BlackBerry wants SEC probe into Z10 sales report

Detwiler Fenton reported Z10 returns now exceeding sales, BlackBerry calls it "absolutely false"

Let's say you are BlackBerry. Right now, you've got everything riding on the release of your latest phone. Your share of the smartphone market has been rapidly dwindling over the last couple of years, and this is essentially make or break time for you. And then a report comes out that says more people are returning your new phone than buying it, something you completely deny, and which causes your stock to go down by over 7% in one day. You'd be pretty angry, right?

Well, BlackBerry seems to be livid over the situation.

After a report from financial-services firm Detwiler Fenton on Thursday said that returns of the Blackberry 10, or Z10, had begun to exceed sales, BlackBerry called it "absolutely false." When BlackBerry was then denied access to the report, or its methodology, the company decided to appeal to a higher power: the government.

The phone maker is set to make a formal request to Securities and Exchange Commission and Ontario Securities Commission so that they can review the report, it was announced Friday.

"Sales of the BlackBerry Z10 are meeting expectations and the data we have collected from our retail and carrier partners demonstrates that customers are satisfied with their devices," BlackBerry President and CEO Thorsten Heins said in a statement. "Return rate statistics show that we are at or below our forecasts and right in line with the industry. To suggest otherwise is either a gross misreading of the data or a willful manipulation. Such a conclusion is absolutely without basis and BlackBerry will not leave it unchallenged."

The request will be made in the next few days.

"We believe key retail partners have seen a significant increase in Z10 returns to the point where, in several cases, returns are now exceeding sales, a phenomenon we have never seen before," Detwiler Fenton wrote in the report.

The firm attributed the high rate of returns to "the unintuitive nature of the user interface, the maps app, and the lack of apps - issues that become apparent once consumers have had several days to use the device," as well as performance issues, saying that the phone has "a tendency to slow down after several hours of use."

The performance issues might be "related to the runtime environment BBRY has created to run Android apps or some OS bloat issue," Detwiler Fenton wrote.

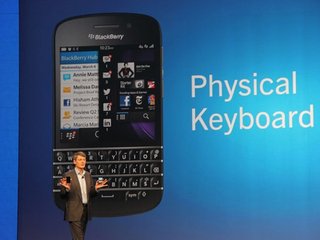

Ultimately, the report speculated that BlackBerry would wind up selling more of its other recently released phones, the Q10, which comes with a physical keyboard, but still said that the phone maker would have a hard time attracting more customers to its platform.

"We acknowledge that Z10 sales for the February Q came in at a respectable 1MM units with relatively strong sell through but we caution investors that there is significant return risk to these numbers and believe that future results are setting up for a disappointment."

Still, the firm said that it was sticking with its forecast of 2.3 to 2.5 million BlackBerry 10 forecast for the month of May.

When asked to comment about the possible SEC review, the company stood by its report.

“We are confident in our research methodology and we welcome any regulatory inquiry. Detwiler Fenton is not the only research provider publishing similar reports regarding customer reactions, sales, and returns of the BlackBerry Z10. It should also be noted that neither the Research Analyst nor any officer or director of Detwiler Fenton has any financial interest in BBRY," Anne Buckley, General Counsel and Chief Compliance Officer at Detwiler Fenton, told VatorNews.

The BlackBerry 10, which was unveiled in January, is a touchscreen phone with a 4.2-inch display and 350 pixels per inch. It launched with some 70,000 apps, which is lightyears behind Apple, which has 775,000 apps in its App Store, and Google Play, which is rumored to have more than 775,000 apps.

The new phone was a long time coming, and it is critical to the company’s survival. The one-time king of the smartphone world has fallen rapidly behind as Google and Apple have taken over the market. Google and Apple alone now account for nearly 89% of the smartphone market, while RIM accounts for 7%. Its case hasn’t been helped by several recent outages that have left millions without service around the world. Times really got tough last year when RIM had to stall on the BlackBerry 10 release. The company’s market cap has fallen 89% since 2008.

BlackBerry's stock is up 1.26% Friday, trading at $13.72 a share.

(Image source: https://usefulagenda.blogspot.com)

Related News