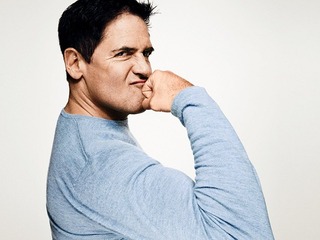

Transcription: Mark Cuban at Vator Splash LA 2016

Dallas Mavericks owner & Shark Tank host sits down with Bambi Francisco Roizen of Vator

Mark Cuban, Owner of the Dallas Mavericks, spoke with Bambi Francisco at Vator Splash LA 2016. Here's the transcript.

Francisco: Hi, I was just reminding Mark that the last time we were on stage together he threw my papers on the floor. He told me I was too studious and I needed to be more improvisational. This time, I’m going to keep my papers away from Mark.

Cuban: And then she just asked me, “Do you want to know about the questions?” and I said, “Nah, let’s just wing it!”

Francisco: Ok. We have to wing it. So, I’ve known Mark – we’ve known each other for a long time, probably 15 years or so – I’ve tried to –

Cuban: At least.

Francisco: "Yes, we’re getting old. And I’ve tried to get him on stage for so many years and so – I’m so excited that he’s here. We’re going to talk about entrepreneurship; we’re going to talk about Trump vs Clinton, maybe a little bit, maybe not. I know, I already started. I told Mark that I’ve already started with the locker room talk this morning but we kept that to a minimum. And then we’re going to talk about investing; Shark Tank investing vs. Silicon Valley investing and lessons learned and how you become a self-made billionaire and so – but I want to start off with entrepreneurship. And many people here probably read your book and know your story right –

Cuban: It’s called, “How to win in the sports of business.” It’s like 10 bucks. [Looks at audience] You can afford it.

Francisco: It’s a good book. And in that book and on his blog, you’ll hear these stories and Mark will talk about how when he was 12 years old, he had to work for his sneakers. Now, we’re talking sneakers. This is not a luxury product, right? This is something that a 12 years old kid needs and he had to go out and sell garbage bags to buy his sneakers and I love that story. So, I just need to know –

Cuban: It wasn’t quite like that – let me, okay. I’ve been a basketball junkie my entire life and I had a pair of tennis shoes that I wanted like the coolest kicks, you know. I wanted what the cool kids were wearing and I went to my Dad who happened to be playing poker with his buddies and probably had a lot to drink at that time and I was 12 and I said, “Dad, I want a new pair of whatever, you know, Converse or whatever that I wanted.” And he’s like “Mark, see those shoes that’s in your feet, they look like they’re working just fine. When you have a job, you can buy whatever kind of tennis shoes you want or need until then, those work.” I’m like, “When I have a job, Dad, I’m 12.”

And then one of his Poker buddies pops out, “I have a job for you.” And I was all ears. “I got all these garbage bags I need to get rid of.” And so, he had boxes of these old, these cheap garbage— I mean really cheap garbage bags, box of a hundred, sold them to me for $3.00 box and I literally took a sample and went door to door to door in my neighborhood in Pittsburgh and said, “Hi, I’m Mark. Do you use garbage bags? Would you like to buy your garbage bags from me and you’ll never have to worry about running out again? And I’ll just show up every week or two and you hand me $6.00 bucks and I’ll hand you a box of hundred garbage bags.” Who’s going to say “No” to that? And so, I sold a lot of garbage bags. I probably had the world’s first and only garbage bags that were out, when I was 12.

Francisco: How long did you have to do that for?

Cuban: Not that long, I got my shoes pretty quick and I was done. It was a lot!

Francisco: That’s great! That’s such a good idea. You have 3 kids, 7, 10 and 13 so do you make them work for their clothes?

Cuban: Yeah, not so much for clothes because my wife will take them shopping for clothes. They know better than to go with me. But for anything extravagant or anything out of the ordinary – like you know my oldest daughter has a phone and she wants an iPhone 7 and so there’s a whole list of things she has to do in order to get there. She’s not there yet, she’s very upset about that last night she told me so. But uhm, yes, so I want them. For my son, who’s 7, in order for him to earn money to get Pokeman cards we play Math for money. So now he’s up to 17x17, which I’m pretty proud of, if he can answer without having to work too hard or use a piece of paper then he gets a dollar or two. He’s just now starting to figure out division a little bit so it’s a dollar for Math and $2.00 for Division.

Francisco: That’s great. That’s great. Do you want them to have the entrepreneurial spirit.

Cuban: Well, I just want them to be confident and be excited about learning instead of just – you know, because my 13 year old just got snapchat, she finally just got allowed. Literally, because she said, “Dad” when she was 12. She just turned 13 couple of weeks ago. “Dad, all my friends have snapchat.” I’m like, “No, the terms of service here say you have to be 13.” We literally read through the terms of the service. And the good news was she didn’t cheat it, right? She waited and so it made it all the more valuable which kinda’ backfired on me because, I think 3 weeks she’s up to 37,000 snaps or something ridiculous. All day long –

Francisco: My teenager just looked at me and said, “Mom, you’re on snapchat?” “Aaagh –“

Cuban: Let me just tell you, okay? I’ll talk about ages. The next kid who walks up to me and says, “You know what snapchat is?” I’m going to smack him in the head. I’ve been on it since 2011.

Francisco: Oh God, yeah. I mean, well yes. You’ve been, I mean you’re on snapchat, instragram, twitter, everywhere and now you have your own email newsletter.

Cuban: Yes, because I wanted to learn mailchimp so I set up a newsletter. Yeah.

Francisco: You started 20 years or so, 25 companies, you had a bar, you taught disco lessons –

Cuban: I’ve had everything. I’ve done everything. I taught dance lesson which was my favorite all time job, going to Sorority houses and getting paid $25.00/hour to teach line dances and different types of dances. Only sororities, not fraternities.

Francisco: Of course, how come you’re not doing “Dancing with the Stars,” like a permanent?

Cuban: I did “Dancing with the Stars.” Things didn’t work out better for me. It’s okay. I did, “Dancing with the Stars.” I got my ballroom down.

Francisco: Okay.

Cuban: I’ll try anything if it’s an interesting challenge.

Francisco: That’s great. I can’t believe you actually made money selling and teaching disco lessons. Did you even know how to dance? Or did you just like learn it, sell it first and then learn it.

Cuban: All of the above.

Francisco: You have a tendency to do that. You just sort of “I know how to do this and then you figure it out!”

Cuban: I teach myself. It just depends on what everybody else learn, you know. I taught myself to code when not a lot of people knew how to code and different database language, scripting languages basic and stuff like that back in the day and so I can stay ahead of everybody else. As long as – to me that’s always been the cool part about technology. Every single second of everyday there’s something new coming out and the people who invented it or created it. Then there’s everybody else and I have the same ability to keep up with you know with everybody else or get ahead of them and if I could get ahead of them and then that’s a competitive advantage for me. And so being able to take new apps, new software, new whatever and use it to get a competitive that’s been a foundation for all the companies I’ve started in tech.

