Daily funding roundup - November 17, 2015

Earnest bagged $275M; Datto raised $75M; IIX Inc. secured $26M

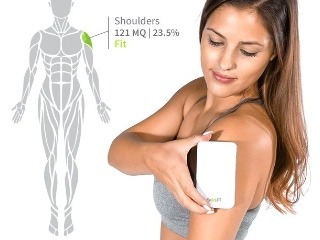

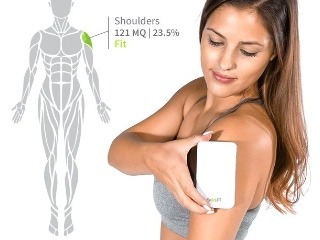

- Skulpt, creator of a device for measuring body fat percentage and muscle quality, today announced that it had raised $4.1 million in a Series A funding round led by Nautilus Venture Partners, with participation from Caerus Venture Partners. Caerus led Skulpt’s $1.6 million seed round last year. Impressively, Skulpt first got its footing in 2013 (four years after its founding) through a crowdfunded campaign on Indiegogo.

- Indotrading, an Indonesian online B2B marketplace, raised funding from Golden Gate Ventures. The amount of the deal was not disclosed. According to a written note, the company is also backed by OPT SEA, GMO Venture Partners, Convergence Ventures, Aucfan, and Rebright Partners. The company will use the capital to expand operations.

- Today, McKesson Ventures announced an undisclosed strategic investment in cloud-based home care platform ClearCare. The latest round of strategic funding follows an $11 million funding round in 2014, led by Bessemer Venture Partners (BVP), with participation from Cambia Health Solutions and existing investors Voyager Capital, Qualcomm Ventures and Harbor Pacific Capital. Prior to this strategic investment by McKesson Ventures, ClearCare raised $15.5 million.

- Wells Fargo & Company today announced it has provided a $1 million Equity Equivalent Investment (EQ2) to Metropolitan Consortium of Community Developers, a 501(c)3 organization that provides small business loans and technical assistance to emerging entrepreneurs who may be challenged to meet traditional underwriting criteria by virtue of being a start-up or those who have credit challenges and/or a shortfall of collateral. MCCD will use the $1 million to fund its Open to Business program, allowing them to directly fund as many as 80 emerging entrepreneurs who would otherwise be unable to access the capital they need to pursue their dreams.

- SDK management startup SafeDK launches with $2.25 million in funds from an investment led by StageOne VC. SafeDK said its service monitors third-party SDKs in real time to warn developers about prospect privacy, performance, and stability issues. By doing so, developers can choose to turn off certain SDK features without affecting the app’s functionality. Eddy Shalev, Marius Nacht, and Kaedan Capital also participated in the funding round.

- BridgeU, a London start-up which promises to make “education decision-making intelligent”, has scooped $2.5 million seed investment in deal led by Octopus Investments. Fresco Capital, Seedcamp and high-profile investors including Founders Forum’s Jonnie Goodwin and Deborah Quazzo, also backed the round. It will use the investment to expand and diversify its range of programmes to include foundation degrees, online programmes and alternatives to traditional higher education such as apprenticeships and vocational training.

- TinyRx officially launches today with a mission of improving healthcare outcomes for consumers by driving lower costs, greater convenience, and improved quality of care. Available to consumers in San Francisco, Oakland, and Berkeley, TinyRx is a service for convenient prescription delivery and management. To-date, the company has raised $5 million in financing from Eight Partners, Palantir co-founder Joe Lonsdale's recently-announced venture capital fund; Google Ventures; Stanford's StartX; and multiple seed funds and angel investors, including founders and early employees from companies like Google, Airbnb, athenahealth, and Collective Health.

