by healthcare and other industry stakeholders for the consumers they serve.