Daily funding roundup - October 9, 2015

Segment bagged $27M; Glamsquad raised $15M; SightCall landed $8.4M

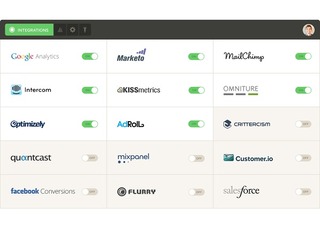

- On Friday Segment, a company that wants to make accessing data as easy as possible across companies announced that it has raised $27 million in a Series B round led by Thrive Capital with participation from existing investors Accel Partners, Kleiner Perkins Caufield & Byers, and Jon Winkelried, former president of Goldman Sachs. The company has previously raised $17.6 million, including a $15 million round almost one year ago exactly This round brings its total funding to $44.6 million.

- Mumbai-based on-demand healthcare marketplace, Inayo which was started by Raunak Jain, CEO (ex flipkart, Toppr, IITB) and Abhishek SInha, COO (ex housing, IIMB) and Purna Chandra, CTO (IITB), has raised $300,000 in seed funding. The investors who participated in the round are Amit Ranjan, Founder, SlideShare; Kemark Ventures; Zishaan Hayath and others. The raised funding will be used for Inayo’s expansion to 22 localities in Mumbai, Delhi and Bengaluru as well as for enhancing the product features. Also, the company plans to process 100 orders per day by October end.

- Singapore-based online remittance platform Toast has secured a S$1.2 million (US$850,000) seed round, the company announced today. The oversubscribed round was led by Singapore-based investment firm Aetius Capital, and joined by international investor ACE & Company, which has previously invested in financial comparison site CompareAsia and online peer-to-peer payments startup Transferwise. New York-based investment company One Zero Capital also participated in the round.

- Property start-up eMoov announced today that it has raised £2.6 million (around $4 million) in an oversubscribed crowdfunding round via Crowdcube; the largest ever investment in a property tech (proptech) company on the equity-based platform. 795 investors backed the campaign, taking it over its initial target of £1 million, with backers including venture capital firms Episode 1 Ventures, Maxfield Capital Partners, and Startive Ventures, alongside start-up accelerator Seedcamp.

- London-based client review site VouchedFor has secured $5.4 million Series A investment in a deal led by Octopus Investments, with participation from Samos Investments. Following a $1.5 million seed round backed by DN Capital in 2014, this latest funding will allow the business to develop its technology and marketing platform. The company claims to have seen 350% year-on-year revenue growth with a user base of over 7,500 financial advisers, mortgage advisers, solicitors and accountants.

- Clue, a Berlin, Germany-based woman-led digital health startup, scored $7 million in Series A funding. Backers included Union Square Ventures and Mosaic Ventures. The company, which has now raised $10 million in total, intends to use the funds to launch new product features, hire new people, accelerate growth, develop in new markets and pursue partnerships with universities with the goal of advancing scientific research in the field of reproductive health.

- SightCall, a San Francisco, CA-based Software as a Service (SaaS) platform for live visual communications, landed $8.4 million in funding. The round was led by Idinvest Partners. The company intends to use the funds to grow sales and marketing efforts. Led by Thomas Cottereau, Founder and CEO, SightCall is a global Software as a Service (SaaS) platform leveraging WebRTC for live visual communications. SightCall provides a solution that complements their existing tools, environment, and processes to solve customer problems.

- Procyrion Inc., a privately held medical device company developing Aortix, the catheter-deployed circulatory assist device designed to treat chronic heart failure, announced today that it has completed a Series B financing round with net proceeds totaling $10 million. An entity sponsored by Houston-based Fannin Partners; Dallas-based Scientific Health Development; and an undisclosed strategic investor led the financing round with participation from existing and new private investors. To date, Procyrion has raised more than $13 million in funding.

- Glamsquad raised $15 million to build its on-demand brand of beauty. The nearly two-year-old mobile beauty services company revealed to WWD that it recently closed on the Series B financing round, which was led by New Enterprise Associates and included Lerer Hippeau, AOL’s BBG Ventures, Montage Venture and Softbank, which led last year’s $7 million Series A. To date, Glamsquad has raised $24 million and used it to build an app that lets users book blowouts and get their makeup done in their homes.

- Earlier today, three heavy hitters in Southeast Asia’s tech startup ecosystem announced a new VC firm named Venturra Capital. At the helm are managing partners Stefan Jung, former founder and managing partner of Rocket Internet Southeast Asia; Rudy Ramawy, former country director at Google Indonesia; and John Riady, current director of Lippo Group, one of Indonesia’s largest and richest family-owned conglomerates. Jung tells Tech in Asia that the US$150 million venture fund has been fully committed by Venturra’s backers, of which Lippo Group is the largest one.

If you are interested in being included in our funding roundup, submit your press release or blog post about your financing round to mitos@vator.tv.

Image source: wired.com

Mitos Suson

I produce Vator Events and enjoy the challenge. I am learning and growing a lot, being involved with Vator and loving every moment of it!

All author postsRelated Companies, Investors, and Entrepreneurs

NEA

Angel group/VC

Joined Vator on

NEA is the entrepreneur’s venture capital firm.

When it is time to take a promising business or business idea to the next level, entrepreneurs want a venture partner who understands and believes in the power of big dreams, bold visions and fresh ideas that have the power to change an industry, a sector, the world.

Moreover, entrepreneurs want a venture partner who knows what it takes—through first-hand experience and carefully nurtured relationships—to make a company succeed, to turn an idea into an action, and to make a plan a reality.

For more than 30 years, NEA has been helping to build great companies. Our committed capital has grown to $13 billion, including a $2.6 billion fourteenth fund closed in 2012. We invest across stage and geography in technology, healthcare and energy.

Remaining nimble as we’ve grown—with more than 65 investment professionals working out of our offices in the US, India, and China and investing across the globe—NEA is the entrepreneur's venture capital firm, consistently ranking among the top firms in portfolio IPOs each year. Since its founding, the firm has backed more than 175 companies that have gone public and invested in more than 290 companies that have been successfully merged or acquired—more liquidity events than any other venture capital firm.

Whether you are seeking investment to get your idea off the ground or looking to propel a proven idea toward greatness, NEA is the venture partner who will be there—because we’ve been there—every step of the way.

Related News