Kate Mitchell: We are in an IPO crisis

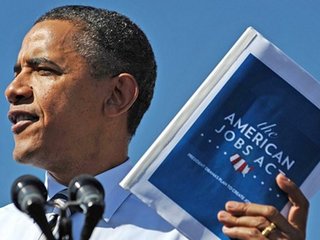

Bambi Francisco sits down with Scale Venture's founder to chat about the JOBS Act

There has been a lot of chatter about the JOBS Act and how the various provisions within it will change the tech startup environment, investments and road to IPO but few know as much about the nuances in the legislation as Kate Mitchell.

Mitchell, the co-founder and managing director of Scale Venture Partners, was on the frontlines of Capitol Hill to get the JOBS Act passed so that smaller companies and investors have a shot at building up the small business market in the US.

Certain provisions of the JOBS Act allow the retail investor to get access to more investment opportunities and helps larger companies go public sooner.

Mitchell shared, with Vator CEO Bambi Francisco and the 400+ attendees at Venture Shift, an evening event hosted by Bullpen Capital and Vator, her insight on what could be in the cards when the JOBS Act makes it through all the regulatory hoops.

Here are the highlights to the fireside chat at this year's Venture Shift:

BF: The JOBS Act essentially loosens regulations to make it easier for private companies to access capital from retail investors. On one hand, larger companies are able to access public-market investors by going public. On the other hand, smaller companies can raise $1 million from non-accredited investors through so-called funding portals. Sketch out some of the components of the Act that will allow for this access to capital.

KM: A piece of the JOBS Act is focused on helping entrepreneurs get their hands on money as well help lay-people become investors. But, we have to remember that there are retail investors that should be protected for the some of the risks that we (as VCs) are all comfortable with. Companies like Apple and Intel aren’t being created right now because so many are encouraged to get bought up before they have the real strength to grow like your well-known tech giants. We want to see that trend shift, especially since 2/3 of the jobs in the US are created by small companies and then we see them really get into hiring more when they have the opportunity to IPO.

BF: There are numbers floating around that the JOBS Act will spur the creation of 200,000 over 5 years. That doesn’t move the needle very much does it?

KM: Well it is far better than the jobs being lost. The objective here is for companies to get the shot at becoming a substantial company as well as help them grow faster. There was never a number of jobs that we had in mind to create, it is more of a way to spur growth and change. It’s also important to note that 92% of the jobs that were created in these tech giants were actually post-IPO – that is when they become the hiring machine that Apple or Google are known as.

Then you have to factor in the fact that regulations on investments were designed for bigger companies like Enron in mind and those regulations tie investors’ and entrepreneurs’’ hands with consumer technology opportunities. We want to be friendlier to smaller companies and help them introduce more funding.

BF: Crowdfunding will hopefully increase the number of companies getting their hands on funding but there could also be boiler room scams, where do you stand on this balance?

KM: The way crowdfunding truly started was as a version of collecting donations for a cause or to help save a small local business in trouble. Then it evolved to become more of a commercial way to connect with small companies for consumer products like with Pebble where you want an item.

But now crowdfunding is more about finding equity for your company. This is where that boilerplate issue does start to play a role. We (as VCs) know that we are in a high-risk business that has a lot of failures, but my mother doesn’t know about all those risks and nuances.

So this is why there are regulations that cap these retail investments, such as the 10% investment cap based on your income.

Some people that don’t understand the ecosystem will still run into problems but it does limit it so that they don’t lose their whole wallet.

I also have to point that this retail investment portion will be the single piece that will slow the regulation boards the most and will be the piece most discussed.

Accredited investors are placed, by the SEC, in the category of allowing more risk-taking and regulators will continue discussing just where the line can be placed comfortably for everyone else.

Companies that are excited about these crowdfunding sources should also remember that there is still a huge benefit in angel investing. With angels we know that you aren’t just getting the funding, you are getting qualified vetting, advice and introductions to others in the sector.

BF: What about general solicitation? Watching late night TV, I imagine rather than seeing the latest workout equipment for sale I'll see "Invest in ABC company. Yours for $9.95." Would the SEC frown on this? And, what kind of ways will companies be able to promote their offerings?

