Meet Mark Hasebroock, Founder of Dundee VC

Dundee Venture Capital aims to raise $30 million in its third fund for tech companies in the Midwest

Editor's note: Our Splash Health, Wellness and Wearables event is coming up on March 23 in San Francisco. We'll have Mario Schlosser (Founder & CEO of Oscar Health), Brian Singerman (Partner, Founders Fund), Steve Jurvetson (Draper Fisher Jurvetson), J. Craig Venter (Human Longevity), Lynne Chou (Partner, Kleiner Perkins), Michael Dixon (Sequoia Capital), Patrick Chung (Xfund), Check out the full lineup and register for tickets before they jump! If you’re a healthcare startup and you’re interested in being part of our competition, learn more and register here.

Also, vote for your favorite healthcare startup before February 16! Vote here!

—————

Venture capital used to be a cottage industry, with very few investing in tomorrow's products and services. Oh how times have changed. While there are more startups than ever, there's also more money chasing them. In this series, we look at the new (or relatively new) VCs in the early stages: seed and Series A.

In this edition of "Meet the VC," we interview Mark Hasebroock, Founder of Dundee Venture Capital.

In this edition of "Meet the VC," we interview Mark Hasebroock, Founder of Dundee Venture Capital.

Mark is an entrepreneur to the core. After selling colorful moccasins to college girls, popcorn to grocers, being an investment banker, and cofounding GiftCertificates.com, he cofounded Hayneedle Inc. – an online home product retailer based right here in Omaha.

While Hayneedle’s growth was swift, it still needed cash to scale. Venture capital firms across the country were calling Mark, but he couldn’t get a dime of risk capital in the Midwest. Luckily, a roadshow in California gave Hayneedle the exposure Mark needed to secure funding from two of the country’s top VCs, Sequoia Capital and Insight Venture Partners.

Mark knew of other rapidly growing businesses in the Midwest with incredibly talented founders. They were succeeding, but had no investment capital to fund further growth. And, as the costs of startup technology companies continued to decline, he couldn’t sit and watch from the sidelines.

So in 2010 Mark founded Dundee Venture Capital to invest in companies at the earliest stages and to mentor startups as they ramp up their growth. Mark and his team have two funds in excess of $20 million. Mark will have you know that he is the 5-time defending Manager of the Year in the Beer & Pretzel Hockey League (it’s serious business).

—————

VatorNews: Tell us a bit about your background. What led you to the venture capital world?

Mark Hasebroock: I’m an Omaha native. I have been in private equity for awhile with a company here in town called McCarthy Capital. I struck out on my own to start a company called GiftCertificates.com in the late 90s, and that’s where the seed was planted. I’d worked with a number of privately-owned companies helping them trying to raise capital, and I noticed how hard it was for them to access early-stage capital.

I started another company in 2002 called Hayneedle and had the same experience. Good business model, scaling nicely, revenues growing, needed half a million dollars just to build out the team and inventory but couldn’t quite get anybody interested until we got investments from Sequoia Capital and Insight Venture Partners. Again, I wondered why can’t we do this here when those markets see the value of something being created in the Midwest.

Fast forward to 2010, I decided to do something about it and started Dundee Venture Capital to help Midwest-based technology companies at that seed stage access the money they need but also the expertise and guardrails to help them grow.

VN: What is your investment philosophy or methodology?

MH: It’s probably overused but we invest in the people. Most folks in the Midwest are very hardworking people, but when they come up with an idea to solve a problem—and typically the problem is a problem in their life—the passion and determination kicks in to solve it. We really like founders who have worked on the solution in great detail.

VN: What do you like to invest in (categories of interest)?

MH: It’s typically web service companies that are solving some sort of problem in a very big market, that are at an early stage, that have little to no capital behind them, and that are willing to work with their investors on a daily/weekly/monthly basis toward the common goal—that being to scale and build as quickly as progress.

E-commerce is a background a lot of us have. We all get “Amazon dominates that, why would you invest in that?” but there are a lot of interesting e-commerce companies that are brand-focused, so we’re looking at quite a few of those.

VN: What do you like to invest in (important qualities for companies)?

MH: We look for four things: the people, the product (what are they building?), the market (is it truly something people care about?), and then, finally, the numbers. So many startups start with the numbers—"here are our projections"—but that’s usually last. If it’s a subscription-based business, can they sustain their pricing? Can they scale with the right capital structure? So if it hits all of those, that’s great.

