If you’re like many small real estate property managers with a couple to a dozen rental properties, you’re probably managing the books on some cloud-based spreadsheet and folder, like Google Drive, at best, or in manila folders and binders in a filing cabinet at worst.

Now it’s time to upgrade to something that’s designed specifically for managing real estate.

Stessa, which was acquired by JLL Spark earlier this year, is a new real estate platform that lets investors manage their rental properties. It’s now out of beta and available to new users, with some pretty cool upgrades.

For instance, you can use your mobile phone to capture an image of receipts, which can then be automatically filed. That’s a nice feature for someone like myself, who typically scans or takes photos of receipts, then drops them into an online folder.

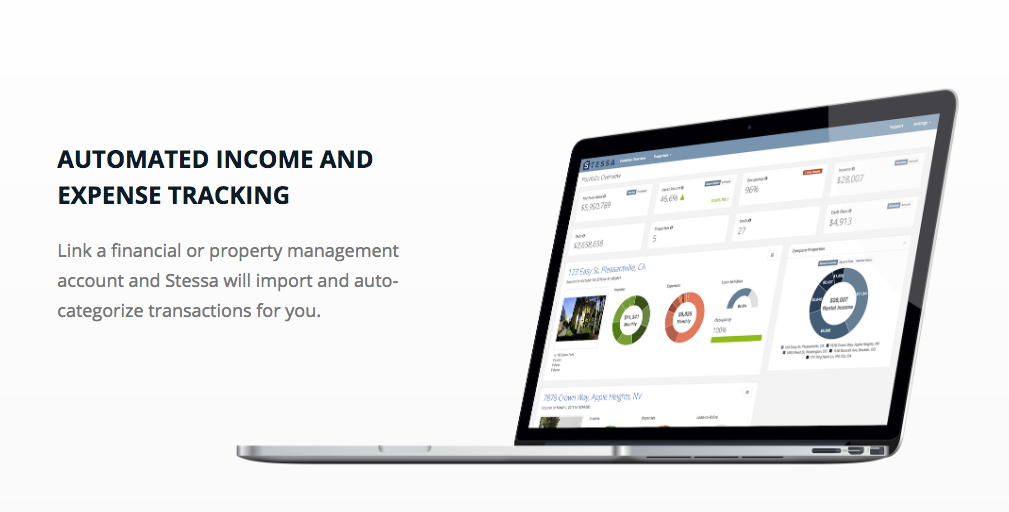

Other Stessa features includes the ability to connect your bank, mortgage and vendors to sync all transactions. If you work with a property manager, Stessa will import monthly income and expense transactions so you can track rent payments, fees and other expenses in one place.

The tool is also free to use for anyone who doesn’t own a real estate fund. It’s also currently Stessa’s current target market: small- to midsized real estate owners, anyone with one property to a dozen multi-family units. Today, the startup has more than 10,000 properties listed and being managed with the software, said Heath Silverman, co-founder and CEO of Stessa. About 80 percent are small property managers while the remainder are large and more professional real estate property managers, paying a starting cost of roughly $500 a month, said Silverman.

Silverman started Stessa in 2016 with his co-founder after the two realized their co-owned multi-unit property in Oakland was overlooked and not properly managed, partly due to lack of software to organize the data.

“This property had been on autopilot, but then we started diving into the details and identified a few key opportunities to decrease the operating costs and increase the income. By doing so, we nearly doubled the value of the building with a few weeks of work,” he said. “We also refinanced it and bought another building. That’s when we realized we could automate this management process for most investors who typically manage their properties with a spreadsheet and a big shoebox of invoices.”

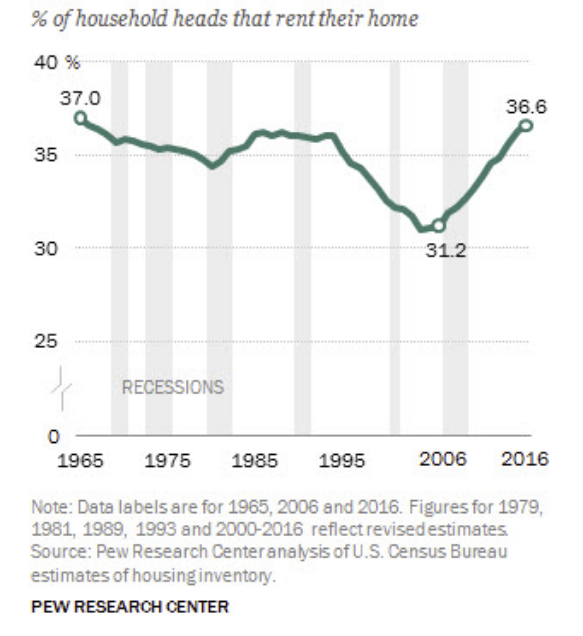

Stessa definitely has good timing as more people are renting. One 2018 study showed that the population of almost a quarter of the 100 largest US cities mainly rents vs owns their primary home. Another study showed that more people are renting than in any other time in the last 50 years.