At our Vator Splash LA 2016 event Oct. 13 2016, Ezra Roizen, founder of Advsr in a Splash Talk. Here is the video.

Get a copy of Ezra Roizen’s Magic Box Paradigm: A framework for startup acquisitions on Amazon by clicking here.

Magic Box Paradigm

The MBP is written for you, the entrepreneur. The book articulates an end-to-end approach to startup acquisitions. Beyond laying out the key dynamics at play in startup M&A, I also tried to give you a bit of a “feel” for the game. The book is designed to be an easy, and even fun, read. It’s not a textbook, but instead more of a guidebook.

I released the MBP last month and so far the reception has been great.

This talk at Vator Splash LA was a quick intro to a few of the concepts in the book.

Startup Growth Resources

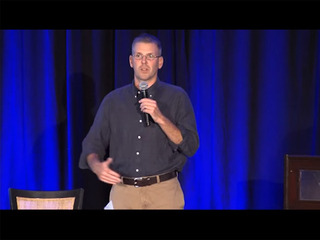

The book begins by positing that a startup’s strategy is about balancing three central forces:

- Product (what they are developing)

- Distribution (how they get it to customers)

- Monetization (how they make money)

In parallel, startups have three primary ways to access growth resources:

- Raise capital (stay independent)

- Establish commercial partnerships (access partner resources)

- Be acquired (fully combine with a partner)

If we plot the strategy/resource elements above on a chart, we get the following:

As such, startup acquisitions aren’t really “exits” but rather “entrances.” They are a way to accumulate the resources your startup needs for growth.

Selling Stuff

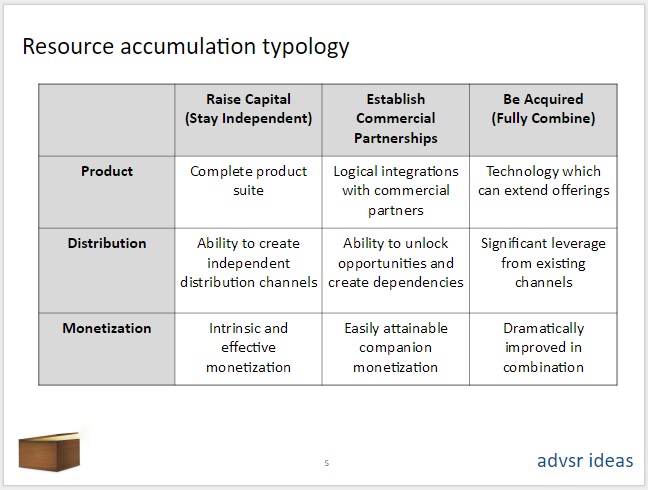

The problem with how many folks approach startup M&A is they believe a startup is an object that can be sold like other kinds of objects – say a Popsicle, or a piece of real estate. Startups aren’t like other objects, and they are very hard to sell. Generally you can sell stuff when the following things are true:

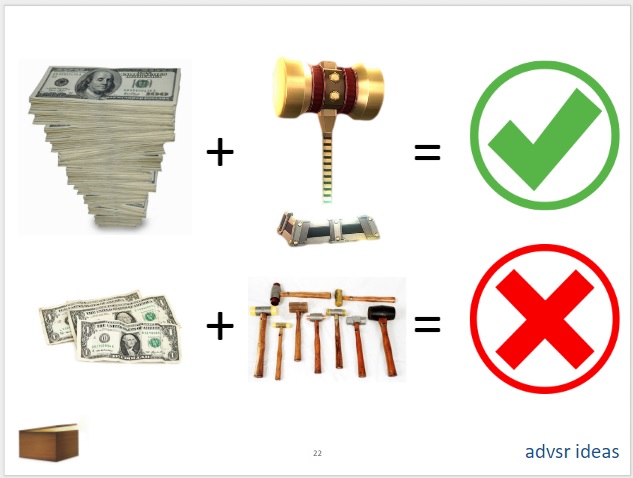

Unfortunately, as it relates to startups:

