Digital health has seen itself on a downward trajectory since the highs of the pandemic: in every single year since 2021, the amount of funding, and the number of deals, has dropped from the year prior.

Digital health has seen itself on a downward trajectory since the highs of the pandemic: in every single year since 2021, the amount of funding, and the number of deals, has dropped from the year prior.

2024 saw $10.1 billion invested across 497 deals, according to a report out from Rock Health on Monday. That’s a drop of 6.5% in funding, and 1% in deals from 2023, making it the smallest drop of the post-pandemic era. However, from the heights of 2021, the drop has been precipitous: a fall of 65% in funding from $29.2 billion, and down 32% in deals from 740. As Rock Health points out, even though 2024 was larger than the $8.2 billion raised in 2019, that doesn’t account for inflation, as one U.S. dollar in 2024 was worth approximately $0.82 in 2019, meaning that 2024’s total approximates to only $8.3 billion in 2019 dollars. 2024 still comes out ahead, but barely.

As Rock Health points out, even though 2024 was larger than the $8.2 billion raised in 2019, that doesn’t account for inflation, as one U.S. dollar in 2024 was worth approximately $0.82 in 2019, meaning that 2024’s total approximates to only $8.3 billion in 2019 dollars. 2024 still comes out ahead, but barely.

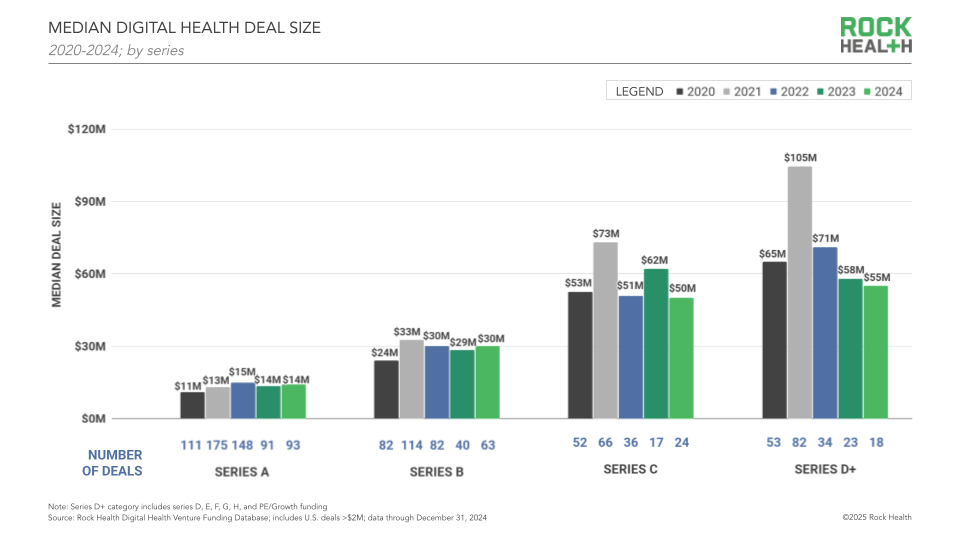

Part of what drove 2024 downward was more early stage funding, and smaller late-stage deals, with median deal size for Series C coming in at $50 million, down from $62 million in 2023, while Series D fundraisings saw a median deal size of $55 million, down from $58 million; in 2021 those mumber were $73 million and $105 million, respectively.  There was also a decline in mega deals, or those over $100 million, with 2024 seeing just 17, accounting for 21% of overall funding. Megadeals have been dropping for a while now, though, having accounted for 32% of funding in 2023, 38% in 2022, and 56% in 2021.

There was also a decline in mega deals, or those over $100 million, with 2024 seeing just 17, accounting for 21% of overall funding. Megadeals have been dropping for a while now, though, having accounted for 32% of funding in 2023, 38% in 2022, and 56% in 2021.

“There are a few contributing factors to lower funding levels in 2024 compared to prior years. One was investor focus on earlier-stage dealmaking, continuing a trend we saw in 2023,” wrote Rock Health.

“Sixty-three percent of 2024’s funding rounds were labeled (an uptick from 57% in 2023), and, of these labeled deals, 86% supported startups raising their Seed, Series A, and Series B rounds. Investors are betting on younger companies, some of which are free from the valuation baggage of 2020-2022 fundraising.”

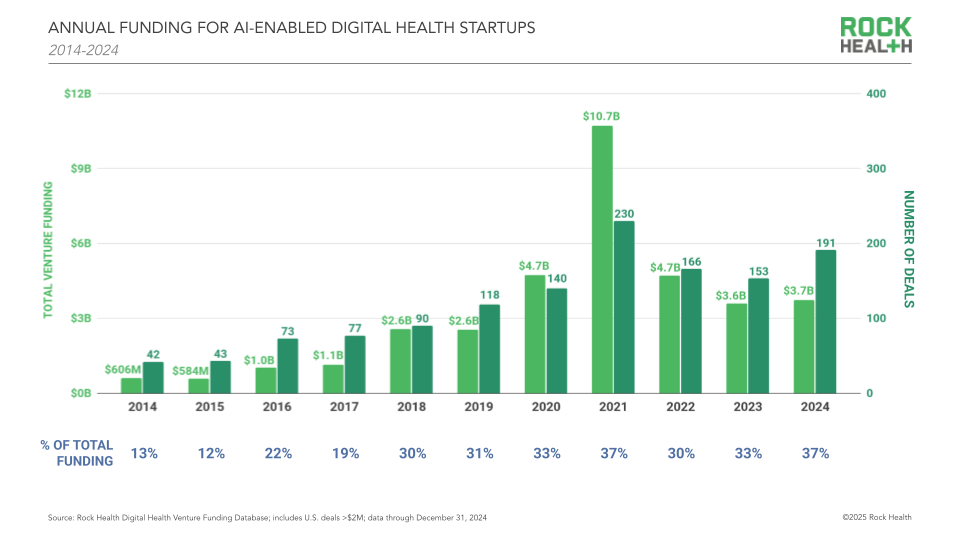

One area that did see an increase in investment in 2024 was AI, as funding for AI-enabled digital health startups rose nearly 3% in to $3.7 billion, up from $3.6 billion in 2023. That, however, is down 21% from the $4.7 billion raised in 2022.

Overall, funding for AI-enabled digital health startups comprised 37% of the total number, while the number of deals hit a three year high, however, growing 25% to 191, the highest number since 2021.  Rock Health notes that there is concentration happening in the AI space as well, including among companies developing foundation models, meaning those that are pre-trained on data sets that power entire ecosystems of downstream AI applications.

Rock Health notes that there is concentration happening in the AI space as well, including among companies developing foundation models, meaning those that are pre-trained on data sets that power entire ecosystems of downstream AI applications.

“Because foundation models are expensive to build and maintain, they’re often built by Big Tech players who can shell out the massive capital needed to acquire data, harness compute power, and deploy staff for model development and management—or they’re the product of open source initiatives. Foundation models are so integral to healthcare AI that we call them the elephants LLMs in the room,” the company wrote.

That includes EHRs like Epic and Cerner, healthcare divisions of Big Tech players such as Microsoft, and digital health companies that have raised enough capital to compete, including Commure and Abridge.

It wasn’t just funding that dropped last year: digital health M&A activity hit a decade low in 2024 at 118 deals.

When it came to the highest funded sectors, mental health once again reigned supreme with $1.4 billion, cardiovascular saw $1 billion, oncology saw $700 million, as did weight management and obesity.

(Image source: freepik.com)