KM: Usually the funders were silenced from discussing if they were investing in a company at different stages but the rules for general solicitation will change because of these crowdfunding and retail investment. You could soon begin seeing companies advertise to everyone, but only take money from the people with the income in the FCC-approved window.

I’d also like to point out that we just aren’t likely to see the JOB Act approved anytime in the immediate future. Usually the expectation is 172 days, but for the JOBS Act that is really unlikely. There will likely be a big staff turnover at the FCC around the election, no matter who wins. This will make it very difficult for this act to happen even within this year.

BF: Part of the Act that is live now is the IPO onramp portion. And the IPO on-ramp provision basically implies that we're in an IPO crisis. Yet in the last 18 months, we've seen some amazing companies go public: Facebook, LinkedIn, Groupon, Zynga, Pandora. Are we in an IPO crisis?

KM: We are in an IPO crisis. We are not seeing smaller companies going publicanymore. Tech is producing big companies that hit the IPO with a lot of cash and aren’t poised for multiple growth like back in the says of Amazon and Google’s IPO. There were 200 medium-sized IPOs a year more than 10 years ago, last year there were 11 huge companies instead. The big companies are also trading down on average. LinkedIn, Jive, Angie’s List were smaller companies and they are trading way up compared to Groupon and Facebook which are trading down but are huge businesses.

BF: There is a lot of capital these days. Roughly 60% of the investments are going into later stage companies, compared to 35% in years past. These later stages seem to taking place of an IPO in many cases so why do companies even need to IPO?

KM: Those companies that went public said the process was incredibly valuable. You have a more stable source of capital, debt sources, competitors see you as a winner, also your employees and shareholders have liquidity. It also allows you to position yourself in the market as the one that crossed the finish line. And I think you see these later stage funding rounds because it has been so hard to go public.

BF: What about some of the issues with analysts that have a Chinese wall between them and the investors. The law is now going to allow investment banks analysts to publish research on companies their firms are bankers on, isn’t this rebuilding the wall separating banks and research?

KM: Lack of research can certainly be a bad thing. It has always been true that bankers can publish research on companies about to IPO, but they have to be sure about not being paid directly by the company going public.

There has also been abuse in the past of analysts giving advice about companies and being paid by similar sources.

You take the case of Millennial Media and see why there are problems when analysts have to stay quiet. Hedgefunds attacked the company to drive down the shares while analysts were held silent because of regulations for 40 days until they were allowed to express the great value of the company and then the shares rebounded.

BF: This small cap IPO needs after-market support. But decimilization rules eviscerated profits in small-cap market making by removing the spread in trading. This risks the core target IPOs of the JOBS Act - these small- to midcap stocks may become orphans - lost in a land of light trading and attention. How do we address this?

KM: If you take a look, 10-15 years ago when companies went public were looking for great multiples and got things like Amazon. Right now, 70% of the share action happening now are from high frequency trading that give hedgefund returns whether the stock goes up or down.

While the boutique bankers do still exist and can help the smaller IPOs, the JOBS Act and smaller tech companies can help reduce the frantic action trading and encourage growth trading. When the smaller companies work with the boutique banks, that really need and want your business and will advice you to help your shares and IPO be successful for both of you rather than catering to those interest that just want irractic action.

Audience question: How will crowdfunding be seen by later stage investors?

KM: We don’t know because we haven’t done it yet but I can say that VCs do like to see angels and their track record as an indicator. We prefer angels that have counseled companies. Our mothers are not as valuable and great indicators like some of the angels in the room.

The merger between angel and crowdfunding could be a better nexus. It might be helpful if crowdfunding was limited to the first $100K and then angels past that.

Related Companies, Investors, and Entrepreneurs

Bambi Francisco Roizen

Joined Vator on

Founder and CEO of Vator, a media and research firm for entrepreneurs and investors; Managing Director of Vator Health Fund; Co-Founder of Invent Health; Author and award-winning journalist.Related News

VCs: Don't value your startup for future dilution

Dave McClure: Get your laws off my startup!

Is the JOBS Act evil? Or just misunderstood?