When it comes to tech ecosystems, there’s Silicon Valley, obviously, then everyone else. The list probably goes something like this: New York, then Los Angeles and then New England, in terms of where companies are most likely to find funding.

While New York is doing well, seeing a big rise in Q1, New England, on the other hand, seems to be going in the opposite direction.

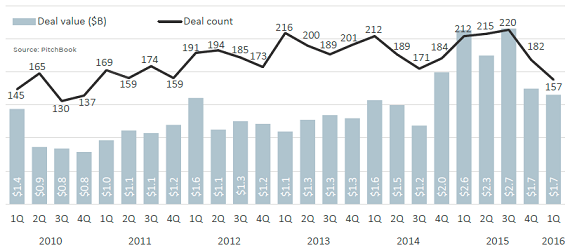

In Q1, New England saw its second consecutive quarter with drops in both deals and dollars, according to data out from Pitchbook on Monday.

Deals dropped 14 percent, from 187 in Q4 of 2015 to 157 in Q1, the lowest number since Q4 of 2010, when there were only 137 deals. While funding only dropped slightly quarter-to-quarter to $1.7 billion, it was still the lowest amount seen since the the third quarter of 2014, when funding was at $1.2 billion. All of this puts this year on pace to see the lowest number of VC investments since 2010.

The quarterly drop is nothing compared to what happened in Q4, though, when the number of deals fell 17 percent, and funding dropped by 37 percent from Q3.

On a year to year basis, Q1 saw dollars drop 35 percent, while deals are down 26 percent from Q1 2015.

The entire VC industry has been feeling the pain this year, but New England seems to be taking it especially hard on the chin. So what’s causing this ecosystem to have fallen so sharply? Pitchbook has a few ideas, including a slow down in late-stage deals, which it said are being done at the slowest rate in six years.

That could be due to “a low supply of companies looking to raise late-stage capital, investments taking longer to close and late-stage investors simply being much more selective after several quarters of high activity,” the company wrote.

The news isn’t all bad, though, as median round sizes have been increasing across the board. Seed/angel rounds have gone from $1 million to $1.3 million, while Series A has risen from $5.1 million to $5.5 million. Series B rounds have been a huge, 60 percent increase from 2015 levels, going from a median round of $15.5 million to $24.8 million this year.

Even late stage deals have increased, with Series C rounds rising from $13.8 million to $22 million, an increase of 60 percent, while Series D round are up 17 percent, from $30 million to $35 million.

This is a trend that I have been seeing a lot of this year: it’s harder for companies to raise money, but the venture firms are still raising big funds, meaning that the checks are becoming larger.

“Investors have focused on quality investments, making sure a startup’s path to profitability and actual revenues are well in place before striking a deal. That strategy has helped drive deal prices higher, even if investors are still excersizing caution over inflated valuations,” Pitchbook wrote.

Overall, venture capital is having a pretty down year so far.

In the U.S., startups raised $14.8 billion according to the Q1 2016 Venture Pulse Report from CB Insights, an 18.6 percent decrease from the $18.2 million invested in the year ago quarter. There were 1,035 deals in Q1; not only was that down over 17 percent year-to-year, its the lowest number of investments made since the first quarter of 2012.

And, at the current rate, 2016’s figures might actually wind up being lower than 2011.

(Image source: en.wikipedia.org)