Francisco: Particularly Micro Solutions which, that was the one you sold when you were in your 30’s, that made you a millionaire –

Cuban: Right.

Francisco: And you started Broadcast.com and then you sold in your 40s and that made you a billionaire in your 40s. So, when you look back on those 2 and when out of the 25, those were the ones that you sold.

Cuban: There were a couple that I sold, but those were the big-name ones.

Francisco: The Big-name ones… So, but when you look back. They were also millstone ones. They at least made you hit a certain threshold economically. So, when you look back, you look back at the journey, the challenges, the sweat equity that you put in, what you learned from it, what the impact it had on people around you, which one are you more proud of and why?

Cuban: I mean I’m proud of all of them, I mean I started Micro Solutions because I got fired from a sales job. You know when I was working at a retail software store and I wanted to go pick up a check because it was a $15,000 check and I would have made $1,500 bucks, which would of allowed me to move out of the apartment I was living in which was six guys in a three bedroom apartment and was just the nastiest place ever.

Francisco: The towels could hang…

Cuban: The towels could hang by themselves. Yeah and so he said no I need you to open the store. So, I made the executive decision to pick up the check thinking – okay, when I show this guy the check he’ll be like, “Okay, you know, all is forgiven.” He fired me. And so, I took that, well actually I didn’t get that full customer, but I went and found another customer, started out of that nasty apartment and start a systems integration company called Micro Solutions in, and you know, when I first started it was helping people configure their PCs, install them, install software, and then it evolved very quickly into connecting them together. You know but so I’m dating myself, but we were one of the first low query networking integrators in the country, and by the time I sold it we were one of the top 10 largest system integrators in the country.

Then I sold it, bought a lifetime pass on American airlines, partied like a rock star for a couple of years… I got really good at it. But I went back to Dallas, I was… came out here to LA to take acting classes and just have fun, live on the beach, went back to Dallas and had lunch with a friend, Todd Wagner. He’s like, “You know, there’s got to be a way for us to listen to Indiana basketball with all this internet thing going on. You know the Internet is? Do you know what this is about?” And I’m like, you know I played around with it some, I’ve downloaded Netscape, let me see what I can do. And you know I started doing research and nobody was, back then they called it, netcasting. Nobody was sending any audio or video over the Internet, so I’m like, I think there’s something here. Let’s go and figure out how to do it and we worked with a lot of different software companies.

And you know I had a network integration background at that point in time, like I said we were one of the largest network integrators, so we put some software, some networks together and went out and gobbled up all the sports rights we could find and started a company first called Audionet, and then Broadcast.com. Where, you know, back in 1997 and 1998 we were getting more than a million visitors and growing, a day, watching audio, listening to audio and watching video. We had a IPO, at the time it was the biggest IPO in the history of the stock market, and then sold it to Yahoo. Then the Stock market took a couple of hits and Yahoo kinda’ imploded and --

Francisco: That’s when Mark and I talked a lot and you kept telling me we should short Yahoo.

Cuban: No. I didn’t say short Yahoo. I said short tech stock.

Francisco: Short tech stock though all the time, that was constant. So, I’d be like covering the market and I’d e-mail Mark. So, Mark kept frothy, should I still keep telling people that its frothy? Like, “yes, yes,” you’d say, “sell, sell.” I still remember that because you were right there. You and Mark Pincus and another friend of mine. I just remembered the two of you very in….

Cuban: So yeah, when we sold Broadcast to Yahoo, we got it all in stock, and so literally at that point in time I’d saved up from companies, I‘d sold them that Integration company. I’d started trading stock, I’d started a hedge fund based on my trade, sold the hedge fund within months did very well there, but I was able to save up $25M dollars in those couple of years. In between, I took every penny I had, literally, and shorted an index that by law couldn’t have more than 5% of Yahoo. Just in case the Stock market crashed, because that bought me six months at which point I could collar my Yahoo stock that I’d gotten.

And so, six months came and went, the market was still up, people were telling me, “I was an idiot.” I’d just lost $25M dollars, but it bought me time to hedge all my Yahoo stock and put together a collar and then within months after that, you know, the whole thing went to hell in a handbasket. And, you know, and I protected everything I had, made a little bit of money. And you know it’s been called one of the top ten trades of all times. And it wasn’t like I was so brilliant about it, but it was like how much money do I need. Right? And plus, I’d been through the wars enough that you know, the tech stocks, the internet stock were frothy, before that we’d seen networking stocks get frothy, before that we’d seen software get frothy, and before that we’d seen PC stocks get frothy. And every time there was a big crater right afterwards. So, I was like, okay. You know, there was every chance, then that’s what you and I would talk about.

Francisco: Yeah, well I want to talk about that for sure. I want to talk about asset bubbles. I want to talk about, whether… which, -- I think that we’re, you know prices are pretty frothy right now, particularly with the real estate. But, just going back to entrepreneurship, you mentioned that the gentleman, that your boss who fired you at a micro….

Cuban: He wasn’t a gentleman at the time.

Francisco: Okay. Your solution to the talk –

Cuban: His name is Michael Humecki if you every run into him.

Francisco: <Laughter>

Cuban: But I don’t hold grudges.

Francisco: And there’s another guy at Nolan Bank, that you probably don’t hold a…

Cuban: Yeah. His name is John Whitman. Yeah

Francisco: John Whitman. Oh.

Cuban: But that’s another story.

Francisco: Clearly these guys, well these guys well – you’re thinking about psychology, there’s push and pull. These forces, right? And so, these guys basically pushed you away.

Cuban: Nah, it wasn’t so much that they pushed me one direction. The guy fired me. I guess that’s the ultimate push. But I knew I was a lousy employee. Right? To me it was just a matter of time. I’d been through three jobs in two years that I either quit before I got fired or got fired from. But in all of them, you know I think I accomplished two things: I got paid to learn and I learned so much that taught me, even though the guy fired me, I learned so much from him about what not to do. I mean literally, that it saved me and made me a boat load of money, because if ever I caught myself doing what he did I’d knew it was wrong.

Francisco: Right.

Cuban: You know because – you know, the guy… the things this guy would tell me; he’d say you want to buy your suits here. Okay. So, first of all, let me just tell you this, based off of what I was making, I bought my suits two for $99 dollars. I mean the polyester, I could wipe them down, I didn’t have to take them in for dry cleaning. I bought my shirts. All of them. They were either fake Polos or I bought them used. Literally, at a place called Rethread in Dallas. I bought all my clothes used. So, you know, and this guy’s telling me you’ll have to step up your game, “Oh, if by the way, you happen to wear glasses? With prescriptions, right? This place called Peeps is where you should buy them because they’ll make you look cool.”