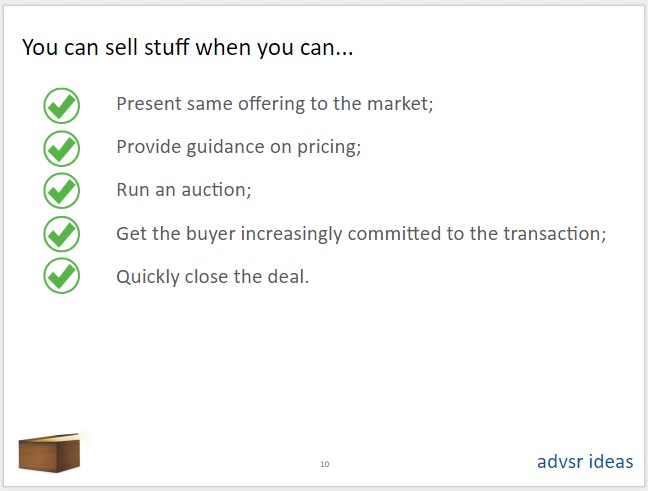

- You can’t present the same offering to the market – as the startup’s technology almost always has a significantly different utility from buyer to buyer

- As such you can’t provide the same guidance on price as value/price are dependent on each buyer-seller pairing

- These pricing dynamics make it nearly impossible to effectively run auctions

- It’s exceedingly difficult to get startup buyer’s incrementally committed to the transaction – if anything the power is shifted towards the buyer in most deals

- Startup acquisitions are extremely complicated and take forever to close

What this means is you can’t sell stuff when you can’t:

So you need to have a different approach, and that’s where the Magic Box Paradigm comes in.

However, before outlining the MBP, let’s be clear on our objective: to create value.

Startup Valuation is derived from your utility to a particular buyer and framed by their view of your scarcity.

If your startup can make a buyer a huge stack of money, and only your golden hammer can unlock that value – then you’re in great shape valuation-wise. However, if the value an acquirer can extract from your startup is modest, and they perceive there to be many others just like it – then your valuation will suffer. As seen here:

As such, the first principles of the Magic Box Paradigm are as follows:

This leads us to see three practical realities for startup acquisitions:

The book dives in and develops a comprehensive approach for accounting for these dynamics – and in many cases – turning them from constraints into enablers.

As a quick overview the book covers:

- Strategy

- Valuation

- Narrative

- Thought leadership

- Process and approach

- Cultivating Interest

- Deal terms

- Closing

In particular the sections on deal terms and closing should be very useful to anyone approaching an acquistiions.

And since the book isn’t a startup – it can be sold! Get it now, get it here!!!

I hope you enjoy the book!

Image sources: money stack, dollar bills, golden hammer, many hammers, check marks, fireworks. limited offer

See more news coverage below.

Splash is Vator’s startup conference, gathering top CEOs to share their lessons learned, and highlighting promising new ones. This year’s winner and runner-up were Industry and Arbiclaims, respective.

If you want to invest in startups selected by Vator, join the Vator Investment Club.

Thanks to our amazing top-tier Vator Splash LA 2016 sponsors: KPMG, Javelin Venture Partners, Bread and Butter, Silicon Legal Strategy, Roger Royse Law, Surf Air, Wavemaker, Scrubbed, Stratpoint,AdSemble, Soothe and Bixel Exchange.

Editor’s Note: Our annual Post Seed conference is around the corner on Dec. 1 at The Village in San Francisco. Speakers include Chamath Palihapitiya (Founder & CEO, Social Capital LP) and Jeff Lawson (Founder, CEO & Chairman,Twilio) and many more. Join us! REGISTER HERE.

Be eligible to get a complimentary ticket to Post Seed. Join the Vator Investment Club before Thanksgiving. Join VIC.