Apple shares dip as more analysts cut price targets

Apple's quarterly results were better than expected, but still troubling to analysts

Yet another analyst has cut his price target for Apple. JP Morgan's Mark Moskowitz said in a research note Wednesday that he has cut his price target for Apple to $545 from $725. JP Morgan is also removing Apple from its Analyst Focus List as the June quarter is expected to be even worse than the March quarter (which turned out to be not quite that awful).

But Moskowitz--like Piper Jaffray's Gene Munster and BTIG's Walter Piecyk--remains confident that Apple will end the year on a high note.

"We expect a new lower-price iPhone in the $350 range (unsubsidized) with potential gross margin of 40%-plus, which is above the corporate average," Moskowitz wrote.

Apple shares were down 1.5% Wednesday morning after Apple released its Q2 2013 earnings report Tuesday. The numbers were mixed, but sales of iPhones and iPads were higher than most were expecting. The company reported revenue of $43.6 billion, which handily beats the $42.6 billion that the Street was expecting.

The company also sold more iPhones and iPads than many had expected. Apple sold 37.4 million iPhones, which is well above the 34 million the Street was anticipating. Additionally, Apple sold 19.5 million iPads, versus analysts’ expectation of 18-19 million.

But it wasn’t all sunshine and roses for the quarter. For the first time since 2003, Apple reported a profit decline. Net profit came in at $9.5 billion, or $10.09 per share, which is roughly in line with the $10.10 analysts had predicted. But that’s down from $11.6 billion or $12.30 per share in the same quarter last year.

And gross margins weren’t so great, which I think most people were expecting. Gross margins came in at 37.5%, down from 47.4% in the same quarter last year. Consensus pegged gross margins at 38.5%.

“The decline in our share price has been very frustrating to all of us,” said CEO Tim Cook during the earnings call. “There are lots of things that we can’t control, like exchange rates. But the more important objective at Apple will always be creating innovative products. That’s directly within our control.”

Cook also added that while “some” haven’t been happy with Apple’s balance sheet over the last few quarters and margins have decreased from the exceptional highs of 2012, “we’ve met our guidance consistently.” The remark seems to be a thinly veiled reference to the fact that a number of analysts are predicting that Apple will actually come in below its own guidance this year. That would be pretty earth-shattering for a company that has consistently low-balled its own guidance every quarter.

Some other highlights: so far this year, Apple has generated over $98 billion in revenue and $22 million in income, and has sold over 85 million iPhones and 42 million iPads.

Many analysts are forecasting doom and gloom for the first half of the year for Apple. Notably, last week, Piper Jaffray’s Gene Munster cut his price target to $688 from $788, citing concerns that Apple’s rumored cheap iPhone will cannibalize its higher end phones.

Specifically, Munster theorized in his report that for every three cheap iPhones sold (which he believes will sell for $300 sans contract), it will translate to one less higher priced iPhone sold. He believes Apple will sell 75 million cheap iPhones, which will account for 11% of the low-end market.

But BTIG’s Walter Piecyk believes that Apple will end the year on a bang, he believes Apple will deliver a lower-priced iPhone by the end of the year, along with another mystery device that will generate an additional $5 billion in revenue.

Last week, Apple shares fell below $400 for the first time since January 2012.

Apple is setting guidance for the June quarter fairly low: revenue between $33.5 billion and $35.5 billion, and gross margin between 36% and 37%.

Image source: businessweek.com

Related News

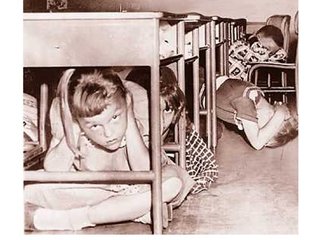

Duck and cover: Apple shares dip below $400

Good news and bad news for Apple's investors...