The Lean LaunchPad at Stanford - Class 3

Value proposition hypotheses

The Stanford Lean LaunchPad class was an experiment in a new model of teaching startup entrepreneurship. This post is part three. Part two is here. Syllabus is here.

Week 3 of the class and our teams in our Stanford Lean LaunchPad class were hard at work using Customer Development to get out of the classroom and test the first key hypotheses of their business model: The Value Proposition. (Value Proposition is a ten-dollar phrase describing a company’s product or service. It’s the “what are you building and selling?”)

The nine teams present

This week, our first team up was PersonalLibraries (the team that made software to help researchers manage, share and reference the thousands of papers in their personal libraries.)

To test its Value Proposition, the team had face-to-face interviews with 10 current users and non-users from biomedical, neuroscience, psychology and legal fields. What was cool was they recorded their interviews and posted them as YouTube videos. They did an online survey of 200 existing users (~5% response rate). In addition, they demoed to the paper management research group at the Stanford Intellectual Property Exchange project (a joint project between the Stanford Law School and Computer Science department to help computers understand copyright and create a marketplace for content). They met with their mentors, and refined their messaging pitch by attending a media training workshop one of our mentors held.

To see the slides, click here.

In interviewing biomed researchers, they found one unmet need: the ability to cite materials used in experiments. This is necessary so experiments can be accurately reproduced. This was such a pain point, one scientist left a lecture he was attending to find the team and hand them an example of what the citations looked like.

The team left the week excited and wondering – is there an opportunity here to create new value in a citation tool? What if we could help scientists also bulk order supplies for experiments? Could we help manufacturers, as well, to better predict demand for their products, or perhaps to more effectively connect with purchasers?

The feedback from the teaching team was a reminder to see if the users they were talking to constitute a large enough market and had budgets to pay for the software.

Agora cloud services

The Agora team (offering a cloud computing “unit” that Agora will buy from multiple cloud vendors and create a marketplace for trading) had 7 face-to-face interviews with target customers, and spoke to a potential channel partner as well as two cloud industry technology consultants.

They learned that their hypothesis that large companies would want to lower IT costs by selling their excess computing capacity on a “spot market” didn’t work in the financial services market because of security concerns. However sellers in the Telecom industries were interested if there was some type of revenue split from selling their own excess capacity.

On the buyers' side, their hypothesis that there were buyers who were interested in reduced cloud compute infrastructure cost turned out not to be a high priority for most companies. Finally, their assumption that increased procurement flexibility for buying cloud compute cycles would be important turned out to be just a “nice to have,” not a real pain. Most companies were buying Amazon Web Services and were looking for value-added services that simplified their cloud activities.

To see the slides, click here.

The Agora team left the week thinking that the questions going forward were:

• How do we get past Amazon as the default cloud computing service provider?

• How viable is telecom as potential seller of computing cycles?

• We need to further validate buyer and seller value propositions

• How do we access the buyers and sellers? What sort of sales structure and sales force does it require?

• Who is the main buyer and what are his motivations?

• Is buying guide/matching service a superior value proposition to marketplace?

The feedback from the teaching team was a reminder that at times you may have a product in search of a solution.

D.C. Veritas

D.C. Veritas, the team that was going to build a low cost, residential wind turbine that average homeowners could afford, wanted to provide a renewable source of energy at affordable price.

They started to work out what features a minimum viable product their value proposition would have and began to cost out the first version. The Wind Turbine Minimum Viable Product would have a: Functioning turbine, Internet feedback system, energy monitoring system and have easy customer installation.

The initial Bill of Material (BOM) of the Wind Turbine Hardware Costs looked like: Inverter (1000W): $500 (plug and play), Generator (1000W): $50-100, Turbine: ~$200, Output Measurement: ~$25, Wiring: $20 = Total Material Cost: ~$800-$850

