Square transactions available the next business day

The mobile payment company gets an edge over competitors, now seeing $5B in transactions annually

The mobile payment and digital register service over at Square just keeps getting faster and more attractive to businesses. Square will now give merchants access to cash on sales made before 5 p.m. by the next business day – now that is a great competitive edge over PayPal’s new card reader. The company’s Chief Operating Officer, Keith Rabois, also told Bloomberg that the company is now processing $5 billion worth of transactions annually. For those keeping track, that is $1 billion more than it was clocking just last month.

“Sole proprietors and small businesses live and die by their cash flow,” Rabois told Bloomberg. “They don’t have access to capital; banks don’t give them loans. They need to take the money they make today and use it to pay bills, buy things and pay employees the next day, so having access to funds is super-crucial for them.”

This next day payment may not be a big deal for box stores but that sure gives small businesses a huge incentive to use Square over the competition.

This is an especially great option for businesses that have avoided credit transactions altogether because it needed the cash flow to stay alive – and could mean bringing in more business now that it has more payment options for customers.

Everyone wants in on the mobile payment market

The mobile payment/wallet market is heating up quit nicely – with PayPal, Intuit, LevelUp, PayDragon and several other trying to get a competitive edge around Square.

The San Francisco-based startup has forced many financial and mobile businesses to consider their payment services, and word is that the company is out there raising new funding and an awe-inspiring valuation of $4 billion.

If the company hits its goal, and with all the buzz around the mobile payment service I bet it will, it will have quadrupled its worth in a matter of just 10 months.

The three-year-old company founded by Twitter pioneer, Jack Dorsey is changing the whole system of transactions across the nation by providing cardless, and now register less, systems of retail.

Over the last few months, Square has been rolling out new apps, services and deals with millions of individuals, restaurants, and retail locations that want to reduce hardware costs and join the techno-savvy paperless revolution.

Two weeks ago, one report came out shooing that mobile payments could become as common as swiping a credit card by 2020.

Approximately 65% of experts surveyed in the study agreed that mobile payments would take off by 2020, while 33% of experts agreed with a more negative statement, which said that consumers wouldn’t trust mobile payments to replace cash and credit cards by 2020.

I'm sure that PayPal, Square, Google, Visa, LevelUp, PayDragon and others are taking notice of what the buzz is about mobile payment adoption, especially now that users have grown more comfortable shopping and checking their banking information via their pocket-sized computers.

Recent Pew Internet surveys have found that one in 10 Americans have used their cell phone to make a charitable contribution by text message; more than one-third of smartphone owners have used their phones to do online banking services like paying bills or checking a balance; and 46% of apps users have purchased an app using a mobile device. So the comfort is growing with phone transactions, but all of these mobile payment companies that have been making waves over the last few months are hoping that you'll feel fine leaving home with just your phone in the very near future.

Previous research from comScore found that 38% of smartphone owners have used their cell phone to make a purchase of music, e-books, movies, clothing and accessories, and daily deals as well, just as mobile retail continues to grow with vigor.

Your wallet is in danger of becoming as obsolete as the pocket watch. With tech companies zoned in on turning your mobile devices into methods of payment, consumers are going to find a lot more value in keeping their smart phones close -- and merchants are clamoring to pick the services that give them the best competitive edge.

Here is the schedule showing when merchants can expect to see transactions in their bank accounts:

Related Companies, Investors, and Entrepreneurs

PayDragon

Startup/Business

Joined Vator on

PayDragon is a mobile shopping app that lets smartphone users order and pay remotely for goods and services. PayDragon translates the convenient one-click shopping experience to the real world by enabling consumers to easily browse, scan, shop and pay for items on the go. Launched by the team behind Paperlinks, a leader in QR code marketing and mobile commerce, the PayDragon app is available for free on iPhone and Android.

PayDragon is headed by CEO and Founder Hamilton Chan.

Related News

Square now processing 1M payments a day

Square seeking more capital, $4B valuation

Square raises $27.5M for $240M valuation

Square wants to replace POS systems with new iPad app

Square raises $100M for $1B valuation

Square securing new round at $200M valuation?

Square squeezes in a new investment from Visa

PayPal handled $4B in transactions in 2011

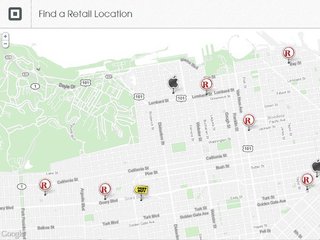

Find Square card reader with store locator feature