I’m like, you know, you’d drive up in this nice car and you wanted to be CEO. I’d be out selling and he’d never go on sales calls, and it’s just all these things about what not to do. And the point being that -- there’s you know perfect job, there’s no perfect circumstance if you think you’re an entrepreneur or you think you want to be an entrepreneur, but when your down or your in-between, I’ve always taken a job because A: It pays the bills. But B: no matter where I was working as a bartender or in a bar, you know or doing whatever, I always learn, because it’s always a business and it helped me understand the restaurant industry, the computer industry, the service industry, whatever it may and that gave me a great foundation for everything I did.

Francisco: So this guy was really helpful –

Cuban: Very helpful

Francisco: Because he really showed somebody you didn’t want to be. But are there people who pulled you into entrepreneurship, who gave you who you aspired to be who…

Cuban: I don’t think there’s anybody who inspired me. I looked up to Ted Turner because he was a freak. You know, if you guys know who Ted Turner was? He started TNT, and TBS, and CNN and also owned the Atlanta Braves. He just… I read his books. He used media. And he just had fun, right? Or tried to have fun. And I thought, “Okay. That’s the goal for me.” I want to enjoy every minute of it, even when I was down, even when I was counting you know how many days of cash I have left. Or literally, when I moved to Dallas, we would take $20 basically for a week for our party budget. And we would go to bars that would have fried food you, you know buy one beer and all you can eat fried mushrooms, or whatever. I mean I gained 30 pounds, I mean, but that’s how I lived. And so, I looked up to him just because he managed to get things done and have fun doing it.

Francisco: Yeah, there isn’t a map. Or I’d say…So let’s switch to Shark Tank. Let’s start talking about…

Cuban: Any one watch Shark Tank?

Audience: clapping

Cuban: Come on now. For those of you who didn’t clap, Friday ABC. 8pm Watch it!

Francisco: I know someone here who went home last night and said I’m going to watch a bunch of shark tank tonight it’s because he presented –

Cuban: Friday night, we got a really good episode.

Francisco: So you have done – you have done $20M – we’ll see a little bit of shark tank here when you judge—

Cuban: Right.

Francisco: We have our own set of rules to –

Cuban: Be afraid. Be very afraid.

Francisco: So you’ve invested in what -- $20M in 85 deals?

Cuban: More than that. So let me give you a little background across Shark Tank. So— when they walk in the door, we know nothing about it. Nothing. We know their first names. They come in, they get on the carpet and what takes as long as 14 minutes on TV, might go 20minutes if it’s really a dumb ass deal to 2 hours, right?

And so, we’ll go through and ask a lot of questions. If you make a deal then we have the chance to do due diligence. Early days, probably 40% fell out because they were bullshitting one way or the other. You know all my widgets only costs 30 cents to make, then you do the due diligence and it costs them $3.00/hour but if they make 7 Billion of them, it’s 30cents, you know. And so—but now I actually, more of them fall out because we’ve kinda’ become a gross act for a lot of companies particularly the Silicon Valley so –

I’d say, you know, 50% of the company closed and to this point I’ve closed 71 deals and I think I’m in for like $30Million give or take and I’ve sold 4 of them none big hits of those 71 I think 5, 2 are out of business. Three are out of business, they are not smart enough to know it.

Francisco: The walking dead?

Cuban: Twelve , fifteen of them are making half a million dollar or more per year, a couple of those are making you know, millions per year.

Francisco: None have returned your $30M?

Cuban: None have returned $30M but if I make a market to market based off on growth, I’ll be way out, right? On a cash basis, I’m still down.

Francisco: But you do investments on the side?

Cuban: Sure, I invest in a lot of companies.

Francisco: You also invest in a lot of companies, so if you look at your shark tank portfolio and your angel investing portfolio, which ones do –

Cuban: I mean, my angel stuff does a lot better just because I invest more money to get a bigger return, right? I’ll take different types of risks. You know, Shark Tank -- I do the show not because they’re great investments. I do the show because it sends the message to kids 8-80, that the American dream is alive and well. You can watch the show and come to realize that somebody out of Iowa or in the middle of nowhere Texas can start a company and turn it into something special and I think so many families watch the show together that it’s just—particularly in this day and age when so many people are saying, what’s wrong with this and what’s wrong with that? What’s wrong with America?

It just really reinforces that. Somebody with an idea who’s willing to go beyond just an idea to a company phase and really work, something special can happen. Just reinforcing that is really important to me.

Francisco: Yes, I know. That’s nice.

Cuban: I mean, you guys talk about entrepreneurship here and everybody’s trying to learn and get better at it and that’s amazing but every episode reaches at least $20M people over this lifetime and we are reinforcing to all the 20M plus that the American dream is alive and well and to me, that’s important.

Francisco: And everybody here knows that because this is what we want to do. We’re entrepreneurs but it’s different in Silicon Valley, when you think, you’ll take typically you’re going to do a seed round or an early stage you’re taking a 20% but when I watch Shark Tank, when I thought I see some of the numbers too – sometimes, these guys – you’re taking 30 to 50% of their company and that’s not – what kind of message are you sending to America if they have to give 30-50%?

Cuban: It’s better to have 10% of a watermelon then a 100% of a dying grape, you know? And so, it’s a little bit different perspective obviously particularly in Silicon Valley. Remember, there’s just a small percentage of companies that are tech companies, particularly software companies. There’s only a few sizes. Software, you know with the leverage, okay. There’s situation where you can say, we might ask for a bigger valuation or smaller valuation bigger equity percent than you might get here in the valley, but I would rather tell you that valuations in the valley are ridiculous and valuations in LA are not as bad, but coming close.

Francisco: Right.

Cuban: If you go outside the west coast, valuations are half and so, you know. I talk about it all the time, the Silicon Valley are – I can invest in companies, in Bostin, Austin, Dallas, Miami, Chicago, New York, whatever not as much as New York anymore and get investors in the valley and get triple the valuation just because that’s the market over there.

And so, I don’t think, in terms of sending a message. Everybody has to value their company but the reality is if you’re asking for money, you’re asking for a reason. I always tell people “sweat equity” is the “best equity.” In this day and age, particularly with software companies, you can try to spend money all you want on growth X – I want to go out there and be ubiquitous and you have to spend a lot of money to get there but 95% or in fact more than 99% of these companies fail.

And so, the best companies – the best experiences I’ve had are where the “best equity are sweat equity,” where you get a great idea, you go out, you launch it, you get some traction, you hit your KPIs, you have great cohorts, (see how I mixed it in with buzz words?) and then you have something to sell. To me, it’s crazy, when somebody just has an idea goes to UC Berkeley and figures they are worth $8M.

