Week 4 of the class.

Last week the teams were testing their hypotheses about their Value Proposition (their company’s product or service.) This week they were testing who the customer, user, payer for the product will be (and discovering if they have a multi-sided business model, one with both buyers and sellers.) Many of them had heard the phrase “product/market fit” before, but now they were living it. And for some of the teams the halcyon days of “we’re taking this class so we can just build our great product and get credit for it” had come to a screeching halt. The news from customers was not good.

Let the real learning begin.

The Nine Teams Present

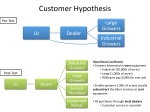

This week, our first team up was PersonalLibraries (the team that had software to help researchers manage, share and reference the thousands of papers in their personal libraries.) Going into the first four weeks their business model hypotheses looked like this:

Last week we told them team: 1) see if the market size was really large enough to support a business, and 2) to find that out they were going to have to talk to more customers outside of Stanford. So during the past week, the team got feedback from >60 researchers from cold calls, in-person interviews, and a web survey. (We were impressed when we found that they did the in-person interviews by hiring usertesting.com for $39 to set up test scenarios, gave the users specific tasks to accomplish with their minimum viable product, videotaped the customer interactions and summarized customer likes and dislikes.) The good news was that customers said that their minimum viable product (easily organizing research papers) was correct. The bad news was that users would play with their product on-line for a while and leave and never return. Politely it was described as “poor customer retention” but in reality it was because the product was really hard to use.

But it was their market size survey that had the team (and us) even more concerned; last weeks “hot” market of biomed researchers looked like it was only $30m market, and the total available reference manager market was another $80M.The question was, even if they got the product right, were there enough customers to make it a business?

If you can’t see the slides above, click here.

For next week, they decided to improve the product by adding more tutorials, do a 2ndCustomer Survey and begin to create demand for their product with AdWords Value Prop Testing and Landing Page A/B Testing.

The feedback from the teaching team was that customer feedback seems to be saying that this product is a “nice to have” versus “got to have.” Is the lack of excitement the MVP? Users? Is this a hobby or a business?

Agora Cloud Services

The Agora team started the week wondering whether they were 1) a true marketplace for cloud computing, where they provide both matching and exchange capabilities for real-time trading. Or were they 2) an information exchange, providing matching services for cloud computing buyers and sellers, providing matching services.

They began with a set of questions:

- What are our new hypothesized value propositions?

- Which segments have we identified and which do we want to narrow in on?

- Which value added services do public clouds want to attract customers for?

- Is there a certain segment of buyers that continually makes purchasing decisions (as opposed to only once at the very beginning of a company).

- How can we attract buyers to our channel before they make purchasing decisions?

- Longer-term work/planning: what other experiments should we be constructing

- Sales process: buyer/ user/ influencer etc.? Demand generation?

The Agora team decided to formalize the customer discovery process by coming up with a set of Customer Discovery principles and questions that were as good as any I’ve seen.

They had 16 interviews with target customers (Zynga, Yahoo, VMware, Walmart, Zeconder, etc.) as well as channel partners and cloud industry technology consultants.

Agora was in a classic two-sided market (having both buyers and sellers. The Business Model Canvas is a great way to diagram it out. Each side of a market has its own Value Proposition, Customer Segment and Revenue Model.) They learned that one their core customer hypothesis about their buyers, “startups would want to buy computing capacity on a “spot market” was wrong. Startups were actually happy with Amazon Web Services. The Agora team was beginning to believe that perhaps their ideal buyers are the companies that have to handle variable and unpredictable workloads.

If you can’t see the slides above, click here.

The Agora team left the week thinking that it was time for a Pivot: find cloud buyers and sellers who need to better predict demand. Perhaps in market segment: medium-large companies that do 3D modeling and life sciences simulations

The feedback from the teaching team “great Pivot” and very clear Lessons Learned presentation. Keep at it.

(For the teaching team one of the most important ways to track the teams progress was through the weekly blogs we made each team keep. Think of this as their on-line diary. They hated doing it, but for us it added a window into their thinking process, allowed us to monitor how much work they were doing, and more importantly let us course correct when needed.

BTW, If I was on the board of a startup with a first time CEO I might even consider asking for this in the first year as they went through Customer Discovery. Yes it takes time, but I bet it’s less than time than you would spend having coffee with an advisor each week.)

D.C. Veritas, was the team building a low-cost, residential wind turbine that average homeowners could afford. From a slow start of customer interaction they made major progress in getting out for the building. This week they refined their target market by building a map of potential customers in the U.S. by modeling wind speed, energy costs, homeownership density and green energy incentives. The result was a density map of target customers. They then did face-to-face interviews with 20 customers and got data from 36 more who fit their archetype. They also interviewed two companies – Solar City and Awea in the adjacent market (residential photovoltaic’s).

If you can’t see the slide presentation above, click here.

The teaching team offered that unlike solar panels which work anywhere, they’ve narrowed down the geographic areas where their wind turbine was economical. We observed that their total available market was getting smaller daily. After the next week figuring out demand creation costs, they ought to see if the homeowners were still a viable target market for residential wind turbines.

Autonomow, the robot lawn mower, came in with a major Pivot. Instead of a robotic lawn mower, they were now going to focus on robotic weeding and drop mowing as a customer segment. (Once you use the Business Model Canvas to keep score of Customer Discovery a Pivot is easy to define. A Pivot is when you substantively change one or more of the Business Model Canvas boxes.)

Talking to customers convinced the team that the need for robotic weeding was high, there was a larger potential market (organic crop production is doubling every 4 years and accelerating), and they could make organic produce more affordable (labor cost reduction of 100 to 1) – and could possibly change the organic farming industry! And as engineers they believed weed versus crop recognition, while hard, was doable.

During the week the team drove the 160 miles round-trip to the Salinas Valley and had on-site interviews with two organic farms. They walked the fields with the farmers, hand-picked weeds with the laborers and got down into the details of the costs of brining in an organic crop.

They also talked by phone to organic farmers in Nebraska and the Santa Cruz mountains.

They acquired quantitative data by going through the 2008 Agricultural Census. Most importantly their model of the customer began to evolve.

If you can’t see the slide above, click here.

Our feedback: could they really build a robot to recognize and weeds and if so how will they kill the weeds without killing the crops? And are farmers willing to take a risk on untested and radical ideas like robots replacing hand weeding?

The Week 4 Lecture: Customer Relationships

Our lecture this week covered Customer Relationships (a fancy phrase for how will your company create end user demand by getting, keeping and growing customers.) We pointed out that get, keep and grow customers are different for physical versus virtual channels. Then different again for direct and indirect channels. We offered some examples of what a sales funnel looked like. And we described the difference between creating demand for products that solve a problem versus those that fulfill a need.

If you can’t see the slide above, click here.

———

The biggest lesson for the students this week was the entire reason for the class – no business plan survives first contact with customers – as customers don’t behave as per theory. As smart as you are, there’s no way to predict that from inside your classroom, dorm room or cubicle. Some of the teams were coming to grips with it. Others would find reality crashing down harder a bit later.

Next week, each team tests its demand creation hypotheses. The web-based teams needed to have their site up and running and be driving demand to the site with real Search Engine Optimization and Marketing tests.