How does Ginkgo Bioworks make money?

Ginkgo makes the majority of its money from the sale of its end-to-end COVID-19 testing services

Read more...

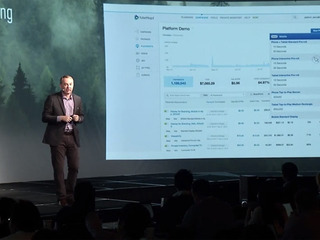

Though it started out as a video analytics platform, TubeMogul pivoted to become a programmatic video advertising platform focused exclusively on the buy side of the media industry.

Unlike other ad tech companies, TubeMogul’s revenue comes exclusively from advertisers; the company does not make money by providing services to publishers. Instead, they provide a SaaS based platform that brands and agencies use to buy media.

The platform automates the execution of campaigns across TV and digital video and optimizes where ads run in real-time based on the goals of each campaign.

The company has two revenue channels, based on the two ways that ads are bought and sold. The first is Platform Direct, and the second is Platform Services. So what's the difference between those two?

Platform Services is a more traditional, service-driven model. Brands or advertising agencies send out a request-for-proposal on a campaign-by-campaign basis, seek guarantees, i.e. cost per click, or cost per ad that is actually viewed to completion, and then choose partners. If TubeMogul wins the business, the company’s operations and account management teams execute campaigns on an advertiser’s behalf using the company’s software.

That kind of buying falls under Platform Services. It is campaign-based, high touch and the price is fixed.

What is happening, though, is that the way brands and agencies buy ads is moving to a more automated, software-as-a-service based model, where a brand or agency partners with the company once and logs in on an ongoing basis to execute campaigns themselves on a self-serve basis.

Instead of trying to win a campaign, TubeMogul has a contract with a brand or agency that dictates what the company will charge for a percent of spend, or fees for using certain features of the software. This kind of buying is Platform Direct. These are one-time models, that are low-touch/self serve.

Examples of TubeMogul’s Platform Direct clients include agencies, such as Trilia Media, Marc USA, Empower MediaMarketing, as well as brands like Dannon, Heineken and Lenovo.

The majority of TubeMogul's revenue comes from Platform Services, which accounted for $72 million of its $122.2 million revenue through the first nine months of this year. That is up around 60 percent from $78 million in the same time period in 2014. Platform Direct was $50 million during the first nine months, up 52 percent from $32.9 million last year.

Direct comparisons between the two revenue types can be misleading, however, since they are accounted for differently (see illustration below).

Looking at spend flowing through the software illustrates the trend toward Platform Direct more clearly. The share of ad spend coming from Platform Direct has been increasing every year since 2011, when it was only 24 percent to 76 percent for Platform Services. In 2014 it was basically inversed, with Platform Services accounting for 74 percent of ad spend, compared to 26 percent for Platform Services.

Founded in 2006, TubeMogul raised a total of $53 million in funding, including a $10 million Series C from SingTel Innov8, Cross Creek Capital, Digital Advertising Consortium, Foundation Capital and Trinity Ventures.

TubeMogul went public in July of 2014. It is currently trading at $13.62 a share, nearly double its $7 IPO price. That is down $10 from its high of $23.62 in December of 2014.

(Image source: bidnessetc.com)

Ginkgo makes the majority of its money from the sale of its end-to-end COVID-19 testing services

Read more...GE Healthcare, which went public after spinning-off, makes most of its revenue from imaging products

Read more...The company makes most of its money through the sale of its Health Monitoring System

Read more...Startup/Business

Joined Vator on

Founded in 2006 by online video buffs who met while in graduate school and won the UC Berkeley Business Plan Competition, TubeMogul's objective from the start has been to empower online video producers, advertisers and the online video industry by providing publishing tools and insightful, easy to interpret analytics.

With TubeMogul, users upload videos once and TubeMogul deploys them to as many of the top video sharing sites the producer chooses. TubeMogul's integrated analytics then provide a single source of metrics on where, when, and how often the videos are viewed. TubeMogul's free beta service has been live since November of 2006. In January 2008, TubeMogul announced the launch of its Premium Products, which include a host of new professional features.