Francisco: I’m just saying that sometimes it feels like --

Cuban: Or Stanford, Stanford it’s a toss-up. When somebody from Stanford got 8 million, somebody from Berkeley’s got to get 8 million and one. And then Sandford’s got to jump to 8 million and two.

Francisco: Alright, but when I look at these guys they seem demoralized because they’re taking away that opportunity. In Silicon Valley, they want to give them –

Cuban: Here’s how demoralized they get. Here’s how demoralized they get. And this isn’t a tech example, 19 yr old woman named Lani Lazzari whose from my Pittsburg, my home town. She has a company called Simple Sugars. She comes on when she’s 19, she’s 21 now. Six months after the show airs, I get an email from her and she goes, “Mark I’ve got a question?” I’m like, “What, what what?” She emails me back, “I’ve got a million dollars in cash in a bank, what am I supposed to do now?” I’m like ‘smile’ and “let’s discuss, put aside some for taxes, and let’s discuss how we can invest the rest to grow your company.”

When you get on Shark Tank, we’ve yet to see a company go backwards. You know it is a growth hack. It will create sales and there’s such visibility, and I think the Sharks are smart, usually for the most part, and we help companies grow. Now if you’re a tech company, some of us have those tech skills, Robert and I, and some don’t. Sacca -- when he’s on there, but again it’s a different beat. So, I think it’s wrong to think that we’re taking too much of the company. Let me add another component to it. The time component to Shark Tank, filming is minimal. Right? I spend 10 days, 11 days, in June, 11 or 12 days in September. That’s it. Go out there and do some promos, a week or so of that; ten days of that. Spending time with the companies, helping them 24/7! They all can e-mail me any time, I’m not a big phone or meetings guy, but I’m always accessible fulltime via email. If it’s a real problem I’ll go visit, or I’ve got a staff of 15, but we’re there all the time. These are needy companies. When you talk about VCs and in investing in the Valley or investing in tech company it’s pretty much hands off. Maybe some connections, maybe a board meeting, right? Let’s sit down and talk at the board meeting, let get on a call if you have a problem, let me make an introduction.

It’s not, we take over their accounting, which we do. It’s not, okay we help you with their HR, which we do. There’s just so many back-office things and then going out and setting up on Amazon Exclusives, Amazon Pay all these different…

Francisco: Plus the distribution!

Cuban: Just getting you access to retail whatever it is. So, there’s so many things that would cost money if you were going through a traditional VCC to Angel type scenario, that we preempt.

Francisco: I agree with that 100%, so you do add more value than a VC.

Cuban: Thank you.

Francisco: So, let talk about something less controversial. Let’s talk about politics.

Cuban: (Laughing) Right.

Francisco: I think we all know who you’re voting for…

Cuban: I’m with her.

Francisco: Initials D.T. but last year you said, or you tweeted, I would prefer to be a republican because I want smaller government, and so Hillary whom you endorsed, wants to expand government by quote, making the biggest investment in American infrastructure since Eisenhower.

Cuban: Actually Trump said he was willing to spend more and was going to spend more.

Francisco: Well I don’t know how he was going to spend more…

Cuban: On infrastructure. Yeah, because he’s got to be bigger at everything.

Francisco: He didn’t say what he was going to spend on infrastructure, but everything’s “HUGE” I get it. But you know with him…. but this is bigger government. This is not smaller government.

Cuban: Yeah, look. There’s a hierarchy. There’s ‘Maslow’s Hierarchy’ and then there’s the real world 2016 hierarchy. Right? And in terms of politics and voting, from my perspective. The first thing, the most expensive thing to business, the most expensive risk to business is political and social instability. And if we’re not safe, if there’s riots in the streets, or there’s social unrest in the streets, businesses can’t open, you can’t get to work, commerce can’t happen. That’s the greatest risks. To me, Trump increases that risk exponentially. You know the guy just doesn’t….

Audience: Applause

Cuban: Here he is this close to being the president of the United States and he can’t shut up! Right? And he has to say some stupid shit all the time. And put aside what he said 11 or 12 years ago, which is bad enough, but just what he says now. There’s no there, there when he talks; he has such a lack of self-awareness and such a lack of contextual awareness or context, its likely he would say something offensive as president and offend North Korea or China, or Russia and invasions happen. You get military instability. There’s a very fragile global peace. To me, he’s the greatest risk, right? What’s more expensive? Higher taxes and bigger government or instability? Instability every time.

Francisco: When you bring in a president, you don’t bring in just one person you bring in an entire team. And hire philosophies, entire world views. You’re not just bring in Trump your bringing in a team.

Cuban: That’s not true. That’s not true. Because Trump has to make the final call. Right and so look at his track record. He’s been through three different campaign managers, right? When you look at his… there’s been nobody, not one single person whose stood up and said ‘boy I’ve worked for Trump forever and he’s been a great mentor to me’. Has anybody heard of one? ‘Boy, Donald Trump invested in my company what a great mentor!’ Have you heard of one investment he’s made in one entrepreneur? Not one. ‘Boy, Donald Trump made me a shit load of money.’ Words no one’s ever said. So when you say, so when you say, well he’ll put good people around him, that’s part one. He hasn’t demonstrated the ability to do that. Part two: your advisor’s are…

Francisco: Well it depends on what you think about Pence, and Giuliani, and Peter Thiel, and Icahn and some of these other folks.

Cuban: Well Icahn just said that, “he’ll just support him,” and he said --

Francisco: T. Boone Pickens and…

Cuban: And when I challenged both of them they said they’re not going to defend him they just support him.

Francisco: Right. Nobody can defend him. Even I, I’m not here to be a Trump apologist, but I am her to just, because I know how much you like…

Cuban: Oh no, look, I started off liking Trump. Right, I said he was the best thing that happened to politics because he was candid and he wasn’t scripted. But then I had to listen to what he had to say… and look, let me just say, I actually talked to him. Right, he called me on the phone. My quotes on his book. And so we’d talk on the phone, we would e-mail,… well I don’t email him, I email his assistant who prints it out, he writes on it, she scans it, she sends me the scan as an attachment. That’s the efficiency we would look forward to in a Trump government.

Francisco: Clearly a lot of Hillary Clinton Supporters. Let me tell you, let me tell you –

Cuban: Let me finish. Right so, and a big part of my supporting Donald at that point in time was that I thought Ted Cruz was smart and dangerous; Donald’s just dangerous. And so, when he got to the Republican convention, I started asking him, “You got to learn this stuff, right you got to learn this.” And just no interest! I sent him links to books, and you know I tried, you know… it’s crazy I mean, I talked to him, I mean when the whole FBI Apple hacking thing was out for San Bernardino, tried to send him stuff to explain it to him; just no interest in learning whatsoever.

