How will health tech startups fare under the ACA?

Out-of-pocket costs are rising, but increased access may ultimately benefit health tech startups

The Affordable Care Act.

OoooBAAAAmaCAAAARE!

It’s been talked to death—how it will affect businesses, how it will impact the middle class, who it will benefit, et cetera ad infinitum. The deadline for enrollment is quickly approaching, but the effects of the ACA are already being seen and felt. So far, 4.2 million previously uninsured people have enrolled, with the (now believed impossible) goal being 6 million by the end of March.

We’ve talked about how the ACA will affect businesses—particularly hiring—but how will it affect health tech startups?

Obviously, different health tech startups will be affected in different ways. Those offering a service covered by insurance, for example, can expect to be impacted in ways that those offering alternative services will not. Fertility tracker and alterna-insurance platform Glow, for example, will likely see big gains based on the fact that the ACA still does not require insurance plans to cover fertility services. And even if it did, those insurance companies would likely raise the out-of-pocket expenses for families requesting fertility assistance, which would make the low cost of Glow even more enticing.

Insurance costs are rising. Just taking a quick glance at the Covered California website, a family of four living in San Jose and making a combined income of $75,000 a year can expect to pay roughly $350 a month in premiums and slog through a family deductible of $10,000. That’s $10,000 before insurance even kicks in.

Those high costs could make preventative care prohibitively expensive, which is particularly evident when it comes to treating mental illness. In 2012 (the most recent year for which the Substance Abuse and Mental Health Services Administration has data), 43.7 million Americans experienced mental illness. Less than half—41%--received help. The number one reason for forgoing mental healthcare services: the cost. Some 48% said they simply couldn’t afford treatment. Those with private health insurance were less likely than those with Medicaid or CHIP to receive treatment, but those without any health coverage at all were the least likely to receive treatment.

So we have a quandary here: those with no insurance are less likely than anyone to see care (10.4% of adults who sought treatment in 2012), but those with expensive insurance aren’t much more likely to seek treatment (14.2% of adults). Meanwhile, 21.4% of adults who sought care in 2012 had Medicaid or CHIP.

That could spell trouble for a startup like Breakthrough, a telehealth platform that allows users to access mental health counseling and treatment online. Three-quarters of Breakthrough’s users pay with insurance, while 25% pay out-of-pocket. The rising out-of-pocket costs of treatment could pose a threat to Breakthrough’s growth if patients simply don’t feel like they can afford it.

But there’s something to be said for increased access. Medicaid has been expanded to cover all individuals earning up to 133% of the federal poverty level, which is $$30,675 for a family of four. This will also cover people who previously didn’t qualify for Medicaid even if they were making below the poverty level. The CBO predicts that 11 million people will gain Medicaid coverage by 2022. That’s 11 million more people who will now seek mental health treatment where they wouldn’t have previously.

“Although the shift of healthcare cost from employers to employees in the form of high deductible plans and HSA accounts began before the ACA was put in place, it has definitely accelerated that shift, giving rise to a new ‘consumer patient’ who is looking to maximize the value of each healthcare dollar spent,” said PokitDok founder and CEO Lisa Maki.

PokitDok, which allows patients to shop and compare prices between healthcare providers, is poised to be a massively helpful tool for those attempting to navigate the new costs of healthcare. It’s not uncommon for there to be a discrepancy of thousands of dollars between the way two hospitals charge for the same procedure. For those with previously low-deductible insurance plans, these costs were often handled by the insurance. But now that more people are going to be on the hook for a good chunk of their own healthcare costs, the need for clear pricing is more important than ever.

“Pre-ACA, when healthcare was essentially free, consumers didn't demand the same kind of transparency they receive in other markets. Now that the average American consumer is paying for more care with their own money they're shopping and demanding to know the price before an appointment, not after a procedure is complete,” said Maki. “A year ago, insurers and employers were more in an ‘I'll wait and see’ mode, now they're actively seeking programs and tools to deliver on the promise of the ACA and that's great for us.”

Other health tech startups, like HealthTap, will capitalize on the search for alternatives to expensive office visits for routine medical questions.

I, for example, could have saved hundreds if I had checked with HealthTap’s network of doctors first before flying into my son’s pediatrician’s office, screaming, “My baby has whooping cough! I know it’s probably not whooping cough, but seriously, I think it is!”

“With more than 25 million new Americans entering the healthcare system under the ACA, we’re facing a critical shortage of primary care doctors (estimated at 44,000) in our already taxed system,” said HealthTap CEO Ron Gutman. “This means increased wait times to see doctors, and less time in-person with doctors when we do see them. One important impact health startups are having is helping us tackle the challenge of how to improve the quality and regularity of our interactions with doctors, while simultaneously making them faster, better, and less expensive.”

HealthTap’s network now counts 55,000 U.S. doctors among its ranks, allowing patients to seek answers to questions that they can’t afford to take to an in-office visit. If the doctor’s answer is anything other than “it’s fine, it’ll go away on its own in a few days,” you can schedule an in-office visit with that same provider.