- Blockchain payments startup Align Commerce has raised $12.5 million in Series A funding led by storied Silicon Valley investment firm Kleiner Perkins Caufield & Byers (KPCB). Rounding out the all-star cast of investors were first-time and repeat firms including Digital Currency Group, FS Venture Capital, Pantera Capital, Recruit Ventures Partners and SVB Ventures, the investment arm of Silicon Valley Bank. The new funding, which follows an undisclosed seed round in April, will be used to expand Align's service beyond the 60 countries it serves today.

- Salesfusion, an Atlanta, GA-based provider of a marketing automation platform for small and medium sized-businesses (SMB), closed a $13.5 million Series B funding round. The round was led by Noro-Moseley Partners, with participation from BLH Venture Partners, Alerion Ventures, Tech Square Ventures, Ellis Capital, Dave Williams, and Hallett Capital, which was the sole Series A investor. The company, which has now raised $14.5 million in total to date, intends to use the funds to launch its new product, Salesfusion 360x, increase its market reach and expand its sales team.

- Irvine, California-based software company Numecent said today it has raised a new round of $15.5 million from a broad range of European investors as the company seeks to expand its cloud-based services beyond Windows. The series B round includes $4.5 million from Deutsche Telekom, with the rest from “European industrialists, family offices and private equity firms,” according to Numecent. Deutsche Telekom also led the company’s series A round. Numecent has now raised a total of $38 million.

- Toronto's Blueprint announced today that it has secured $23 million in funding, led by US-based Centana Growth Partners. Blueprint helps enterprise organizations to de-risk and accelerate large, complex IT projects. Customers include JP Morgan Chase & Co., Costco, MetLife, Intercontinental Hotels Group, Sallie Mae and several Blue Cross Blue Shield organizations. With the injection of funds, Blueprint will focus on continued expansion into new, global markets, increased innovation to respond to evolving market needs and interests, and enhanced services with Customer and Partner programs.

- IIX Inc., a software-defined interconnection company, today announced that it has secured $26 million in Series B funding from a group of investors. New Enterprise Associates (NEA) increased its investment in the company with its participation in this round, and was joined by Formation 8, Drew Perkins, and AME Cloud Ventures (launched by Yahoo co-founder Jerry Yang). This latest equity round brings IIX’s total raised funds to approximately $65 million, comprising debt and equity. The company has grown rapidly since completing its Series A round in 2014, and now operates offices in the U.S., Canada, the U.K. and Australia, as well as a global interconnection footprint that includes more than 150 Points of Presence (PoPs) worldwide. The company will use the capital from its Series B funding to continue the growth of its team, expand its customer base in North America and EMEA, and accelerate its expansion throughout the APAC region.

- ElMindA Ltd., a pioneer in neuroscience-based technology for analyzing brain network functionality, announced the successful completion of an oversubscribed $28 million Series C financing round. The global syndicate of investors in this round includes Shanda Group, New England Patriots owner – The Kraft Group, Wexford Capital, WR Hambrecht & Co, Palisade Capital Management, OurCrowd and Healthcrest AG and others. Proceeds will be used to continue advancement of ElMindA’s proprietary BNA™ (Brain Network Activation) system, which uses multi-channel EEG-ERP electrophysiology technology to provide a more accurate, objective assessment of brain functionality over time. ElMindA will also use the funds for commercial and clinical adoption following BNA’s 2014 FDA clearance in the U.S., and CE Mark approval in Europe for brain function assessment.

- Datto, a company that specializes in backing up and keeping corporate data safe, now has another $75 million in funding. This Series B round, led by Technology Crossover Ventures, comes atop $25 million in earlier Series A funding from General Catalyst. In a statement, company founder and chief executive Austin McChord said the company was already profitable, and that it would use the latest investment to expand into Australia, New Zealand, Europe, the Middle East, and Africa.

- Earnest, one of the new online lenders using smart algorithms to serve millennials who may have short credit histories, announces Tuesday $275 million in new funding. Seventy-five million dollars of that is a series B round led by venture capital firm Battery Ventures, and an additional $200 million comes in the form of lending capital from New York Life and other insurance companies. The company also announced the addition of Battery Ventures general partner Roger Lee to its board.

