How does Oscar Health make money?

The company makes its money by selling premiums directly to its members, and to CMS

2021 looks like it's going to the year of the health insurance disrupter. First, Clover Health, which uses data analysis to lower the cost of health insurance for seniors using Medicare Advantage, went public (though it didn't take the traditional IPO route), and now Oscar Health has announced it is doing so as well.

2021 looks like it's going to the year of the health insurance disrupter. First, Clover Health, which uses data analysis to lower the cost of health insurance for seniors using Medicare Advantage, went public (though it didn't take the traditional IPO route), and now Oscar Health has announced it is doing so as well.

Founded in November 2012 by Mario Schlosser, Kevin Nazemi, and Josh Kushner, Oscar combines technology and health insurance, taking a concierge-like approach to treating patients. That means that, rather than having the insurer be a faceless middleman, Oscar's mission is to be more personal, basically treating patients like customers and giving them tools to be more proactive.

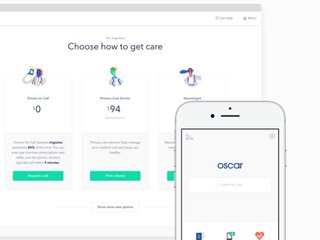

Oscar offers a services such as a concierge team, including care guides and a nurse, who provide all sorts of services, from referrals to specialists to managing the patient's condition. They also have a Doctor on call service, where members can talk to a doctor any time, without an appointment, free of charge. The company also has its own brick-and-mortar clinics facilitating wellness programs, such as yoga.

The company makes its money from selling its premiums, either to directly to members, or to Centers for Medicare & Medicaid Services (CMS) as part of the advanced premium tax credits (APTC program).

In the company's S-1 filing with the SEC, it revealed that 40 percent of the company's policy premiums were collected directly from its members, while the other 60 percent was collected from CMS in 2020; in 2019 the numbers had been 57 percent from members and 43 percent from CMS.

In all, it made $1.7 billion from selling its premiums in 2020, up over 60 percent from the $1 billion it made in 2019.

However, the company actually saw its total revenue drop 5 percent year-to-year to $462 million as it wound up ceding a much greater percentage of its premiums to reinsurance companies: $1.22 billion, or 73 percent, in 2020, versus $572.3 million, or 55 percent, in 2019.

"In 2020, we utilized quota share reinsurance arrangements with two other insurance companies, Axa France Vie and Berkshire Hathaway Specialty Insurance Company, to reduce our capital and surplus requirements, which enables us to more efficiently deploy capital to finance our growth," the company explained in the filing.

The company also made $7 million from "investment income and other revenue," which primarily includes interest earned and gains on investments in U.S. Treasury and agency securities, corporate notes, certificates of deposit, and commercial paper. This revenue stream was down 60 percent from 2019.

Oscar had 529,000 members at the end of January, across 18 states and 291 counties.

(Image source: hioscar.com)

Related News

Startup competitions seeking InsurTech companies

How does Clover Health make money?

Oscar Health launches new product for employer-based care

Accelerators targeting InsurTech companies