Gutman says HealthTap is already seeing increased engagement from both patients and doctors as a result of the ACA. Additionally, more doctors are joining HealthTap’s Medical Expert Network to set up their own “virtual practices,” thereby relieving some of the pressure they experience due to the large number of people they see in their clinics.

Overall, Gutman sees a golden opportunity for health tech startups.

“When you create much-needed or even essential services, and price them right, and find a cost-effective way to communicate their existence to the market, customers will follow en masse,” said Gutman. “Given the prevalence of high deductible plans, the limited number of available doctors, and the increased availability of digital health information and services, startups are well-equipped to offer consumers new ways to save on healthcare by bridging the gap between costly insurance offerings and customers’ immediate needs.”

Image source: urbanfaith.com

Related Companies, Investors, and Entrepreneurs

Breakthrough.com

Startup/Business

Joined Vator on

Breakthrough.com connects mental health providers with clients via video, phone, email, and chat.

Fifty eight million Americans have a mental illness and millions more struggle with stress and relationship issues. Therapy and medications work, but are stigmatizing, hard to access, costly, and inconvenient. Telemedicine has been shown to address these issues.

Clients can search for providers on a variety of criteria, be anonymous, take diagnostic tests, seek peer support in free communities, and engage in sessions via secure video, phone, email, and chat.

Providers such as psychologists, counselors, and social workers can hold secure sessions and build an online profile with their prices, mediums, degrees, styles, specialties, and associations. Breakthrough confirms all providers are credentialed professionals.

Breakthrough can also help health plans, hospitals, schools, prisons, employee assistance programs, and veteran groups. Breakthrough can also help clients and providers receive insurance reimbursement so that treatment is low cost or free.

A video of Breakthrough's launch at TechCrunch50 is here:

http://www.ustream.tv/recorded/2167353

HealthTap

Startup/Business

Joined Vator on

HealthTap+ has reinvented the way people all over the world manage their health and well-being. Our free web and mobile apps enable 24/7 access to personalized, relevant, and trusted health information in the form of answers, tips, checklists, and news from over 67,000 U.S. doctors.

Members can get expert answers to their personal health questions, read personalized news and tips, and access expert reviews of health apps from HealthTap’s Medical Expert Network of more than 67,000 doctors for free.

In July 2014, HealthTap launched its premium HealthTap Prime subscription service. Prime members pay a monthly subscription fee for unlimited live consults with physicians via HD video, voice, and text chat. The service is available via any mobile device or personal computer.

HealthTap then launched HealthTap Concierge in October 2014, which connects members with their own doctors, via HD video, voice, and text chat for a low, per-consult fee. No monthly subscription is required to use HealthTap Concierge.

HealthTap released its first annual AppRx Report in January 2015. Thousands of doctors on HealthTap independently reviewed tens of thousands of health and wellness apps available in the iOS and Android app stores and provided recommendations for those they deemed the best.

In March 2015, HealthTap launched RateRx, the first free, large-scale resource of doctor ratings and reviews for over 4,000 drugs and medications. It was created by doctors to help consumers understand the effectiveness of drugs and treatments based on doctors' real-world experience.

The company is backed by leading investors such as Khosla Ventures, Eric Schmidt’s Innovation Endeavors, Mayfield Fund, and Mohr Davidow Ventures.

PokitDok

Startup/Business

Joined Vator on

Provider of a cloud-based application programming interface (API) platform designed to make healthcare transactions more efficient and streamline the business of health. The company's platform enables third-party developers such as payers, health systems and digital health companies to process eligibility checks, claims, scheduling, payments, and other business transactions, enabling hospitals and health systems to build new patient-centered experiences. With DokChain, an evolution of PokitDok’s platform utilizing blockchain and other distributed technologies, PokitDok seeks to remove even more waste from healthcare administration while enabling new value creation by healthcare and other industry stakeholders for the consumers they serve.

Mark Goldenson

Joined Vator on

Lisa Maki

Joined Vator on

Co-founder, board member & former CEO @PokitDok, Previously CEO, co-founder of BeliefNetworks (Benefitfocus, 2010), multiple roles in consumer product development at Microsoft.

Jason Wreath

Joined Vator on

Ron Gutman is an inventor and a serial technology entrepreneur who has built several successful companies in digital health. He's currently the Founder and CEO of HealthTap. He's also a writer, speaker, angel investor and advisor to tech startups.Related News

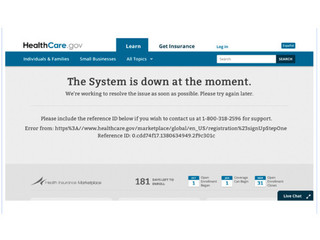

POTUS Funny or Die clip now #1 driver to Healthcare.gov

Healthcare.gov receives 1M hits before 7 am

100,000 people enrolled via Healthcare.gov in November