FutureAdvisor powers up with $15.5M for smart investing

Investment advisory comes to the masses with FutureAdvisor

One of the lessons we all learned from the recession: when you have money, you have to save that shit. Don’t go out and buy a damn boat! Boats don’t appreciate in value! What's wrong with you?? (Exact words I said to my neighbor when he bought a second boat.)

Investing has always seemed like something you do when you’ve suddenly experienced some kind of windfall and thousands of dollars have mysteriously dropped in your lap, but the truth is that everyone needs to be investing. While I’m loath to quote Rich Dad, Poor Dad, you need to make your money work for you.

Enter FutureAdvisor, an automated investment advisory platform for “mass-affluent” families, described as those who have paid off their debts and are now focused on growing their wealth.

The company announced Wednesday that it has raised $15.5 million in a Series B round of funding led by Canvas Venture Fund, with help from existing investor Sequoia Capital. The new round brings FutureAdvisor's total raised to $21.5 million altogether.

Traditionally, financial advisors have been seen as a luxury reserved for high net worth individuals—namely, those with more than $1 million in investable assets. That’s because human advisors are limited in the number of clients they can take on. It’s a relational business, which means you’re out there scheduling meetings and golf games with clients.

FutureAdvisor, on the other hand, is a hybrid human-algorithmic advisor.

“We use the same mathematical models as human advisors, but we let the software do more of the work,” explained CEO Bo Lu. “That means we can charge less, because we have less overhead. We think many more people will want that service at a lower price, even if we don’t remember their birthdays.”

It’s essentially the same model that Lending Club uses: cut down on overhead (brick-and-mortar branches, employees) and pass the savings on to the customers, which allows for greater reach.

And that means FutureAdvisor can afford to focus on families and individuals with fewer than $1 million in investable assets. The platform does require users to keep a minimum of $10,000 in their account for FutureAdvisor to manage, but there is a surprisingly high number of people who have saved up $10,000 and don’t know how to invest it.

But with the traditional (human) model of financial advisors, a whopping 80% of those with less than $1 million in assets are getting financial advice. Meanwhile, 60% of families with more than $1 million are working with a financial advisor.

The company is already getting traction—it now has some 100,000 registered users.

“We’re at a historical moment when investment advisory, which has always been a service reserved for high-net-worth individuals, is being offered to everyone,” said Canvas Venture Fund managing director Rebecca Lynn. “Software has made that possible. Tens of millions of households that know they need solid guidance, but could never afford it, have access to advice that can help them accumulate enough wealth for a safe retirement.”

Lynn added: “FutureAdvisor is the most weather-proof of all the digital financial advisors, and there are a couple reasons for that. FutureAdvisor can work with people’s assets where they are now. You don’t have to open a new account to work with them. They can help you rebalance whatever you have (and most people don’t know quite what they have) in your brokerage accounts, IRAs and 401ks. That’s a more convenient model than FutureAdvisor’s competitors, which are built to serve clients coming from cash. FutureAdvisor’s model is one where I expect a lot less churn, and a lot more loyalty.”

Bo Lu says that the company plans to use the new capital from this round to double its current 20-person staff and beef up its product with new features.

Related News

How does Lending Club make money?

Lending Club raises $115M and makes first acquisition

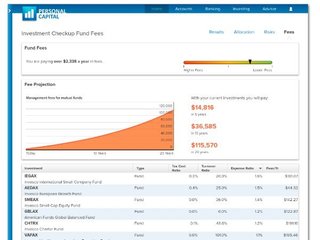

Personal Capital helps sort your complex finances