And so when he asked me, “What happened? Why did I change?” I told him, “At some point, you have to stand up and learn these policies. You have to learn, so how does that apply to advisors? If you’re sitting around and you’re trying to decide what Putin is going to do next, and you’re trying to anticipate what’s going to happen with North Korea? And what should you do here and what should you do there? You’re going to have five different advisers potentially giving you five different pieces of advice. You can’t make a choice, and make a qualified decision if you have no idea what they’re talking about. That’s the problem, right?

If you look at the people he trusts. He’s been in business fifty years, at some point or another. The only people he trusts around him right now are his kids. No knock against his kids, but at some point there would be some trusted people that came in that he -- I mean I’ve got Ty Wagner my partner from Broadcast.com, I’d trust him with my life. There’s guys, you know, hopefully, and I’m not running for an office, but hopefully if I ever did, and I have no intention of it, if I ever did…

Francisco: Well talk about that.

Cuban: There’s no chance but -- Somebody would stand up for me, right? You don’t see a single person. I mean there’s a video tape….

Francisco: They’re not standing up for his words; no one can. But they stand up for what he stands for, which is conservative…

Cuban: What does he stand for?

Francisco: Well he stands for jobs in America. Sure.

Cuban: Who isn’t for jobs in America?

Francisco: Yes, but he is bringing it home in his very inarticulate way. He’s trying to say that, ‘sure we need to be a little bit more protectionist’. People aren’t talking like that before he introduced a lot of these issues that are now front and center. I’m not defending him. He’s not articulate and nobody can defend his, some of his actions…

Cuban: What I suggest everybody… I give him credit for being consistent, right? So before I looked at supporting Hillary I did all the research on the emails and the foundation all the stuff. A lot of it, all of it I think is nonsense. But, I also went back and wanted to know, because Trumps been

interviewed a lot, put aside the 2005 era in his life. I went back and found this tape from and interview he did with David Letterman in 1988. And, all the topics he talked about then; immigration, trade, only back then it was Japan that he was talking about, “they’re killing us. We negotiate the worst trade deals ever. They bring in VCRs, and they’re killing us with their VCR pricing and they’re abusing the ‘in’. He hasn’t evolved his perspectives at all; they’re exactly the same. So, you can give him credit for being consistent or you can say he hasn’t evolved, but the guy just doesn’t learn. There’s nothing where you say, ‘golly’ is there one topic you think Trump has gotten smarter on in the fourteen months since he’s announced, or whatever it is?

Francisco: So lets… you know, well so Hillary is still leading I the polls however narrow, she has a narrow lead. But you talked about instability and that really can hurt the stock market. I can tell you another thing that can really hurt the Stock Market, and that’s the Fed. And every time the Fed eases over the last ten or so years, that the Stock Market just spikes higher. And so, the one thing you have to give him credit for, and I know you’ve tweeted about this that Donald Trump doesn’t know a thing about the Fed, and I agree with you there. But, again he doesn’t know these things but he calls them out. And I think the Federal Reserve –

Cuban: <Laughing> Think about what you just said. Think about what you just said. He doesn’t know them, he doesn’t understand them, but he calls them out?

Francisco: No. He doesn’t know the inner workings of what the Federal Reserve… No. what he’s pointing out is that we have had quantitative easing for the last ten years. Has the Fed created an asset bubble? Do you think there’s an asset bubble? Do you think we should look at what the Fed’s doing? Even the Prime Minister of Britain…

Cuban: Here’s what I know: If you put ten economists in a room, they’re all going to disagree about what you should do.

Francisco: Sure. Well what do you think though?

Cuban: It doesn’t matter what…

Francisco: But you might run for president.

Cuban: I’m not running for president.

Audience <laughter>

Cuban: Personally, I think you leave the Fed alone. They are trying to find a reason and a way to raise interest Rates because they know, any tools in their tool box that they’ve had, that they thought they had, really hasn’t worked the way they expected them to. And so, they’re trying to, they’re playing big data. Look. Probably everybody in this room has some view point towards big data, machine learning, deep learning, AI etc. Right? And is trying to find ways to take huge amounts of data and use them in an intelligent way. The Fed is trying the same thing. IUs there an absolute answer? No. I don’t have an absolute answer and neither do they. But here’s what I do know: what other economies in the world are better than ours right now? Where are people sending their money? Is there an export?

Is anyone rushing to invest their money outside the United States? China and Russia are passing laws and cracking down on people investing money in the United States. Do you know who’s going to hurt the most from that? Trump because he can’t sell his condos, but that’s a different issue. But there’s nobody, those countries are working to try to keep capital, that’s controlled by individuals in particularly, inside their countries. So, if you just look at the path of capital it’s all coming here. Now we can complain that our growth isn’t high enough, 1 ½ to 2% growth; we’d all like higher, but this is the longest period of sustained growth. Every other post-recession or depression growth period has had a recession in there. See you go two steps forward, one step backward for the various sizes.

Francisco: That’s because we doubled our debt to get there. So we doubled our debt by 10 Trillion dollars. Hundred percent –

Cuban: First of all, a lot of people like to quote 9 Trillion dollars, right? That’s –

Francisco: No, now it’s 20 Trillion dollars.

Cuban: 20 Trillion dollars of –

Francisco: Debt, not –

Cuban: Right, and what’s our GDP? And what is our asset based on this country?

Francisco: Our GDP is probably equivalent to it or actually less.

Cuban: So if you take all the entitlement program and everything that we possibly own, right? Than yes. The amount appears—the amount has always been about equivalent to our GDP, right in absolute debt, right? So, what’s the alternative? What do you think happens if we didn’t spend the money?

Francisco: Well, no.

Cuban: That’s the question, right? You want to lower the—you want lower debt.

Francisco: That’s the question. Does the debt concern you?

Cuban: No, because right now – look, if it was up to me. Next debt – we can argue about Fed and QE and the value, you there. I don’t think, there’s an absolute answer. That’s why the fed is struggling. But what I do know is – if you give me, the ability to borrow any amount at basically nothing. I can invest it and get a return.

Francisco: But somebody got to pay that back!

Cuban: Yeah and I get a return. So it’s like any investment. If I invest in anybody out here, somebody’s got to get paid back.

Francisco: So you don’t care about the debt. Fine. I want to go back to the sort of quantitive easing, because he doesn’t care about it, so we’re not going to talk about it.

Cuban: It’s not that I don’t care about it. I care about what happens to this country. I want to see the economy grow. I want to see more jobs, but I want to think through. I don’t want just headline porn. Headline porn is 9 trillion dollars increase in debt. Headline porn is – we have so much debt the country is going to implode which is nonsense, right? Now, can we just spend forever? No. But look at China?

