Daily funding roundup - December 10, 2015

SnapLogic closed a $37.5M financing; Orckestra raised $12M; ItsOn raised $12.5M funding

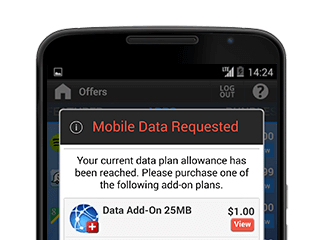

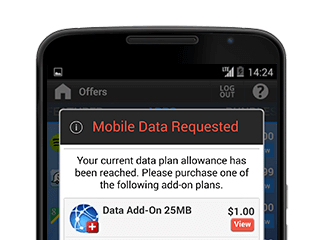

- ItsOn, a cloud-based mobile platform provider, announced today that it has raised a $12.5 million Series D funding round led by Delta Partners Capital Limited with participation from Verizon Ventures, Andreessen Horowitz, Tenaya Capital and other existing investors. Including today’s new round, the company has raised over $52 million in total from the above investors as well as Cisco, Vodafone Ventures, SV Angel, and an investor group led by Silver Lake Partners co-founder Jim Davidson.

- LifeSite, a new technology company, announces the close of its Series A round with $5 million in total funding from a syndicate of private investors. One of the additional investors to close out the round is Michael Dan, the former chairman, president and CEO of The Brink's Company. Dan also joins LifeSite as an advisor.

- Boundless said Thursday that it raised more than $5 million in Series B funding led by Motorola Solutions Venture Capital. Existing investors Vanedge Capital and In-Q-Tel also participated in the round. New York-based Boundless provides open source “geospatial” software and services, which use location-based mapping technology.

- Seattle-based startup, TINYpulse, today announced a $6 million funding round to help fuel growth for its employee happiness platform. Arthur Ventures led the round, which included participation from Varenne Partners, Baseline Ventures, Harrison Metal, and High Alpha Capital. Founded in 2012, TINYpulse gives leaders a pulse on how happy, burnt out or frustrated their employees are. The startup, which has raised $9.5 million to date, saw 100-percent year-over-year growth in 2015 and will use the fresh funding to hire more employees — it has nearly 100 now — and invest in its product.

- Orckestra has completed its Series B round of financing with Fonds de solidarité FTQ, Fondaction CSN and W Investments. This group of investors, already shareholders of the company, demonstrates their continued confidence in the company's strategy and successful commerce platform. Orckestra's Commerce Cloud, developed for mid-size and large enterprises, helps retailers, grocers and branded manufacturers deliver innovative shopping experiences online and in-store. This new investment will be used to sustain the rapid expansion of Orckestra's sales capabilities in North America and an increased presence in Europe, as well as supporting their accelerated partner channel that has already grown significantly in North America and Europe in the last year with the recent addition of key global partners.

- DataScience, Inc., a Culver City, Calif.-based company has closed $22 million in funding this week. The investment, led by Whitehart Ventures, extends the $4.5 million Series A financing round led by Greycroft Partners, bringing DataScience's total amount of funding to more than $28 million. The new funding round will be used to grow DataScience's team of leading data scientists and engineers who combine intellect, proprietary in-house tools, and data to drive significant business results.

- SnapLogic, a San Mateo, CA-based enterprise integration platform as a service (iPaaS) for big data, closed a $37.5 million financing. Backers included Microsoft and Silver Lake Waterman, the growth capital arm of Silver Lake, which joined existing investors Andreessen Horowitz, Ignition Partners and Triangle Peak Partners. The company intends to use the funds to accelerate growth and expand internationally.

- O3b Networks, a St. Helier, Jersey, Channel Islands-based global satellite service provider, closed $460 million in financing. The company intends to use the funds to expand the total number of satellites in its constellation from twelve to twenty. Led by Steve Collar, CEO, O3b Networks is a global satellite service provider operating a network for telecommunications operators, Internet service providers, enterprise and government customers in emerging markets.

If you are interested in being included in our funding roundup, submit your press release or blog post about your financing round to mitos@vator.tv.

Image source: adweek.com

Mitos Suson

I produce Vator Events and enjoy the challenge. I am learning and growing a lot, being involved with Vator and loving every moment of it!

All author postsRelated Companies, Investors, and Entrepreneurs

Andreessen Horowitz

Angel group/VC

Joined Vator on

Andreessen Horowitz is a $2.5 billion venture capital firm that was launched on July 6, 2009. Marc Andreessen, Ben Horowitz, John O’Farrell, Scott Weiss, Jeff Jordan, and Peter Levine are the general partners of the firm.

ItsOn

Startup/Business

Joined Vator on

ItsOn is a proven leader in mobile digital transformation, having fundamentally changed how mobile services are delivered and consumed. Founded in 2008, the company launched its services platform for mobile operators in the U.S. and globally last year, and counts both Sprint and Virgin Mobile as customers. ItsOn investors include Andreessen Horowitz, Tenaya Capital, Vodafone Ventures, Verizon Investments, Cisco and Delta Capital Partners. The company is privately held and headquartered in Redwood City, CA. For more information, please visit www.itsoninc.com or follow @ItsOnInc on Twitter.

Related News