Groupon releases, then pulls new simplified POS app

The POS app is a simpler, more generalized version of Breadcrumb

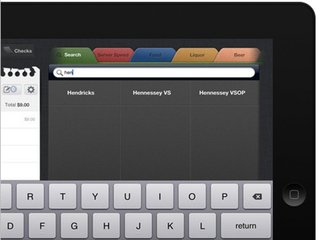

So it looks like Groupon is really taking sharper aim at some of its mobile payments competitors with a new point-of-sale app that appears to be a super simplified version of Breadcrumb for the masses. But the app was suddenly pulled from the App Store Monday morning as it was apparently a beta version that wasn’t meant to be released yet.

While Breadcrumb is a comprehensive point-of-sale system for restaurants, Groupon’s premature POS app (which will be released at a later date under a different name) appears to follow the same basic concept and can be used with an optional cash register, but it doesn’t have all the bells and whistles. For example, Breadcrumb allows restaurant owners to manage operations, like orders and payments, as well as employee time sheets. Breadcrumb users can also get labor reports and real-time info on sales stats.

The POS app, however, is more generalized for merchants across a range of different segments, such as cafés and delis, florists, salons, and more.

It’s probably safe to assume that the POS app will be integrated with Groupon Payments, which charges roughly half of what Square and PayPal charge. Transactions using Visa, MasterCard, or Discover will be charged 1.8%, plus 15 cents when swiped (2.3% plus 15 cents when keyed). And the rates apply to all merchants, regardless of whether they’ve run a Groupon deal before.

Square charges 2.75% or a flat rate of $275 a month for businesses processing less than $200,000 a year. PayPal charges 2.7%.

Groupon acquired Breadcrumb last year as part of its quest to become the ultimate local commerce operating system. Since then, Groupon’s man-child CEO Andrew Mason has been ousted, but it seems that the company is staying true to the operating system vision.

In its first quarter sans Mason, Groupon beat analysts’ expectations with higher operating income and revenue. Non-GAAP operating income (excluding stock compensation) came in at $51.2 million, or $0.03 a share on revenue of $601.4 million. Street consensus called for non-GAAP operating income of $29 million on revenue of $591.3 million. Shares were trading at $6.32 Monday morning, a five-day increase of 18%.

But TheStreet has downgraded its Groupon rating from ‘hold’ to ‘sell,’ citing a decrease in operating cash flow, as well as the stock’s historically bad performance.

Image source: engadget

Related News

Groupon taking on Square & PayPal with Groupon Payments

Groupon cracks down on competitors with Breadcrumb POS