Audience: Can we open this up?

Francisco: Yes, of course, we can open this up.

Audience: Awesome! Alright! We got a live mic. I’d like to kick things off – This has really been a dynamic conversation. I can really appreciate it. The questions from your interview, I think are spot on and I really commend your tenacity with Mark Cuban who’s – a good guy.

Cuban: Get to it, go ahead.

Audience: Mark Cuban, who’s a Shark Tank! Hey Mark, you’re a successful entrepreneur, who’s done amazing things but you seem to lack some knowledge about the natural –

Cuban: If that’s a question, don’t try to fuck with me. Just ask the question.

Audience: I not messing’ with you right here. I’m bringing it on. So Martin Feldstien Chairman of the Economic Council under Reagan,

Cuban: I’m sorry?

Audience: Do you know who Martin Feldstien is?

Cuban: Right.

Audience: So in 1984 said the biggest problem our generation will have to deal with is the national debt. The single most important problem. You seem to write off that issue. We’ve actually doubled the national debt … in the last nine years.

Cuban: So first of all, look if you just want to quote people I was very clear that if you put ten economists and put them in a room, you get ten different answers. He was economist correct?

Audience: He was an economist. Yes.

Cuban: Right. So, thank you very much. Do you have an actual question?

Audience: We’ve doubled our national debt over the last couple of years.

Cuban: Do you have a question?

Audience: I do.

Cuban: So ask.

Audience: you seem to have dismissed the importance of the national debt. I think that’s a very important question.

Francisco: Okay.

Cuban: Okay. Let him go guys, don’t pick on him. Come one. No, no, no, let a man…let him go. let him go.

Audience: So my question is: you’ve made a lot of personal comments about the characters involved in the election.

Cuban: Yes.

Audience: You seem to have written off some very important substantive issues beginning with the national debt, but let’s no go there.

Cuban: I didn’t write, I said that… its very… what I would do is invest. And we need to get a return on that investment. And I felt like, if I was making the decisions, I qualified it. I thought I could get a return on 0% interest. That I thought that the amount of debt that we have relative to the GDP and the asset base we have in this ‘company’ was not out of course. I would have also gone on to say; “Yeah, that with entitlements that continue to grow there’s an issue there,” but… if we ever get a political system that can address those, then we will be in a position to address those, because right now nothing that either candidate is going to propose is going to change that.

Audience: Growth. Growth address debt.

Cuban: Right. Growth is going to do it. So, exactly. You have the exact answer.

Audience: Which candidate do you think is going to encourage growth better?

Cuban: Well, I can tell you this: Donald Trump doesn’t know what he’s going to do, so that’s the first problem. The second problem is, that whatever they propose has to get past’ which is a big problem. Right?

Audience: Growth Improves stability and security. The other issues you raised earlier. Right?

Cuban: What’s that?

Audience: Growth improves the economy, stability and security, the issues you raised earlier.

Cuban: So, what would you do for growth? Just cut taxes?

Audience: I think cutting the corporate tax is a huge step forward. We have …

Cuban: I’m for cutting corporate tax. I have no problem. I’m all for cutting corporate tax. I think that we should be competitive with other counties. I’ve got no problem with that… Secretary Clinton

Audience: Regulations… regulations that are increasing concentration in industries, decreasing competition.

Cuban: I haven’t run into… look there’s regulations. We could talk about regulation all day long, right? In some cases we need more and in some cases we need less.

Francisco: Let’s take a couple of more questions. We have more questions here.

Cuban: Hold on. Hold. Hold on. One more, just one more.

Audience: I do have a more important question. I’ve been teasing Mark, I do have a more important question.

Cuban: Go ahead, this is your last one.

Audience: My last question is: corruption. Historic, unprecedented corruption, multiple felonies.

Cuban: Okay. You’re an idiot. Okay, so let me just deal with that real fast

Audience: <Applause and laughter>

Cuban: First of all, look if you want to go into the whole Clinton corruption thing I’m going to just shut you down, and give you facts, right? I’m going to just deal with this right? So first before I endorsed Secretary Clinton I did my homework. I didn’t read ‘Breitbart’, I didn’t read ‘MSNBC’, I don’t read the ‘Wall Street Journal, I didn’t read ‘Newsweek’. I went and read transcript. Right. I read actual criminal reports, I talked to different people, I talked to people who were involved. So, I can’t really address what happened 20 years ago, but Bill Clinton isn’t running.

Audience: In an article yesterday, the vast majority of the FBI agents believe that, they are recommending Clinton’s indictment… the vast majority…

Francisco: Can we? Okay, okay. This is great but I really want to get some other questions.

Audience: I really want to get your response.

Francisco: I really want to get some other questions.

Cuban: Go back to your job at Breitbart and we can talk after you get fired.

Francisco: Go ahead. We have another question

Audience: I don’t know if this is on. Are we on here? Mark thank you very much for taking your time. And having the patience for dealing with that. We really appreciate it.

Cuban: No that’s fine. Let me just add, if you’re going to be a good entrepreneur, you’re going to have to have the courage to put something out there that other people may not agree with. When I told people, we wanted to listen to Indiana basketball over the internet, they’re like… what’s wrong with the radio, you know? That makes no sense to me. And so, every time I put something out there I want to be challenged. I call it checking my whole card.

Because he might have just asked a question, he might have said, I actually talked to so and so, or I actually did research, instead of just reading headlines, and I might have learned something, right? So when someone challenges me. When an entrepreneur get challenged.

Audience: I’ve got a lot of primary research.

Francisco: oh, no! no! no! no!

Cuban: When someone challenges me, when an entrepreneur gets challenged that is how you learn. That’s how you make your company better. So, when you see me do interviews about politics, do you know where I’ve done most of my interviews? FOX, because I love being challenged on it. It allows me to get smarter and I think it’s something every entrepreneur should do.

Audience: I agree. Yes. So, what I want to do is get back to what we are all here for, and that’s Entrepreneurship. I want to ask you. I’m an investor too, by the way. I’m an investor in a company that I think you’re an investor too, called Connected Signal, so I want to use that as a basis for… what do you look for in companies you in invested in?

Cuban: There’s no one thing I look for, right?

Audience: and if you use Connected Signals as an example of why you invested in that company?

Cuban: There’s no one thing that I look for, right? I mean if they have great entrepreneurs, I think it’s a great idea. If there’s great people behind its I think it’s a good idea. I think it could scale to something big, then I’m willing to take a chance. There’s just no one set of rules that I follow.

Audience: Thank you very much.