If you are interested in being included in our funding roundup, submit your press release or blog post about your financing round to mitos@vator.tv.

Image source: ccdaily.com

Mitos Suson

I produce Vator Events and enjoy the challenge. I am learning and growing a lot, being involved with Vator and loving every moment of it!

All author postsRelated Companies, Investors, and Entrepreneurs

Battery Ventures

Angel group/VC

Joined Vator on

You’ve got a great idea, a winning product, an amazing team, a great business. You have choices. There are hundreds of firms who could invest in your business. So why choose Battery? Yes, we have a track record of success backing breakthrough companies. We’ve been through hundreds of IPOs and M&A events. We have 30 years of experience. We’ve raised $4.5B since inception and are investing a $900M pool of capital, so yes, we have deep pockets along with big Rolodexes and a smart team.

So what else matters? That we’ll be the most engaged, collaborative and passionate investor around the table. That we remain open to exploring all business ideas, no matter how complicated or far off the beaten track they might at first seem. We will roll up our sleeves and work as hard as you do. We will add value every day, in between board meetings, not just at them. But that doesn’t mean we’ll run your business, we know where to draw the line. We keep our egos in check, operate with integrity and honesty, and put the needs of your business ahead of our own.

Above all, it’s really about chemistry. So get to know us. Talk to the teams we’ve worked with. Ask them how we’ve helped. You’ll discover the value Battery can add long before we write the first check. Here’s a bit more about the companies we’ve backed and the difference we’ve made between a great company and an also-ran.

Google Ventures

Angel group/VC

Joined Vator on

GV provides venture capital funding to bold new companies. We invest independently of Google, and we’ve backed more than 300 companies, including Uber, Nest, Slack, Foundation Medicine, Flatiron Health, and One Medical Group. We provide these companies unparalleled support in design, engineering, recruiting, marketing, and more.

General Catalyst

Angel group/VC

Joined Vator on

There’s a simple premise behind the founding of General Catalyst (GC) in 2000: entrepreneurs are best served by those who've been in their shoes. In fact, all of GC’s managing directors are accomplished entrepreneurs in their own right. We’re familiar with the challenges you face. And we thrive on our ability to use our entrepreneurial experience to assist, guide, and nurture entrepreneurs on their journey.

As a venture capital firm focusing on Early Stage and XIR/Growth investments, we're thrilled to encounter and delight in helping exceptional entrepreneurs and innovative companies bring a new product to market or transform an industry. But it’s more than just writing a big check. We're tireless in our business-building and partnership development assistance.

NEA

Angel group/VC

Joined Vator on

NEA is the entrepreneur’s venture capital firm.

When it is time to take a promising business or business idea to the next level, entrepreneurs want a venture partner who understands and believes in the power of big dreams, bold visions and fresh ideas that have the power to change an industry, a sector, the world.

Moreover, entrepreneurs want a venture partner who knows what it takes—through first-hand experience and carefully nurtured relationships—to make a company succeed, to turn an idea into an action, and to make a plan a reality.

For more than 30 years, NEA has been helping to build great companies. Our committed capital has grown to $13 billion, including a $2.6 billion fourteenth fund closed in 2012. We invest across stage and geography in technology, healthcare and energy.

Remaining nimble as we’ve grown—with more than 65 investment professionals working out of our offices in the US, India, and China and investing across the globe—NEA is the entrepreneur's venture capital firm, consistently ranking among the top firms in portfolio IPOs each year. Since its founding, the firm has backed more than 175 companies that have gone public and invested in more than 290 companies that have been successfully merged or acquired—more liquidity events than any other venture capital firm.

Whether you are seeking investment to get your idea off the ground or looking to propel a proven idea toward greatness, NEA is the venture partner who will be there—because we’ve been there—every step of the way.

Related News