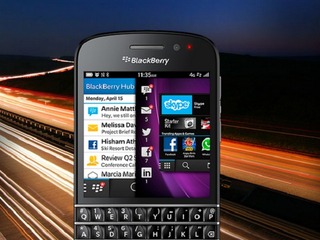

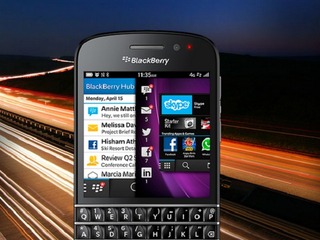

Finally, some good news from BlackBerry: stellar Q1

Revenue, income and gross margin all beat Wall Street's expectations

BlackBerry CEO John Chen is really cleaning up over there. Dude isn’t joking around when it comes to turning BlackBerry into a smartphone power house again. Behold: BlackBerry’s fiscal Q1 earnings for the three months ended in May. The company beat Wall Street’s expectations across the board—which might actually make it the first good earnings report we’ve gotten from BlackBerry in years.

Revenue was down 1% to $966 million from $976 million in the previous quarter, but analysts were expecting $963.17 million in revenue. (It’s still a little sobering to think that a year ago, BlackBerry’s Q1 revenues were $3.07 billion.)

Non-GAAP income came in at a loss of $60 million or 11 cents a share, which is a far cry from the 26 cent loss Wall Street was expecting.

BlackBerry also saw a big bump in gross margins, which climbed five percentage points to 48% from 43% last quarter.

J.P. Morgan analyst Rod Hall notes that the better-than-expected revenue was likely the result of better smartphone sales. The company launched the Z3 in Indonesia last quarter and has plans for eight more countries. BlackBerry also sold more phones last quarter—1.6 million compared to 1.3 million the previous quarter. Additionally, the company saw improved sell-through at 2.6 million units.

“We assume mix was the main driver of the better gross margin, possibly toward Foxconn produced units,” noted Hall in a research note.

Cash and investments came in at $3.1 billion, up from $2.7 billion the previous quarter.

So all in all, a damn good quarter for BlackBerry.

“Our performance in fiscal Q1 demonstrates that we are firmly on track to achieve important milestones, including our financial objectives and delivering a strong product portfolio,” said Chen, in a statement. “Over the past six months, we have focused on improving efficiency in all aspects of our operations to drive cost reductions and margin improvement. Looking forward, we are focusing on our growth plan to enable our return to profitability.”

The company announced Wednesday morning that it has partnered with Amazon to make the Amazon Appstore available for BlackBerry devices as of this fall. CEO John Chen said that the deal will allow him to focus on the company turnaround effort, since he doesn’t have the “time, energy and money” to devote to building up BlackBerry’s app selection right now.

For its outlook, the company says it’s targeting break-even cash flow results by the end of this fiscal year.

BlackBerry shares spiked 13% Thursday morning to $9.38 at the open, up from $8.29 at the close on Wednesday.

Image source: cbc.ca

Related News

How John Chen plans to save BlackBerry in 2014

BlackBerry to cut 4500 jobs after horrendous Q2 results