Oftentimes we’ll see a pitch from a technical founder, but there’s no one who knows how to sell. We really like to see a technical and a sales co-founder. So much of the dialogue is about the shortage of engineering talent but the bigger hurdle startups are facing is the ability to sell. A lot of them don’t have that baked into their culture yet. They just assume the market will buy their solution.

VN: What kind of traction do you look for in companies?

MH: Some will have anywhere from $5,000 to $10,000 in monthly sales. We haven’t done any pre-revenue companies just yet because we like to see that people are paying for it, using it, and that there’s no churn. If you’re seeing 20 percent churn per month, you’ve got a problem: more than likely the market doesn’t care.

VN: What would you say are the top investments you have been a part of (and what stood out about them)?

MH: One is Phone2Action, which is now based in Washington, D.C. but started out in Kansas City. The founding team fits that criteria really well: a very methodical, technical founder and a very driven sales co-founder. And it’s an advocacy tool that initially started to help consumers engage in civic projects. So here’s something I feel strongly about, here’s something I disagree with, and it’s everything from city councilman to mayor to governor to a bill being considered. Then they suddenly got approached by large brands like Airbnb, Pepsi, and Nike who said, why don’t we use this platform to better engage and understand our customers. And it’s scaling very nicely.

MH: One is Phone2Action, which is now based in Washington, D.C. but started out in Kansas City. The founding team fits that criteria really well: a very methodical, technical founder and a very driven sales co-founder. And it’s an advocacy tool that initially started to help consumers engage in civic projects. So here’s something I feel strongly about, here’s something I disagree with, and it’s everything from city councilman to mayor to governor to a bill being considered. Then they suddenly got approached by large brands like Airbnb, Pepsi, and Nike who said, why don’t we use this platform to better engage and understand our customers. And it’s scaling very nicely.

VN: How long does it take between meeting the startup and making the investment? How do you conduct your due diligence?

MH: Short answer: maybe a month. We try to be really fast. Speed gives you an advantage with these founders because the fire’s burning. We don’t like to wait six months to do too much diligence and delay. But once we’ve met them and done a little bit of a preliminary analysis on our own, we try to get third-party validation. We talk to customers. We spend a lot of time on personality profile of the founders, the founding team and their first 2-3 hires. And we compare those characteristics to the successful companies we’ve invested in.

One thing we try to do: if we pass, we’re going to pass quickly. And we try to refer them to someone if we say no. We say it’s not a fit and here’s why, but here’s someone you can talk to.

VN: What is the size of your current fund? And where is the firm currently in the investing cycle?

MH: This is our third fund. Our first fund was $2 million. Our second was $18.5 million, and that’s almost fully deployed. This one we’re targeting $30 million, and we have $23 million raised. Our goal is to have it closed by April 1.

VN: What is the investment range? How much do you put into each startup?

MH: $250,000 to $1 million.

VN: Is there a typical percent that you want of a round? For instance, do you need to get 20 percent or 30 percent of a round?

MH: We target 10 to 25 percent. We like to lead the round if we can. We get pretty involved with founders and companies, but if we just own two percent we find that we don’t have a big enough impact.

VN: What percentage of your fund is set aside for follow-on capital?

MH: We’ll earmark a half million to a million. We can’t allocate anymore than 10 percent of our fund to one company, so we cap that at about $3 million.

VN: What series do you typically invest in? Are they typically Seed, Post Seed, or Series A? MH: Seed.

MH: Seed.

VN: In a typical year how many startups do you invest in?

MH: We’ll target investing in 20-25 companies in this fund, or about four per year.

VN: What do you like best about being a VC?

MH: I get so much energy from the founders. I feel like I did 25 years ago, seeing so many unique ideas and high-energy people. I selfishly drain their emotional tanks more than they do mine. I like to be a lifelong learner.

VN: Is there anything else you think we should know about you or the firm?

MH: We’re very approachable. It happens a lot where someone will call, and they’re shocked that it’s my cell phone. We learn from founders and they learn from us. We just love to be part of growing this ecosystem in the Midwest. I can see how, in 10 years, it’s going to be completely different than it is today.

Related News

85 percent of Thrive Market’s customers are women

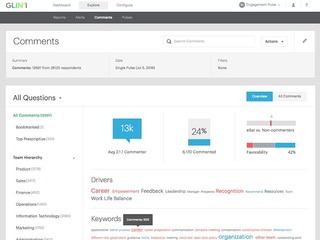

Glint adds another $10M to its Series C funding

Meet Patrick Mathieson, Partner at Toba Capital