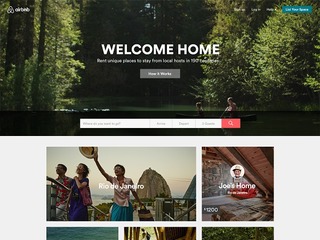

SEC filing confirms Airbnb’s monster $1.5B round

Valued at $25.5 billion, Airbnb is the third most highly valued private company in the world

A new SEC filing just confirmed the Wall Street Journal’s report from last June, which had reported home sharing site Airbnb's raising of an absolutely massive $1.5 billion funding round.

A new SEC filing just confirmed the Wall Street Journal’s report from last June, which had reported home sharing site Airbnb's raising of an absolutely massive $1.5 billion funding round.

The round was led by General Atlantic, Hillhouse Capital Group of China, and Tiger Global Management, which collectively purchased about a third of the shares allocated for the round, according to the original WSJ report. Other participants included Singapore’s Temasek Holdings, Kleiner Perkins Caufield & Byers, GGV Capital, China Broadband Capital, and Horizon Ventures.

Nothing in the SEC filing confirms details about the investors, as it only lists Airbnb’s executives, financial and legal heads, and two previous investors now serving on the company’s board directors: Alfred Lin of Sequoia Capital and Jeff Jordan of Andreessen Horowitz.

Valued at $25.5 billion, Airbnb is the third most highly valued private company in the world, after Uber ($62.5 billion) and China-based smartphone maker Xiaomi ($46 billion). The company has raised nearly $2.3 billion.

HomeAway, Airbnb’s main competitor, was only worth $3.9 billion—though that’s how much an actual company (travel booking site Expedia) actually paid to acquire the home sharing site. An acquisition for Airbnb is highly unlikely given the company’s lofty valuation, leaving an initial public offering as its only viable exit.

How Airbnb would fare on the IPO market won’t be known anytime soon, however, as the company is following the trend among unicorns by shying away from the public markets for as long as possible.

Square looked like one of the most promising unicorns coming out of Silicon Valley until everyone took a good hard look at their financials. Once its IPO drew near, the company's valuation took a 30 percent cut when it priced its shares at a best-case $13. Today, Square is trading at around $12 with a market cap just under $4 billion. For this and other reasons, many in the technology and investor community are beginning to rein in some of these private companies’ sky-high valuations.

In the month since its victory over extra short-term rental restrictions in San Francisco, Airbnb has been aggressively campaigning to brighten up its image by casting itself as a partner to communities, especially in the cities where it does the most business. This was summed up in the company’s Community Compact, a highfalutin document released last month.

As one of the first orders of the Community Compact, Airbnb last week shared data about its nearly 60,000 listings in New York City. Though the company hoped to paint a rosy picture of its service by saying that most hosts use the money they earn on Airbnb to pay the rent, many were quick to point out that over half of Airbnb’s hosts are still breaking the law, according to the company’s own data.

Related Companies, Investors, and Entrepreneurs

Airbnb

Startup/Business

Joined Vator on

Airbnb.com is the “Ebay of space.” The online marketplace allows anyone from private residents to commercial properties to rent out their extra space. The reputation-based site allows for user reviews, verification, and online transactions, for which Airbnb takes a commission. As of June, 2009, the San Francisco-based company has listings in over 1062 cities in 76 countries.

Alfred Lin

Joined Vator on

Related News

Expedia buys HomeAway for $3.9B to take on Airbnb

Square valuation drops 30 percent in IPO pricing