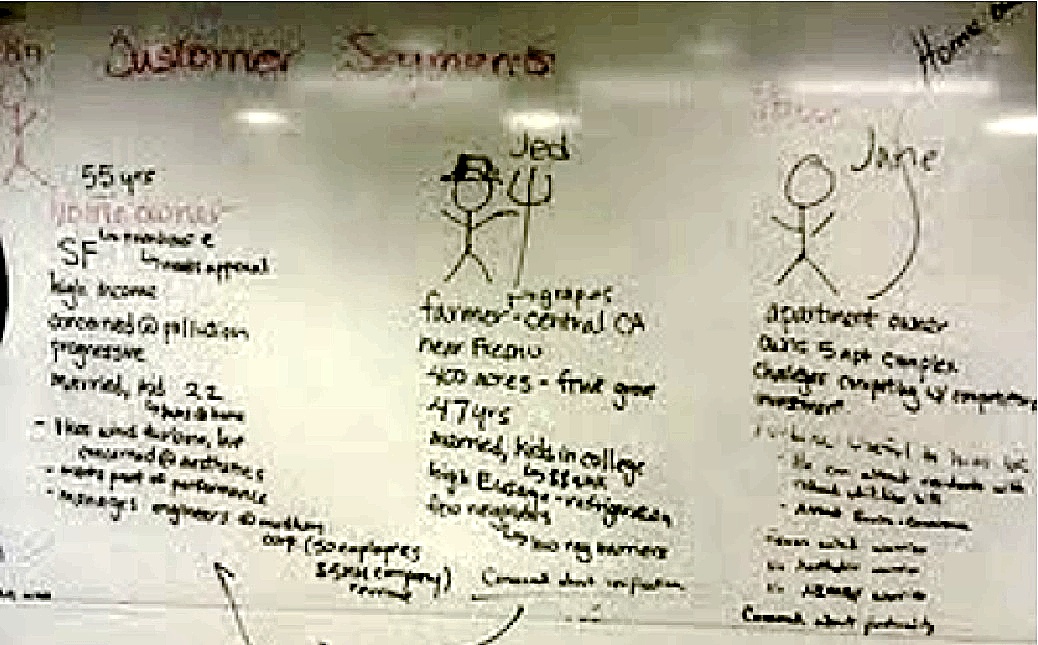

The team also went to the whiteboard and attempted a first pass at who the archetypical customer(s) might be.

To get customer feedback the team posted its first energy survey here and received 27 responses. In their first attempt at face-to-face customer interviews to test their value proposition and problem hypothesis (would people be interested in a residential wind turbine), they interviewed 13 people at the local Farmer’s Market.

To see the slide presentation, click here.

The teaching team offered that out of 13 people they interviewed only 3 were potential customers. Therefore the amount of hard customer data they had collected was quite low and they were making decisions on a very sparse data set. We suggested (with a (2×4) that were really going to have to step up the customer interactions with a greater sense of urgency.

Autonomow

The last team up was Autonomow, the robot lawn mower. They were in the middle of trying to answer the question of “what problem are they solving?” They were no longer sure whether they were an autonomous mowing company or an agricultural weeding company.

They spoke to 6 people with large mowing needs (golf course, Stanford grounds keeper, etc.) They traveled to the Salinas Valley and Bakersfield and interviewed 6 farmers about weeding crops. What they found is that weeding is a huge problem in organic farming. It was incredibly labor intensive and some fields had to be hand-weeded multiple times per year.

They left the week realizing they had a decision to make – were they a “Mowing or Weeding” company?

Our feedback: Could they really build a robot to recognize and kill weeds in the field?

To see the slide, click here.

The Week 3 lecture: Customers

Our lecture this week covered Customers – what/who are they? We pointed out the differences between a user, influencer, recommender, decision-maker, economic buyer and saboteur. We also described the differences between customers in business-to-business sales versus business-to-consumer sales. We talked about multi-sided markets and offered that not only are there multiple customers, but each customer segment has its own value proposition and revenue model.

To see the slide, click here.

Getting out of the building

Five other teams presented after these four. All of them had figured out the game was outside the building, with some were coming up to speed faster than others. A few of the teams ideas still looked pretty shaky as businesses. But the teaching team held our opinions to ourselves, as we’ve learned that you can’t write off any idea too early. Usually the interesting Pivots happen later. The finish line was a ways off. Time would tell where they would all end up.

———

Next week each team tests its Customer Segment hypotheses (who are their customers/users/decision makers, etc.) and reports the results of face-to-face customer discovery. That will be really interesting.