Audience: Hi, My Name is Bradly Khan. I’m not an economist and I’ve never worked in the financial sector, but just hearing you speak moments ago about growth. How much in your research, how much value have you, and do you see the community around you placing on sustainable growth rather than just trying to grow to meet targets so that… you know what I mean?

Cuban: I know exactly what you mean. So, look, there’s growth where you are just buying numbers basically, right? You go out there and you buy downloads if you have an app. You underprice your product, your services, so that you can say you have an installed base then you try you figure out how to make it up afterwards. I’m a far bigger fan of organic growth. You know, I get all the time, particularly from my Shark Tank companies, “can you get us another TV show” because you know PR is like Viagra for business, right? Unless you need a doctor’s warning if it lasts too long, typically it gives you one big pop and your back where you started, and so I always want my entrepreneurs to tell me how they are going to have organic growth and how it’s going to be sustained?

And trying to figure that out is critical because the… the food delivery companies right now, Blue Apron etc. It’s going to very very difficult for them to make money because their cost of customer acquisition is enormous and it’s not really going down, or at least not enough. And so, I look for sustained growth. And something I learned from Warren Buffett, he said, “the number one thing he looks for is ‘pricing power’”. Can you raise your prices? So if your price is nine dollars can you get it to Ten? And your customer are going to be so happy they don’t want to go anywhere else? If the answer is “Yes”, then you’re doing things right. If your answer is “No” then you have to really question your marketing and approach.

Audience: Just to add another dimension to that, in terms of environment also and the broader issues we are facing as a species, do you factor that in to any of these, its business specifics so… it may not be so relevant in tech but it may be in food production for example.

Cuban: No, of course. Everything. Anytime there’s disruption. Everybody looks for disruption. Everybody talks about disruption. And so, I want -- when you’re disrupting and industry it’ll make sense to everybody why they should use you, right? Snap Chat’s a good example. Didn’t make sense to me the first six months I was using it but then as I saw everybody just -- now that they had smart phones and they just wanted to take pictures and it was so easy and that was a simpler way of communicating than using a keyboard, that it became obvious it was organic. And so, I think it applies whether it was sustainable food because the food is better, the food safer. People want to be healthier.

There’s a company I have called Alyssa’s Healthy Cookies. These guy sent me the cookies. I look at the back at the nutritional information and the huge cookie was 190 calories, high in fiber, low in net carbs which is important to me. The problem was, the cookie crumbled, right so? You couldn’t really distribute it, so we reformulated it. We came up with this new approach to maintaining moisture in the cookie. So now these cookies are smaller, but a pack of 8 is only 350 calories. I eat them everyday for breakfast. Seriously, I’ve lost 15+ pounds because I don’t have these sweet cravings anymore and etc, etc, etc.

And now, we started – this was 3 years ago, I think. We start with 40,000 in sales when he reached out to me. We do $10M in sales. Not a single penny of advertising. We get in the grocery stores by the time they are there in 6 months, they can’t keep them in stock because people are going in and buying 5,6,7 packages at a time, so they have them. That’s organic growth where it was disruptive, we found an approach to keep the moisture in that made it taste great and kept all the calories down and kept the fiber up etc.

When you have something that’s truly disruptive, you know I have to spend every penny you have marketing it. People tend to find it and tell people about it and it grows organically and so yeah, I think that’s important.

Francisco: I’m going to try to get through these questions guys. I think people want to hear them, so let’s try to get through this quickly.

Audience: Hello Mark, my name is [inaudible], I’m an entrepreneur. My question is – on pricing. So I have a new product. It’s called Quadraclicks RBT, it’s called right above touch, sounds like a rabbit. It’s actually a mouse, but it looks like a rabbit so we call it rabbit. It’s actually at the demo table right in front.

Cuban: I’m sure, it is.

Audience: We were debating on the pricing point when we launched it because it’s such a good product, it’s actually better than anything out there now.

Cuban: I’ve never heard an entrepreneur ever say, “my products sucks.”

Audience: Well, some will be honest –

Cuban: Price it as high as you can, right? Look sometimes, there’s a compelling reason where you just need to get out as widely as possible for competitive reasons but – physical products, right? You want to price it as high as you can and maximize your margins and make as much money as you can as quickly as you can. Software products are different, just because your marginal costs to deliver one more isn’t much and so, you’ve got to look at the market place but for physical products like I’ve mentioned, the cookies, right? We did not try to underprice it to say, “Okay, let’s get as many people as we can trying them. “We’re like, “how much will people pay?” We tested different price points and we pick the highest point that they will pay and –

Audience: Let me give you –

Francisco: No, no, no, no—

Cuban: I’ll go out there – if I have time, I’ll go out there. We can’t go into individual products.

Francisco: Yeah, let’s just get to this. There’s 3 more questions just behind you. I really want to get to through them really quickly and that’s it. But Mark will –

Cuban: I’ll probably get out there and check it out. Good luck.

Francisco: Yeah, thank you.

Audience: Hello. I have an entertainment news blog for young readers, 12-22 teens media and I’m wondering if you would grant me an interview via email giving young readers career and life advise.

Cuban: I didn’t hear all that, but sure.

Audience: Thank you Vator for the opportunity. Thank you Mark for being here today. My name is Holly and I’m the CEO of HealthyHeavyLifestyle. We have been called the Mary Kay of Mary Jay. I know that cannabis is not an area that you have been looking at, however, do you see the potential I know that you said was a little bit flooded. I really want to know your thoughts and opinions as we are looking at – clearly here in November for legalization of the adult use.

Cuban: I’m all for it, right? I have no problem of legalization. I’d be a hypocrite if I did. So, yeah. As far as the business, every stoner ever born thinks it’s their salvation to start a company and get high in some shape and form so there’s just too many people. There’s many businesses but there’s so much competition and –

Look on one hand, all the legal uncertainty, all the financial uncertainty, all the banking uncertainty creates opportunity but on the other hand, there’s so many people just going at it and so many things can happen. I would tell you to look at what happened with FanDuel and DraftKings and Daily Fantasy, right? They’re just crushing it and one little the guy who was telling me about all the right wing stop, all the republican stuff, you know he gets elected and all of a sudden, marijuana is the worst thing that happen and it’s a gateway drug to supporting Donald Trump.

Audience: Yeah, exactly. Thank you very much. I really appreciate the opportunity.

Cuban: Good luck.

Audience: Good morning Mark. My name is Roger Wu from Ice for life and my question is regarding the startup valuation versus the product launch. I know the variation for start can be all over the place and my product itself – we launch the product 4 months ago and before we launched we got advise saying that we should just hold off until we can raise additional money because if you capture the launch, the traction – depends on how quick you can get a traction, it could actually hurt the valuations so am not sure what your take is on this?

