It looks like we can all tentatively mark May 17 on our calendar because reports are coming citing that as the big Facebook IPO date. Sources close to the financial decision leaking that date to reporters over at Tech Crunch, and that day also jibes with many other estimates and the window left by the filing put in earlier this year by the biggest social network online.

The date could still float a little bit based on how long it takes the federal regulators to review Facebook’s recent $1 billion acquisition of mobile-photo-sharing startup Instagram — but it is likely the company’s target date so that it can start trading that Friday, May 18.

Facebook is looking to raise around $10 billion from the stock sale, with valuation as high as . . . wait for it . . . $104 billion.

That would place Facebook at nearly the same level it was trading at on the secondary market — about $40 a share — and would make it the largest IPO of any Internet technology company ever.

Due to the silence required up until the IPO, Facebook is not able to comment or confirm the dates of financial expectations it has for its IPO.

The Facebook IPO has been long awaited since the hugely successful offering from online professional networking site Linkedln Corp. last year, which excited many companies about possible IPOs such as Yelp, Jive and Angie’s List.

Facebook, which was launched in February 2004, now has well over 800 million users sharing 4 billion items per day.

The last big Internet tech company to IPO was the advertising company Millennial Media IPO, which debuted March 29. Millennial Media had the same underwriters, Morgan Stanley and Goldman Sachs, as Facebook.

Millennial Media expereienced a significant pop in early trading and closed the day at nearly double its $13 IPO price.

Trading under the symbol MM, the stock closed on its debut day at $25 — which puts the company valuation at nearly $2 billion.

Millennial which filed its first S-1 in early January, raised over $130 million in the offering, which is up from $75 million originally stated in earlier filings.

Two weeks ago we learned that the Nasdaq won a battle with the New York Stock Exchange for one of the highly largest tech IPOs ever — Facebook. Nasdaq hosts Apple, Microsoft, Amazon and Google, while the NYSE have smaller public tech companies like LinkedIn, Yelp and Pandora Media.

In January, the company halted shares, raising speculation that the IPO would be right around the corner. Now, it’s being speculated that the debut day will come some time in May, according to Bloomberg.

By halting the trading of shares, however, Facebook would certainly be letting the market settle down before it goes public. It would end price fluctuations and allow investors to determine its valuation, which is expected to be around $100 billion.

Earlier this month, Facebook took out a $5 billion line of credit and $3 billion 364-day bridge loan.

It was also announced last week that Facebook would only be paying its 31 underwriters, which include Morgan Stanley, J.P. Morgan, Goldman Sachs, Bank of America, Barclays, Citigroup, Wells Fargo, Goldman Sachs, and Allen & Co., a 1.1% fee.

The SEC has even begun cracking down on trading companies who they say were misleading investors looking to buy Facebook stock.

SharesPost, and its CEO Greg Brogger, were accused of not registering as a broker-dealer but still engaging in securities transactions. SharesPost and Brogger agreed to settle and pay penalties, without denying or admitting to guilty to the charges. SharesPost will pay $80,000 and Brogger will pay $20,000.

The company generated $3.7 billion in revenues in 2011, and $1 billion in profits. Net income was $1 billion.

Profits grew 65% last year from $606 million in 2010. And revenues grew 88%.

Up until this point Google’s $1.9 billion debut has been the largest U.S. Internet IPO.

The public spent the last three months estimating just how big the company and its bankers were going to go with in the S-1 form — with many estimates placing the valuation of the company near $100 billion and the total amount the company would raise in its public debut near $10 billion.

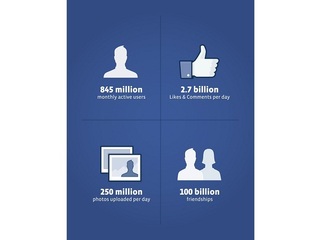

In the filing, Facebook disclosed that it has 845 million MAUs as of Dec. 31, 2011, an increase of 39% as compared to 608 million MAUs as of Dec. 31, 2010.

In November, when reports first started trickling out that the company was on the verge of filing paperwork for its IPO with a planned date to hit the markets in May.

Following up the less-than-stellar showings of several recent tech IPOs (from the likes of Pandora, Groupon and Zynga), Facebook appears to be leaning on the conservative side in order to insure a stronger clamor for shares out of the gate.

Image Source: Nerdreactor.com