Sequoia-backed PepperTap shuts down deliveries

A month after BigBasket's big $150 million round, another Indian grocery service shuts down

Editor's Note: Our annual Vator Splash Spring 2016 conference is around the corner on May 12, 2016 at the historic Scottish Rite Center in Oakland. Speakers include Nigel Eccles (CEO & Co-founder, FanDuel), Andy Dunn (Founder & CEO, Bonobos), Mitch Kapor (Founder, Kapor Center for Social Impact); Founders of NextDoor, Handy, TubeMogul; Investors from Khosla Ventures, Javelin Venture Partners, Kapor Capital, Greylock, DFJ, IDG, IVP and more. Join us! REGISTER HERE.

The twin trends of a slowed down VC market and an overly ambitious food tech space have collided once again.

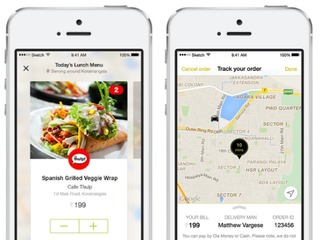

India-based PepperTap announced this week that it is shutting down its on-demand grocery delivery service, citing several growing, unavoidable problems of money and scale.

In the last year, PepperTap had raised $50 million from a host of investors, including BEENEXT, InnoVen Capital India, JAFCO Japan, ru-Net, SAIF Partners, and India-based online marketplace Snapdeal. And one very well-known Silicon Valley firm, Sequoia Capital, had funded PepperTap as early as its seed round.

But $50 million isn’t enough when you’ve quickly stretched yourself to 17 cities (across India) and have to fulfill an average of 20,000 daily orders. Even harder when you’re not an Amazon, with warehouses full of goods where you know your exact inventory at all time, but instead are operating as an on-demand company connected to a multitude of local stores.

Ultimately, PepperTap says it failed for three reasons. First, it wasn’t able to create sophisticated integration with all its partner stores, meaning inventory counts lagged and customer orders constantly needed to be amended. Second, as with Uber and Lyft in the ridesharing battle, PepperTap constantly had to offer deep discounts on orders to entice customers to use its platform. And that led to the third big problem, which was simply a matter of maintaining momentum without running out of cash too quickly. In today’s VC landscape, that problem just grew too big.

The closing of PepperTap’s delivery service today comes a little over a month after Ola Cabs, a competitor of Uber’s in India, announced that it was shutting down Ola Café and Ola Store. Those were two food delivery apps launched in 2015 by Ola as experiments, but they ended up failing.

And yet, the food tech space is far from dead. A month ago, BigBasket, another online grocery shopping platform in India, secured $150 million in new funding led by the Abraaj Group with support from several existing investors. In 2015, the food tech space raised $5.7 billion across 275 deals, according to CB Insights, an increase of 152 percent in funding and 102 percent in deals compared to the year prior.

In its long story of how it continually faced more and more problems, the company shares a vision of where it’s going:

“PepperTap was born to be a logistics company – the one thing we could call our core competency was optimisation of delivery fleets, routes and general logistics. We just needed to revisit some of the basics of the business, this time with a stronger technology lens, and set the wheels in motion.”

Though PepperTap provides tons of details about the business problems it wrestled with over the past year, details about its future plans are a bit more scant. What we have is the above, a description of the company as focusing on fleet optimization, route information, and logistics technology. I’ve reached out to the company to see if they would share more about their future plans, and will update if I hear back.

Related News

BigBasket wraps up $150M for food delivery in India