Cuban: I tell people to wait as long as possible because if you’re really, really, good you won’t have to raise money, right? You could use sweat equity and the longer, you can go without raising money the better. The more your company, you own – if you can go without ever raising money, you know what ends up happening? You own 100% and that means you don’t have to raise money and that means business is good so—I think a lot of people fall into the trap that raising money is an accomplishment. It’s not an accomplishment. Raising money is an admission that you need money, right? And that’s never a good starting point.

Now look, I invested a lot of companies that are startups, I typically don’t do series A or later, I do angel and seed. I’m always looking but when people ask me, same companies ask me – my advice is, that as long as you can go without raising money, the better the valuation you’ll get and maybe you’ll crush it and you won’t have to raise money and you’ll be far better off financially and you won’t have to worry about people like me, looking over your shoulder.

Francisco: Okay, next one. We’ll go over, superfast.

Audience: Hi, my name is Rosilio Lopez and I have a small kid’s theater company called Kid’s LA and so I have a very artsy background. I’m an educator. And I do have a – I designed a food app but because I’m not in the business world, I’m more like a non-profit educator type. And I don’t have a tech background. My insecurity is I feel very investable? Is that a word?

Cuban: That’s because you are. I don’t mean to be mean.

Audience: What advice would you give to people that have a lot of potential, that are smart but are not really in –

Cuban: Be amazing at your design business. Be phenomenal in your design business. The most successful entrepreneur is – find something that you’re good at, become great at it. Then you’ll know, right? The problem is – we all get stale. No matter what you do, no matter what business you’re in. No matter who you work for, even if it’s your own company. You get stale, right? You get those low points relay. “Oh shit, what did I do? Why am I here? Why am I doing this?” Sound familiar, right? Where you’re down on yourself and it’s like – “Oh shit, right?” and then you just have to find your own way to reenergize.

You have to find a way. So, what happens – for all of us, you’d doing design work and you got all these other ideas because you’re doing something is not fulfilling in your design work. Find a way to be fulfilled there or find a spot in the design world where you can be great because no one ever hates something they are great at. You always find a way to love it, right? And so – and for entrepreneurs who have existing companies, we have a tendency to try to drown in opportunities. “Oh, I am killing it here but I must be smart so – I’m going to have another idea, right? Because if I’m smart, this will even be smarter. This will even be bigger because we don’t want to do the work in our first idea that we thought was so smart, right?

We want – it’s always a grind, when people ask me, what’s my greatest strength? One of my greatest strength is I grind like a motherfucker, right? When people are slowing down, I’ve always been able to go play basketball, go workout, go get drunk, whatever it is – and then, just reenergize and get back at it. And so, that’s a challenge everybody with ambition goes through. And so it’s not a knock on you. Rather, than trying to be investible, go find something to be great at or something you really love doing and the rest works itself out.

Audience: Thank you, Mark Cuban.

Cuban: Thank you.

Audience: Hey Mark, my name is Costin. I have a company called “anymeeting’ and this sort of ties into the last piece of advice you just gave. What do you look for in first time entrepreneurs? What is that spark that you think makes an entrepreneur scalable, that they can build great things, that you continue to –

Cuban: I look for them, just what I said. What are they great at? What is their core competency? How are they differentiated? Another Warren Buffet saying, “First, theirs the innovators, then there’s the imitators, then theirs the idiots. Which one are you? And that’s what I try to figure out. Are you an innovator? Sometimes, imitators make money but it’s tougher. And by the time, you’re the 10 thousand person doing the “Uber” for something, right? It’s already too late.

And so, that’s what I tend to look for and then I ask myself, whether or not this person can actually execute it. And going back to a couple of previous questions, if you have some type of track record and you’re not just buying your growth but you’re demonstrating the ability to organically grow and the demands there and you have the ability to execute and you work hard at it and you’re smart at figuring things out. And when I say smart, it doesn’t matter where you went to school, doesn’t matter what your GPA was? It’s more about, what are you learning as things come at you. Do you check your whole card? Do you continuously get smarter at your business?

Dude, everybody starts out equal. Or every industry for the most part. If I sat you on a room with your competition, who knows more about your business and your industry? You or them, that’s what I look for.

Francisco: Okay, this is great. I get the last word, and ask the last question. This is the last question, so Shark Tank or your Shark Tank co-host, Chris Sacca said you’d become president last month. Ralph Nader said, you would run in 2020.

Cuban: Did he say that? If Ralph Nader said, it must be true.

Francisco: Yes, he said it. Steven Colbert also, you’d said, “You’d consider presidency but you want to spend more time with your kids.” But what would tip your decision over this “Okay, I’m going to run in 2020.”

Cuban: Nothing.

Francisco: Nothing at all?

Cuban: Do you think I’d put myself and my family through this shit show, there’s just no chance.

Francisco: Who would want Mark to run in 20-20?

Cuban: What about that one guy? If he says “yes”

Francisco: Alright, thank you Mark.

Cuban: Thanks Bambi.

[End]

Mitos Suson

I produce Vator Events and enjoy the challenge. I am learning and growing a lot, being involved with Vator and loving every moment of it!

All author postsRelated Companies, Investors, and Entrepreneurs

Vator, Inc.

Startup/Business

Joined Vator on

Vator (short for innovator) is an awesome professional network for entrepreneurs and investors that sits at the intersection of media and finance. Our entrepreneurial ecosystem consists of startups, investors, strategics and service providers.

Vator’s platform offers an extensive set of services to the entrepreneurial community. Here is a quick summary of our suite of offerings:

VatorNews: Research, analysis and coverage, spanning news, thought leadership and lessons learned

VatorX: SaaS platform leveraged by startup communities and competitions to rank and filter participating startups

Vator Events: Well recognized large and small events across numerous geographies and sectors

Vator Investment Club: Our investor group for accredited investor members of the Vator community

Vator Teams: Our confidential acquihire platform for startup teams

Background

Vator was originally founded by Bambi Francisco and seed funded by its original lead investor Peter Thiel as a social network for startups and investors, combining media coverage with rich profiles and filtering. Over the more than decade since its founding Vator has expanded to offer a full range of services to the entrepreneurial community. Today Vator is a well-recognized and trusted member of the startup community.

Business Model

Vator has a range of business models due to its diversified set of offerings.

Mark Cuban

Joined Vator on

Bambi Francisco Roizen

Joined Vator on

Founder and CEO of Vator, a media and research firm for entrepreneurs and investors; Managing Director of Vator Health Fund; Co-Founder of Invent Health; Author and award-winning journalist.Related News

Lessons Learned: Mark Cuban advises entrepreneurs to do their homework

Mark Cuban is coming to Splash LA, 10/13 - what's in store?

Mark Cuban to speak and judge at Splash LA 2016

Mark Cuban invests in men's advice site Brotips

Mark Cuban: Sweat equity goes a lot further than money